What Is Personal Injury Protection Car Insurance

If it is required in your state however you re legally mandated to purchase a minimum amount.

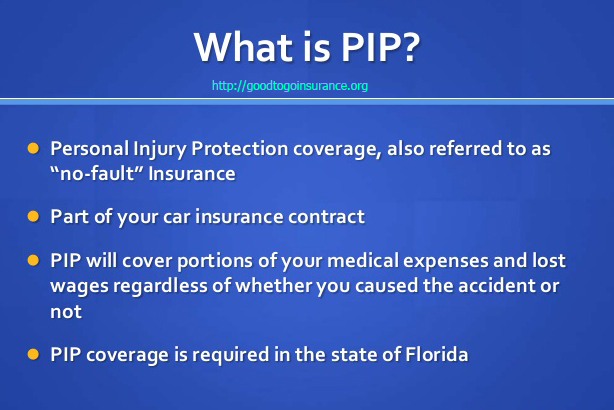

What is personal injury protection car insurance. Personal injury protection or pip is a type of car insurance that pays the expenses you and your passengers incur after being hurt in a car accident regardless of who was at fault. Pip stands for personal insurance protection personal injury protection and it is an extension of car insurance that covers medical expenses and in many cases lost wages. Replacement services personal injury protection insurance pays for replacement services benefits which covers the daily cost of getting someone else to do the everyday household tasks that car accident victims did for themselves before being injured such as housework vacuuming dusting cooking dish washing making beds ironing doing laundry changing linens snow shoveling grass. Personal injury protection or pip is an insurance policy that covers medical bills for you and your passengers in the event of a vehicle accident.

Basic personal injury car insurance coverage is for the insured s own injuries on a first party basis without regard to fault. It is often called no fault coverage because its inherent comprehensiveness pays out claims agnostic of who is at fault in the accident. As the name suggests personal injury protection insurance is designed to cover expenses relating to injuries suffered in a car crash. For more info and free car insurance quotes visit https.

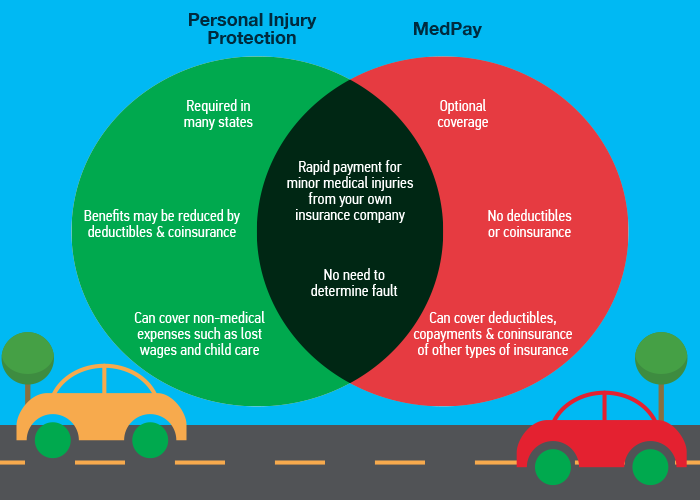

Also called no fault car insurance and first party benefits coverage pip coverage can pay for medical expenses lost wages custodial services like child care and even funeral expenses. Personal injury protection pip. Unfortunately in most states it doesn t cover much beyond people s injuries. With personal injury.

Personal injury protection pip car insurance covers your medical bills if you or a passenger is injured in a car accident. Personal injury protection pip car insurance can help pay the cost of injuries caused by a car accident where neither party was at fault. Pip insurance pays a per person benefit amount for injuries you and others specified in your policy sustain in an auto accident. A feature of automobile insurance that covers the health care expenses associated with treating injuries sustained in a car accident.

It can also cover things like lost wages childcare funeral expenses and long term rehabilitation.

/car_accident-e79ae57204b34f5589a2967bff98e89a.jpg)

/people-helping-a-woman-after-a-car-accident-104304102-d7c7bec2c3bf45f78b16aa96f19427d9.jpg)

:max_bytes(150000):strip_icc()/GettyImages-840918402_2000-0e04e37d44cc48b7ac2cbc09b8986b3c.png)