Tax Debt Relief Program

Everyone has to pay taxes.

Tax debt relief program. Notification effective april 27 2020. If this describes your current situation the irs tax debt forgiveness program might be your best option. If you think you need tax debt relief act quickly to resolve your issues. If your irs tax debt is between 10 000 and 20 000 then you ve still got some good options for handling the debt but you may end up needing to request assistance from an attorney tax resolution specialist or tax debt relief company.

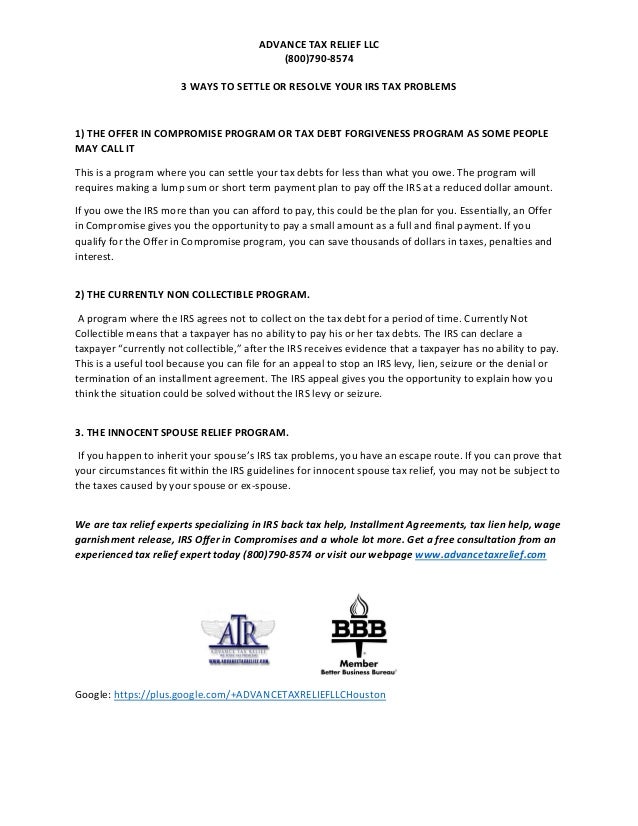

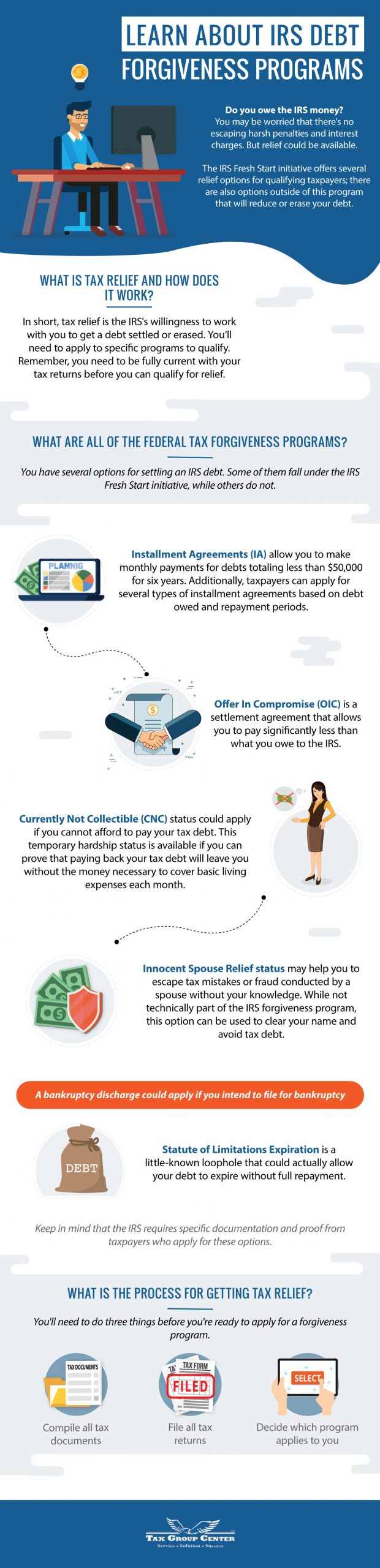

The best tax debt relief companies will begin by investigating your case to determine where the debt is coming from and your eligibility for certain programs. An offer in compromise can let you settle your tax bill for pennies on the dollar. While they may employ attorneys cpa s and enrolled agents pursuant to irs regulation circular 230 the use of the term tax attorney is used as a general or generic term referencing attorneys seasoned in aspects of tax relief and collection work. In general it is undesirable to get behind on tax payments because the irs can make life even more difficult by filing a tax lien or by garnishing wages.

A less extreme measure would be consulting a reputable tax debt relief service which may be able to intervene to relieve liens bank account seizures or wage garnishments. No matter which company you choose all of them charge for their initial investigation though some companies fold this fee into their overall cost. Tax debt also can be discharged via the statute of limitations. Usually this relief comes in the form of a payment plan or debt settlement with the irs.

Irs tax relief programs are available to people who either can t afford to pay their tax debts. A tax relief program is a type of irs debt solution that reduces the total amount of tax debt owed. The irs has a program that lets you pay what you can afford regardless of what you owe. Signs of a tax debt.

But sometimes the money you owe the irs is greater than the amount of money you make. What is tax debt relief and why might you need it. Fortunately for those who are struggling financially the irs does offer some tax debt relief programs. Taxes the irs has attempted but been unable to collect are erased after 10 years.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. If you can t afford to pay your taxes on time you may qualify for some form of tax debt relief. If you or your business are overwhelmed with tax debt consider hiring a tax relief firm such as optima tax relief. If you owe more in taxes then you can pay the fresh start program is there to help you resolve your tax debt.