Refinancing Home Loan Costs

An administration fee paid to your current lender to pay out the existing loan in full and to prepare the required documentation.

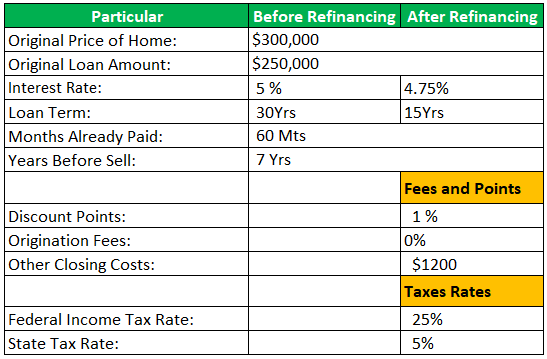

Refinancing home loan costs. This covers the costs of processing your loan refinance request including the lender checking your credit report. Refinancing costs and fees. But it s not always a slam dunk decision. 0 75 to 1 5 of the undisbursed portion of the loan.

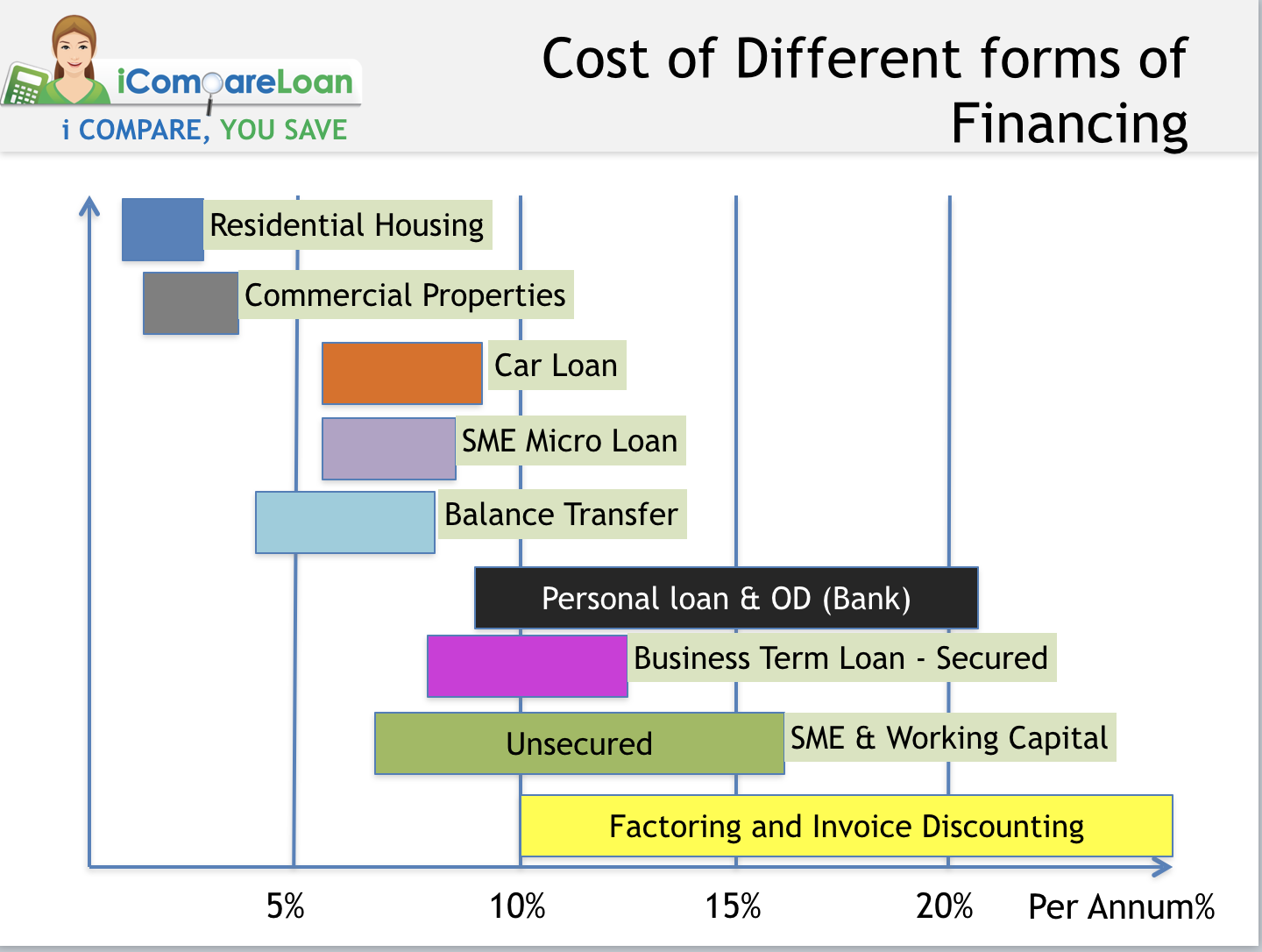

There are costs and risks involved which you should know before you decide. But before you decide on a new mortgage it s important to understand the cost to refinance and find ways to lower your mortgage refinance fees. Refinancing a home might be the best plan for you. Refinancing your home loan can result in considerable long term savings but it largely depends on your personal situation and current home loan.

