Understanding Your Auto Insurance Policy

We get it reading your insurance policy is probably not high on your to do list or your want to do list.

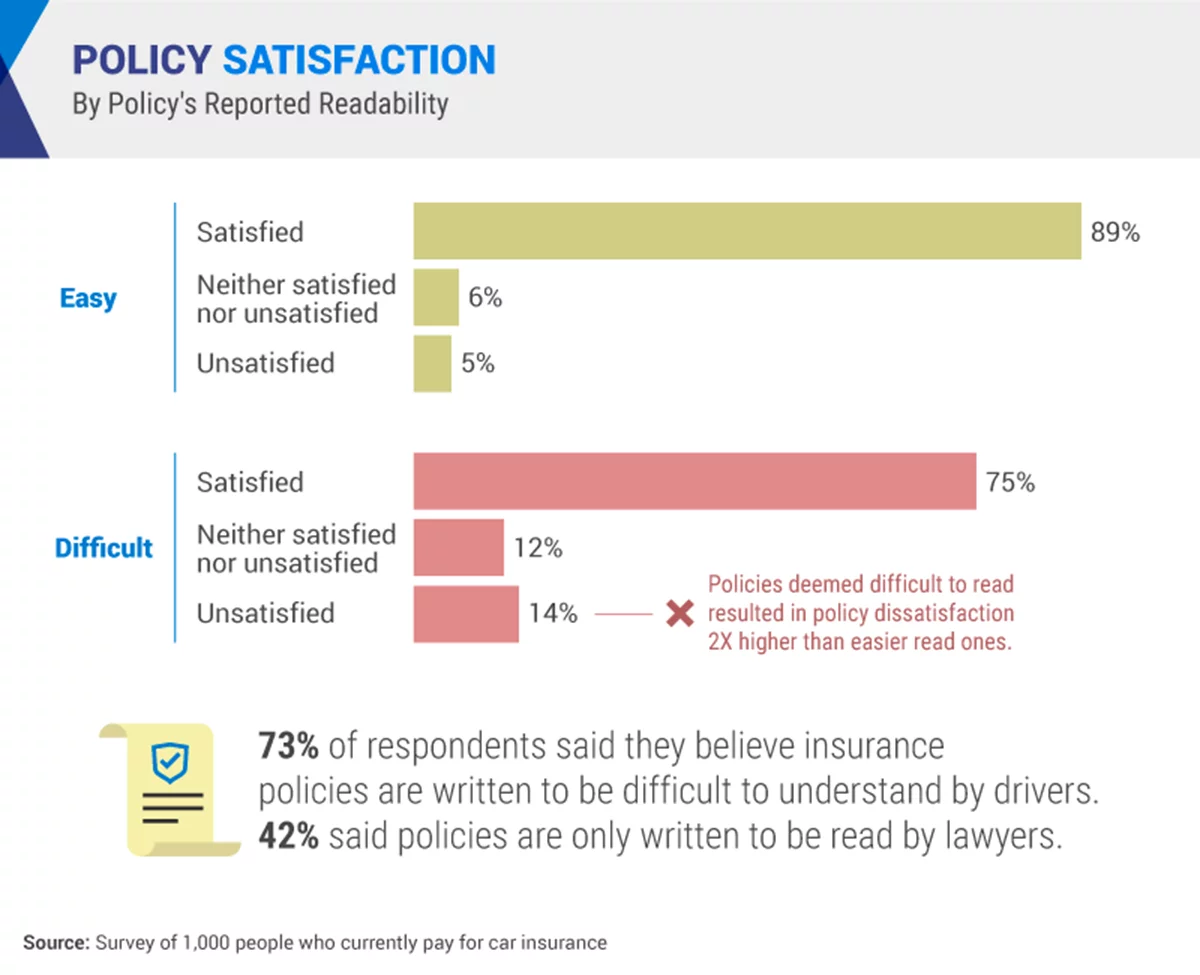

Understanding your auto insurance policy. As with most legal contracts it contains a multitude of provisions and stipulations that can leave you bewildered and frustrated. Auto insurance policies are confusing and boring documents filled with legal jargon that can be an absolute nightmare to read. Your personal auto policy however will not provide coverage if you use your car for commercial purposes for instance if you deliver pizzas or operate a delivery service. This article summarizes the major coverages offered by your policy to simplify the process of purchasing personal auto insurance.

Understanding your auto policy. Drivers are required to carry minimum liability coverage in most states in the u s. Understanding your personal auto insurance policy is not simple. Note too that personal auto insurance will generally not provide coverage if you use your car to provide transportation to others through a ride sharing service such as uber or lyft.

Your policy is a legal contract binding the insurance company to perform specific actions under certain circumstances for an agreed upon price. However getting a basic understanding can help you make sense of your coverage what s included and how your insurance works which is especially important to know when the time comes to make a claim.

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)

/insurance-adjuster-assessing-damage-to-car-89771702-57b835ee3df78c8763625d43.jpg)

:max_bytes(150000):strip_icc()/car_insurance-928675064-5bbe7d28c9e77c0058d884e9.jpg)

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)