Tax Relief Company

Both companies offer services throughout the united states.

Tax relief company. If a tax relief company promises it can eliminate interest and or penalties for you be wary. It s not a service everyone will be interested in but if you have tax debt and you still need to file taxes for the year it makes sense to work with a single company for all of this so you can have a cohesive strategy. For example a tax credit can incentivize homeowners to make. You can deduct the costs of running your business from your profits before tax when you prepare your company s accounts.

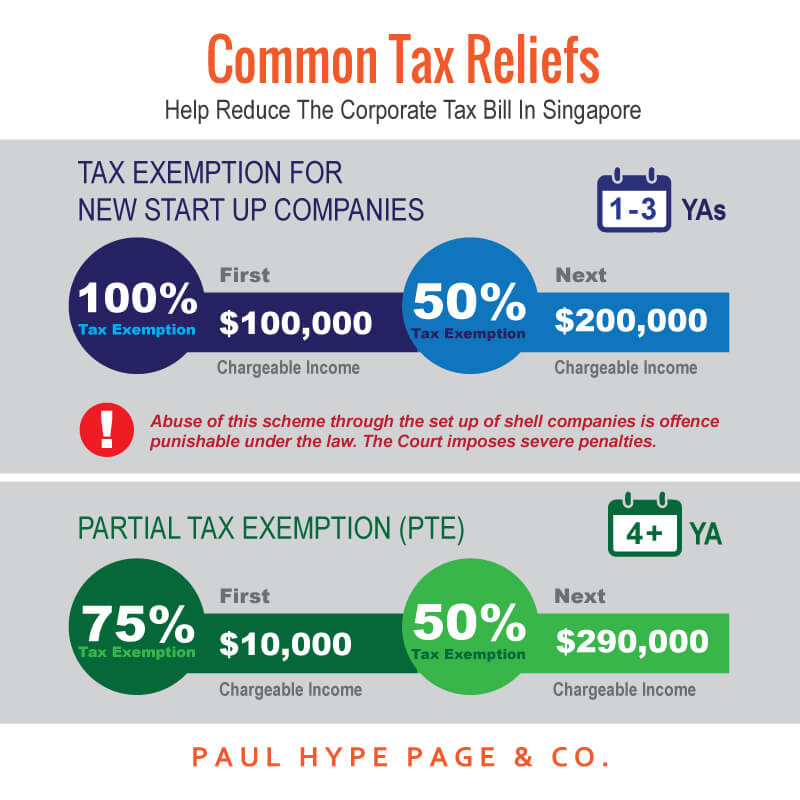

Anything you or your employees get personal use from must be treated as a. Partial tax exemption for all companies. However please evaluate whether you would benefit from the tax relief and make an informed decision. Tax exemption scheme for new start up companies.

Their services should include a face to face meeting with you where they explain your options and their fee structure. Tax resolvers provides tax preparation services to its customers which isn t something all tax relief companies do. You should continue to claim the personal reliefs if you have met the qualifying conditions. What is the best tax relief company.

Tax relief is any reduction in taxes owed by an individual taxpayer or business entity including tax deductions and tax credits. Optima tax relief and tax defense network have earned the top spots on our list because of their high quality services and positive customer reviews. A personal income tax relief cap of 80 000 applies to the total amount of all tax reliefs claimed for each year of assessment. Deduction of expenses incurred before commencement of business.