Roths Ira

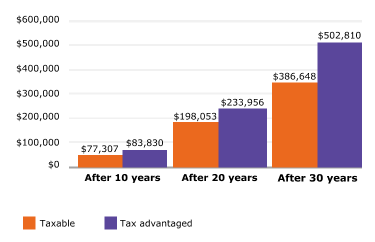

The principal difference between roth iras and most other tax advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan qualified withdrawals from the roth ira plan are tax free.

Roths ira. For some savers the lure of moving assets to a roth individual retirement account from a traditional ira or 401 k plan often boils down to the tax free income it will deliver in their golden years. In a traditional ira you will pay taxes on every single penny you withdraw from it. Therefore a suitability assessment should be done to determine if the roth ira is the right. You cannot deduct contributions to a roth ira.

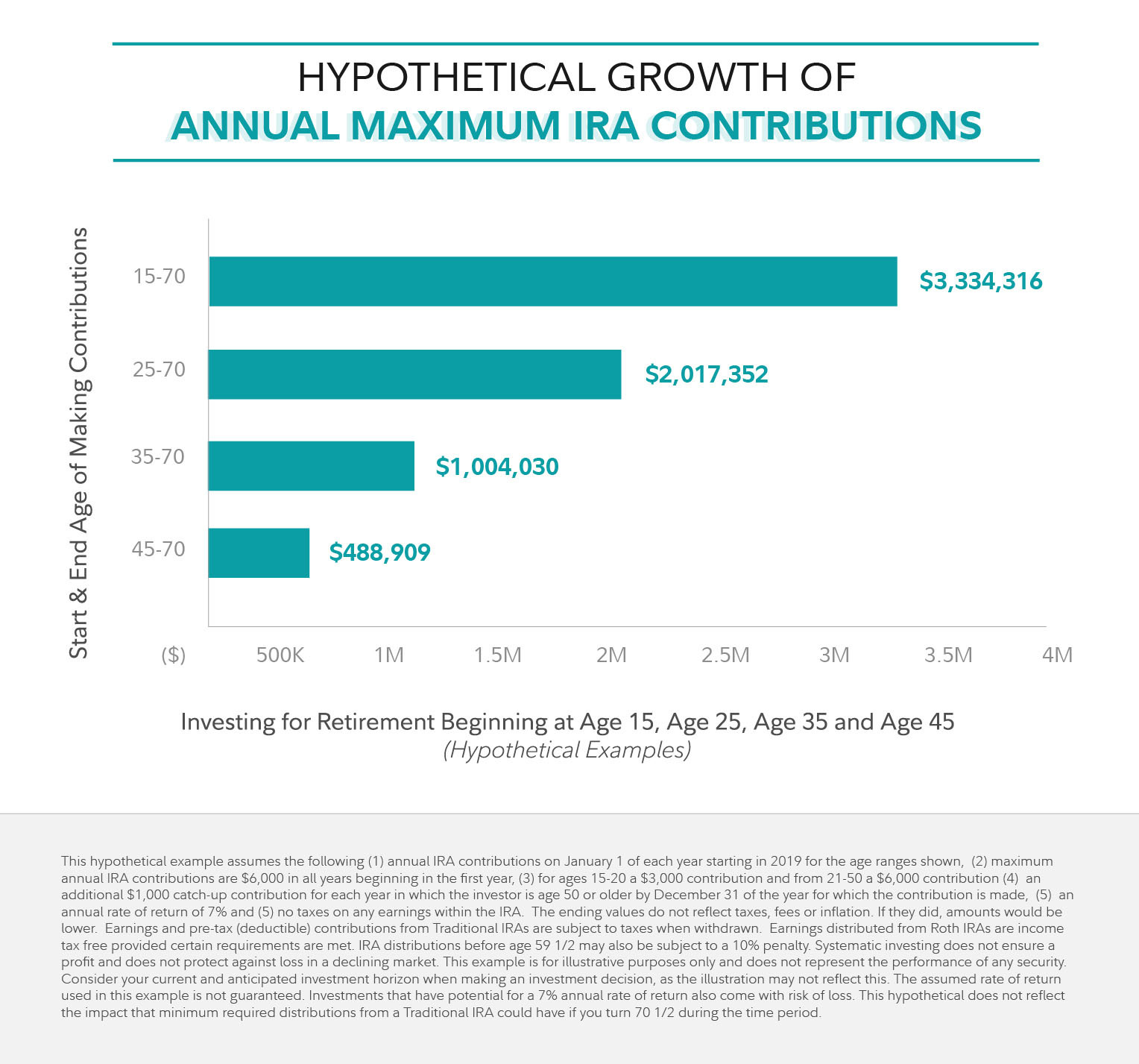

If you satisfy the requirements qualified distributions are tax free. A roth ira is a retirement savings account that allows you to withdraw your money tax free. Subtract from the amount in 1. The roth ira allows workers to contribute to a tax advantaged account let the money grow tax free and never pay taxes again on withdrawals.

Learn why a roth ira may be a better choice than a traditional ira for some retirement savers. A roth ira is a retirement savings account that allows you to withdraw your money tax free. Learn why a roth ira may be a better choice than a traditional ira for some retirement savers. Amount of your reduced roth ira contribution.

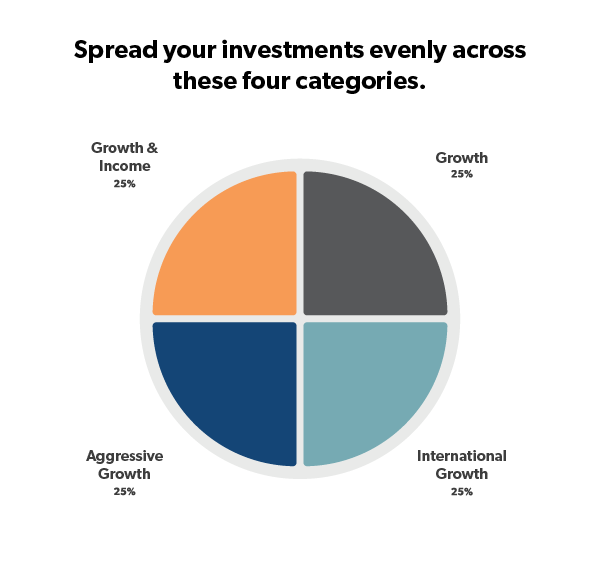

If the amount you can contribute must be reduced figure your reduced contribution limit as follows. A roth ira offers many benefits to retirement savers. A roth ira is an ira that except as explained below is subject to the rules that apply to a traditional ira. Taxes provide a disincentive for you to withdraw.

Start with your modified agi. While there are no current year tax benefits your contributions and earnings can grow tax free and you can withdraw them tax and penalty free after age 59 and once the account has been open for five years. A roth ira is an individual retirement account to which you contribute after tax dollars. A roth ira is an individual retirement account ira under united states law that is generally not taxed upon distribution provided certain conditions are met.

193 000 if filing a joint return or qualifying widow er.

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)