Schwab Intelligent Portfolios Performance

This quarterly commentary is designed to provide you with insight into the market environment during the quarter.

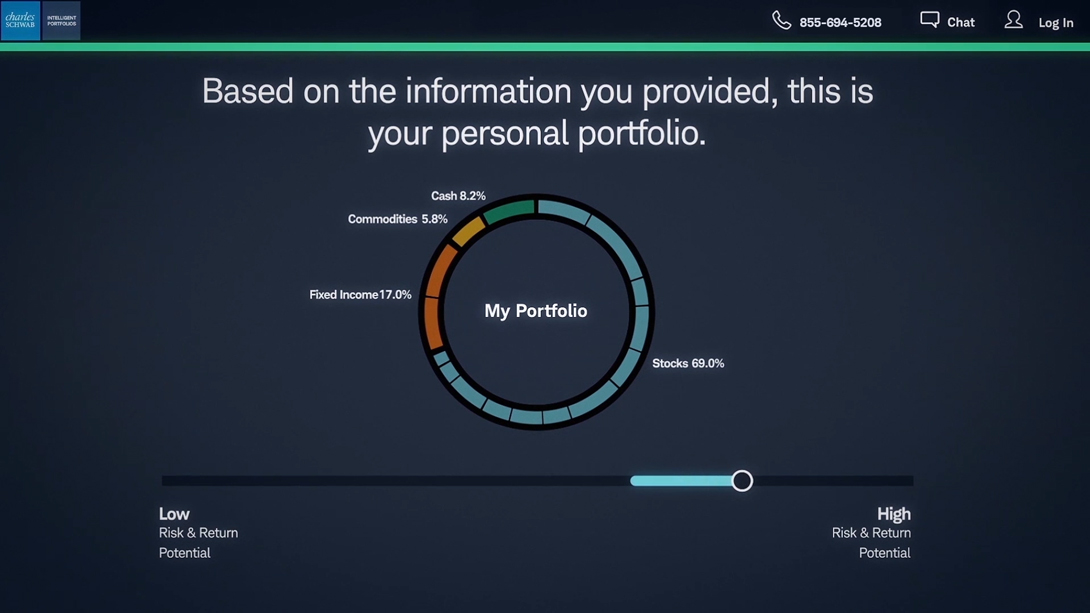

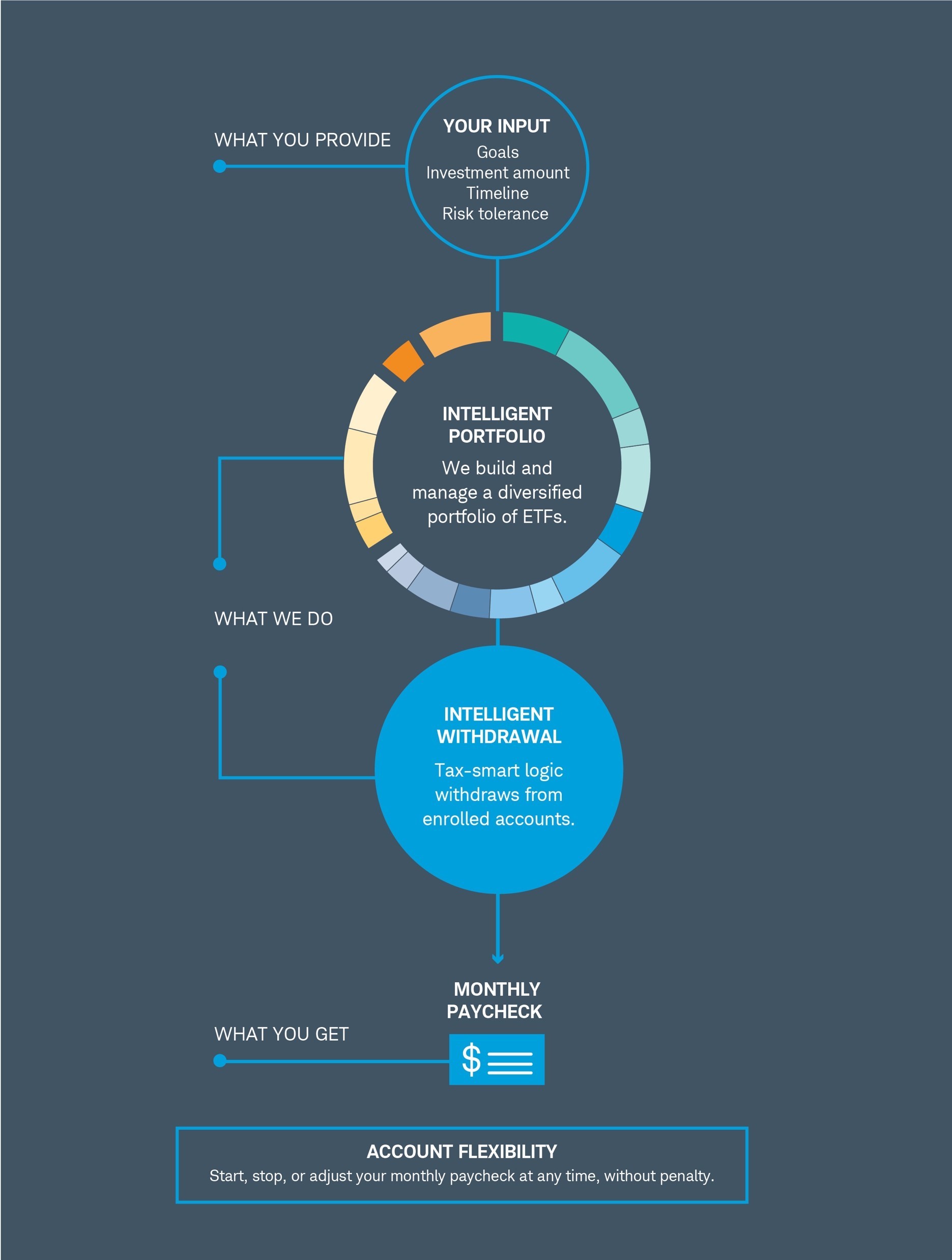

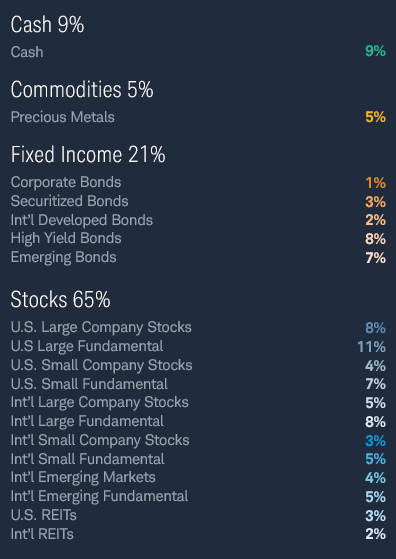

Schwab intelligent portfolios performance. The base service intelligent portfolios is a robo advisor that requires a 5 000 minimum. Schwab intelligent portfolios aum returns portfolio performance schwab intelligent portfolio had 43 billion in aum as of the end of the fourth quarter of 2019. These allow for diversified exposure to stocks bonds. Schwab intelligent portfolios schwab intelligent portfolios premium overview compare solutions an introduction to robo advice.

