Tax Deferred Retirement Plans Are A Type Of Quizlet

Definite determinable benefits systematic payment of benefits primarily retirement benefits the most common funding tool used for defined benefit plans are individual or group deferred annuities.

Tax deferred retirement plans are a type of quizlet. There are no comments. A regular ira also known as traditional ira is also tax deferred. A tax deferred savings plan is an investment account that allows a taxpayer to postpone paying taxes on the money invested until it is withdrawn in retirement. B tax deferred retirement plans.

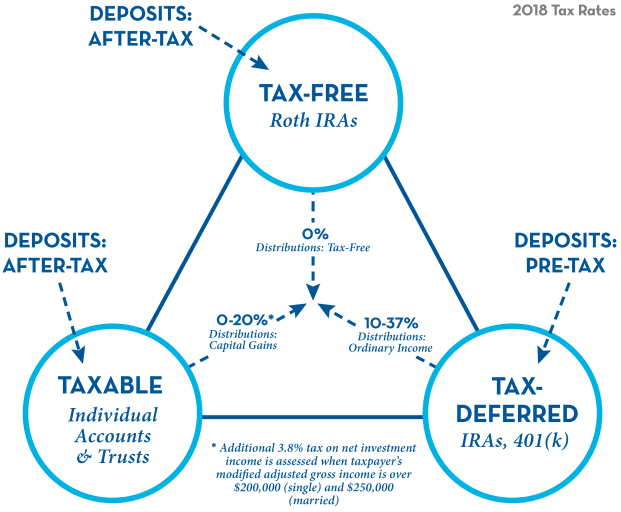

The nonqualified deferred contribution plan nqdc is similarly structured like a roth but allows greater contribution amounts. Tax deferred retirement plans are a type of tax shelter. For those with higher incomes who have other retirement plans but have reached their contribution limits the nqdc is an option. An employer sponsored retirement plan such as a 401 k 457 or 403 b plan is an example of a tax deferred retirement savings vehicle that allows participating employees to contribute a percentage of their pre tax salary and direct it to one or more investment accounts.

They were introduced in 1957 to promote savings for retirement by employees and self employed people. Retirement plan which pays a specified benefit amount. Added 11 days ago 9 2 2020 4 01 18 pm. A registered retirement savings plan rrsp or retirement savings plan rsp is a type of financial account in canada for holding savings and investment assets rrsps have various tax advantages compared to investing outside of tax preferred accounts.

Some of these plans may also allow for roth contributions. E job related expenses that are tax deductible. They have the following characteristics which qualify the plan for federal tax purposes. Add an answer or comment.

An ira keogh plan and 401 k plan are examples of a tax exempt retirement plans. Log in or sign up first. You may contribute to multiple retirement accounts in the same year but note that contribution limits apply to all accounts of the same type. Examples of tax deferred accounts.

Thrift savings account tsp individual retirement account ira this is only a partial list of some of the available tax deferred retirement plans that are common in the united states. Money saved by the investor is not taxed as income until it is withdrawn usually after retirement. You may not contribute 19 500 to a tax deferred 401. Here are a few types of tax deferred accounts.

D self employment insurance programs. Nonqualified deferred contribution plans.