Rollover Your 401k

If you roll over your 401 k into an ira you ll also want to consider the kind of rollover you need.

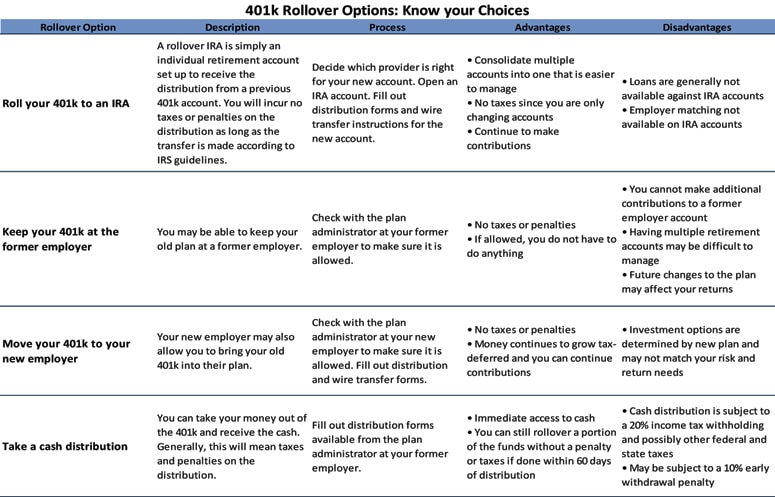

Rollover your 401k. One other tax consideration. Tax consequences of a 401 k to ira rollover. There are many reasons to roll over your 401k plan when you move on to another job. You could also transfer money from an ira into a 401 k sometimes called a reverse rollover but in most cases it s not a good idea.

Get help deciding if you should roll over your old 401 k to an ira. With a roth 401 k you ll likely be more interested in a roth ira so that you can. You can still roll over the distribution within 60 days. Some of the top reasons to roll over your 401 k into an ira are more investment choices better communication lower fees and the potential to open a roth account.

Rolling over the money from your 401k to an ira is still the best move in many cases. Transferring tax advantages fees and more. The most common type of rollover is the 401 k rollover which lets you transfer money from a 401 k you had at a previous job into an ira or the 401 k at a new job this is the type of rollover we re going to focus on. If you re leaving your job for a new employer it s important to address rolling over your 401 k.

Reasons to roll over. You can choose to do a direct or indirect rollover. If your plan account is 1 000 or less the plan administrator may pay it to you less in most cases 20 income tax withholding without your consent. You may be used to the ease of having a plan administrator manage your money and to the discipline.

The only time you ll have to deal with taxes is if you have a traditional ira and want to rollover to a roth ira. Compare 401 k rollover options. You can roll your money into almost any type of retirement plan or ira. A roth 401 k rollover allows you to move your money from your current retirement account to a new retirement plan without any immediate tax consequences as long as you follow certain rules.

The wrong decision could cost you. Which retirement accounts can accept rollovers.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)