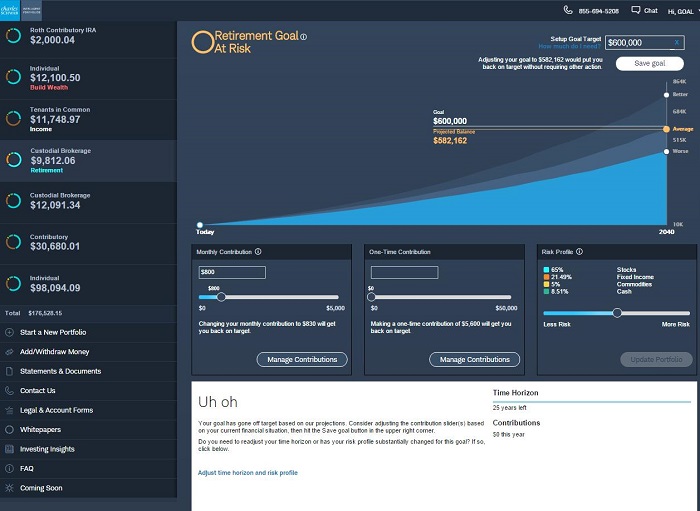

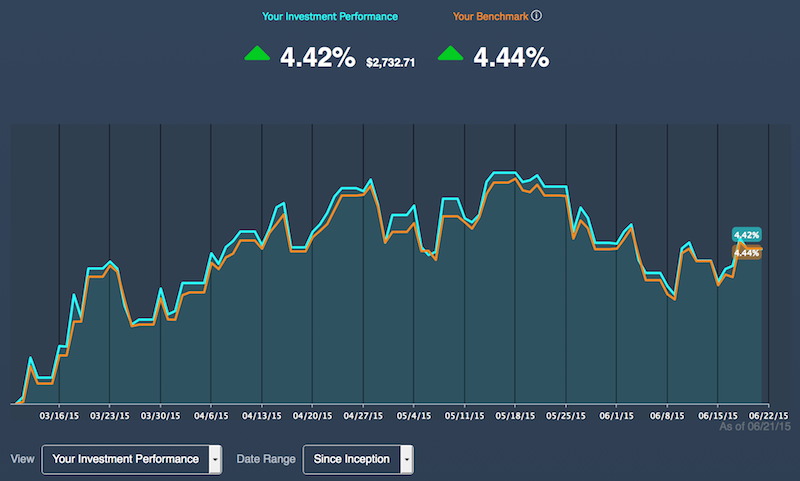

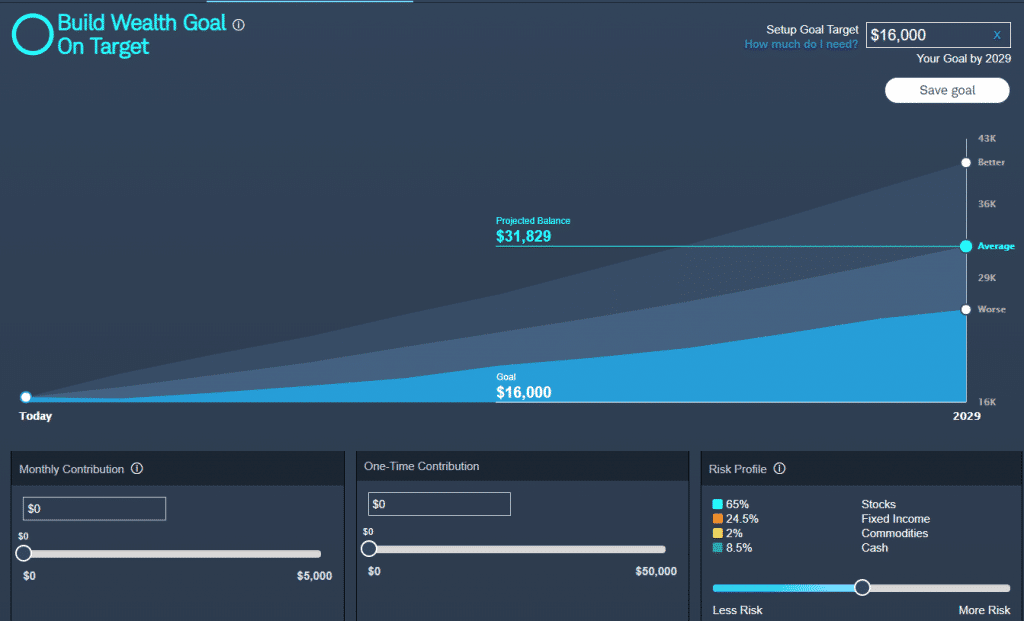

The typical fee range for robo advisors is 0 25 to 0 50. The tax loss harvesting feature that is available with schwab intelligent portfolios solutions is subject to significant limitations which are described on the schwab intelligent portfolios solutions website and mobile application collectively the website as well as in the schwab intelligent portfolios solutions disclosure brochures the brochures and the irs website at www irs gov. How your portfolio performed is dependent upon your asset allocation across the risk spectrum from conservative to aggressive as well as criteria such as when you. Schwab s portfolio performance reporting provides you with the confidence to know how your portfolio is working at any time.

The fact that schwab intelligent portfolios comes with no fees is an obvious benefit. Charles schwab launched its intelligent portfolios offering in 2015 and made a splash with its zero fee advisory service with a minimum investment of 5 000. Charles schwab s online advisor service schwab intelligent portfolios offers two options to investors. Schwab intelligent portfolios lets investors put their money to work in a portfolio of exchange traded funds or etfs.

Schwab intelligent portfolios looks to be one of the best overall robo advisors available. This can significantly reduce a portfolio s performance over the long term.

/wealthfront-vs-charles-schwab-intelligent-portfolios-dc8b708347dc461fb7dd0970a48de0c3.jpg)