W2 Consultant Means

As a w 2 employee payroll taxes are automatically deducted from your paycheck and then paid to the government through your employer.

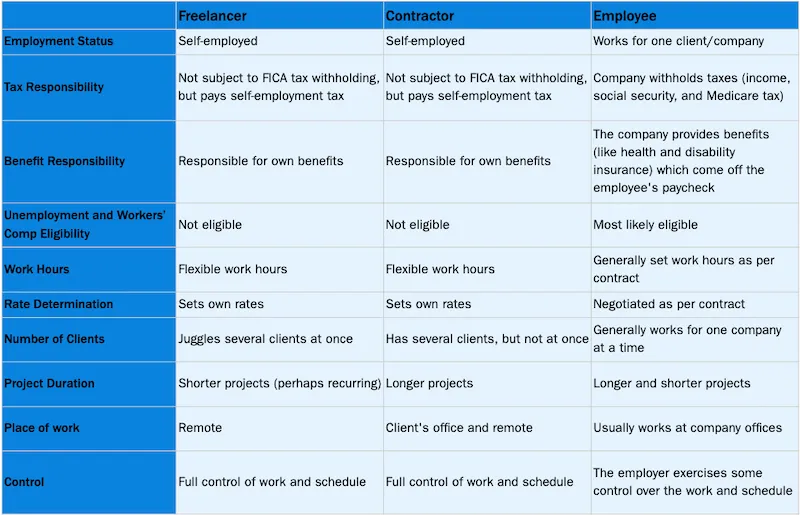

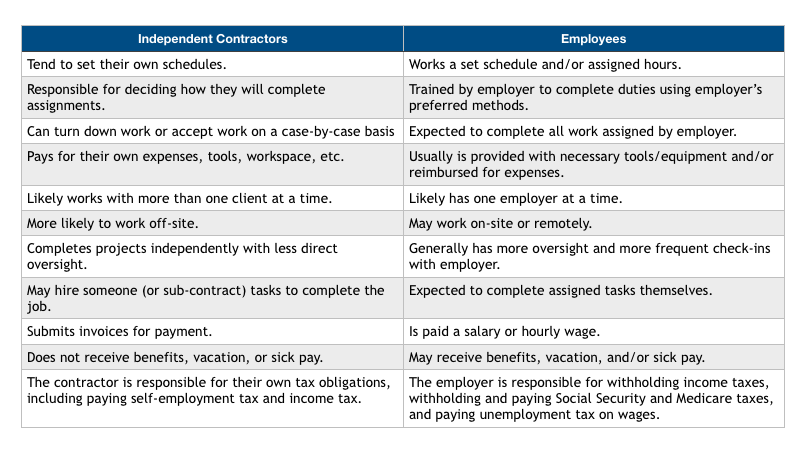

W2 consultant means. If you re an independent contractor you get a 1099 form. Simply put 1099s and w 2s are two separate tax forms for two different types of workers. A w 2 contractor is an individual who is issued a form w 2 by a temporary work agency but who works as a contractor for a client of the agency. I was a contract worker for several years and i pretty much agree with peter stanwyck s description but a description of my experiences might give some context.

