Spread Betting

There are a range of similarities and differences between these two derivative products.

Spread betting. Spread betting example. Tax law may differ in a jurisdiction other than the uk. Spread betting is a derivative strategy in which participants do not own the underlying asset they bet on such as a stock or commodity. Spread betting is a bet on the future direction of a market while a cfd is an agreement to exchange the price of an asset from when the contract is opened to when it is closed.

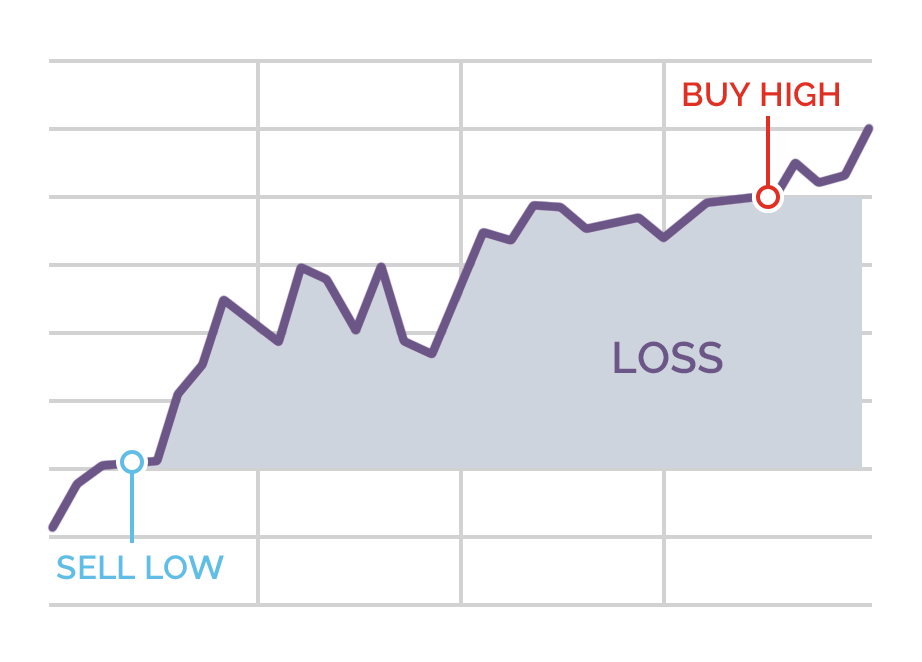

It allows traders and investors to take a position on whether they think a market will rise or fall without having to buy or sell the underlying asset. Spread betting is a tax efficient way of speculating on the price movement of thousands of global financial instruments including spread betting forex indices cryptocurrencies commodities shares and treasuries spread betting is one of the most common ways to trade on price action over several asset classes in the uk and ireland. Spread betting is any of various types of wagering on the outcome of an event where the pay off is based on the accuracy of the wager rather than a simple win or lose outcome such as fixed odds or money line betting or parimutuel betting. Cfd leveraged trading allowing you to speculate on whether the price of a share or the value of an index currency or other financial assets will go up or down.

Best trading app as awarded at the advfn. Let s assume that the price of abc stock is 201 50 and a spread betting company with a fixed spread is quoting the bid ask at 200 203 for investors to transact on. Rather spread bettors simply speculate on whether the. What is spread betting.

1 applies to uk spread betting. A spread is a range of outcomes and the bet is whether the outcome will be above or below the spread. 2 based on revenue excluding fx published financial statements june 2020. Spread betting is a tax free financial derivative that enables you to speculate on the price movement of a financial marketwhat is spread betting.