Second Mortgage Or Home Equity Loan

Usually a home equity loan describes credit based on heloc your home equity line of credit.

Second mortgage or home equity loan. You can borrow up to 80 of the appraised value of your home minus the balance on your first mortgage. Cash out refinancing which also requires home equity is the refinancing of a mortgage into a new one at a larger amount. All three options home equity loans helocs and cash out refis can be used to buy a second home provided you have enough equity. Your home is an asset and over time that asset can gain value.

A loan to purchase a home is usually the first mortgage lien recorded on a property. While you pay off your second mortgage you also need continue to pay off your first mortgage. Your home equity is calculated by subtracting how much you still owe on your mortgage from the. A second mortgage is another sort of home equity loan.

While both types of loans borrow against the equity in your home the difference between them is how the loans are paid out and handled by the bank. When looking to take a loan based on the equity accrued in your house you must consider whether a second mortgage or a heloc offer is the best option for your current financial situation. Getting a second mortgage. This allows us to factor in to a degree the effect of interest rate increases when working out how much you may be able to afford.

The loan is secured with your home equity. A home equity loan also known as a second mortgage term loan or equity loan is when a mortgage lender lets a homeowner borrow money against the equity in his or her home. Like with your original mortgage your second mortgage is secured by your home meaning that if you don t pay the loan the bank can take your home. A home equity loan is a second mortgage that allows you to borrow against the value of your home.

If you go ahead with a nab home loan we may apply a higher interest rate buffer depending on your choice of home loan product. If you haven t already paid off your first mortgage a home equity loan or second mortgage is paid every month on top of the mortgage you already pay hence the name second mortgage. Another second mortgage on your home. A second mortgage is a second loan that you take on your home.

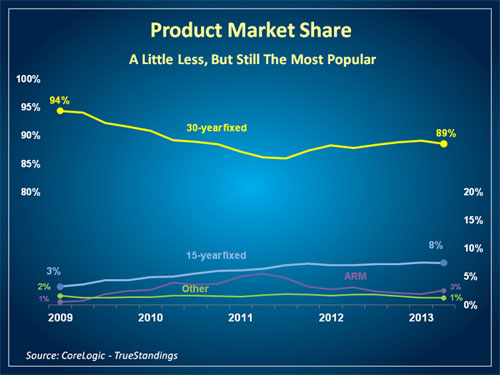

A home equity line of credit and a home equity loan are both additional loans on your home but many people don t know the difference between the two or how they differ from a second mortgage. A second mortgage also referred to as a home equity loan or home equity line of credit is just what it sounds like. Subsequent loans depend on the amount of owners equity in the home and generally require a new appraisal. We have assumed a 30 year loan term.

The difference between the two mortgages is given to the homeowner in cash.

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)

/GettyImages-1145828900-57f4abfc7bb343379e15f4c3fc2fce5f.jpg)

/business-with-customer-after-contract-signature-of-buying-house-957745706-85fbb1739bcc4a27b1e5d1e80dd9c1c9.jpg)

/couple-signing-loan-57a5e5a15f9b58974aeeb2a0.jpg)

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

/Remodel-Project-Financed-By-Home-Equity-1500-x-1000-56a49eb45f9b58b7d0d7df93.jpg)