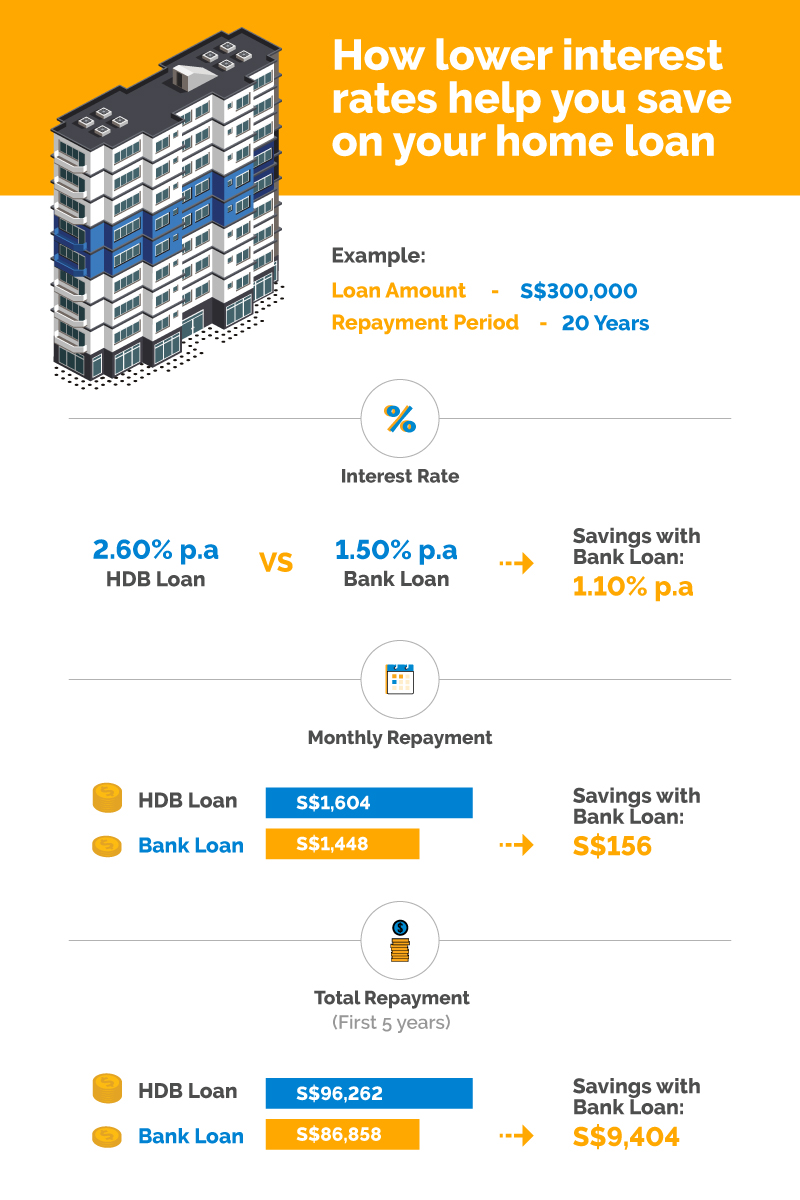

Home loan refinance costs will vary depending on your individual circumstances. You will likely have to pay this fee unlike other fees on this list even if. The cost to refinance a mortgage can vary depending on several factors. For example say you are currently paying five per cent interest per annum on a 500 000 home loan and refinance to a lender offering a four per cent interest rate per annum.

Make the most of refinancing to enjoy potential savings on your home loan. Our mortgage refinance cost calculator can help you figure out how much it will cost to refinance your mortgage. The hidden costs of transferring a home loan to another bank watch out for the costs of refinancing your mortgage to get the most out of switching. For example the interest rate credit score and loan amount.

Some common refinance costs to enquire about though are. The closing costs of a home refinance generally include credit fees appraisal fees points which is an optional expense to lower the interest rate over the life of the loan insurance and taxes escrow and title fees and lender fees. Refinancing your mortgage comes with a list of expenses similar to what you paid when you got your original home loan.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)