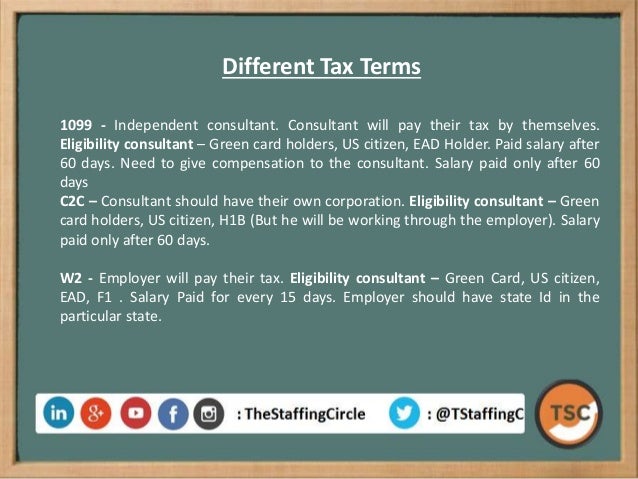

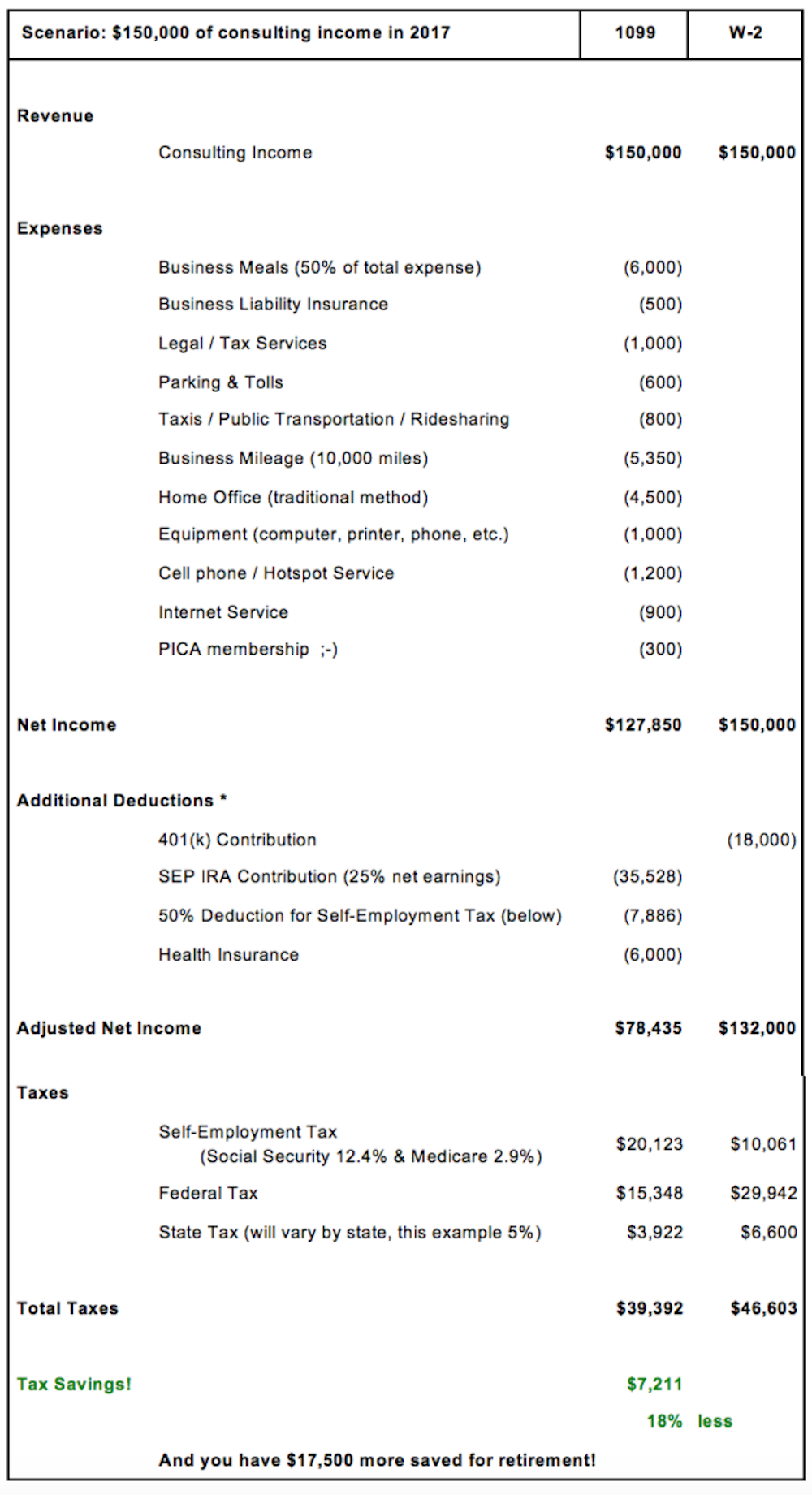

1099 means nothing is taken out and you are responsible for all those taxes at the end of the year or you pay taxes quarterly. That means the employer pays the employer side of payroll taxes 7 65. Fica social security medicare and workers comp and handles income tax withholding 20. A consultant is a specialized professional who provides expert advice in their field.

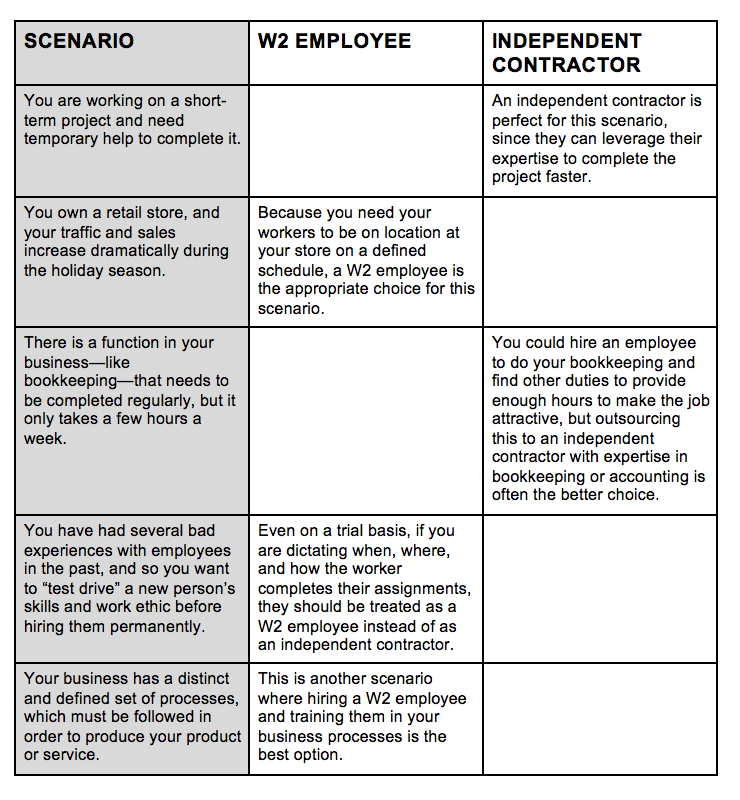

In the work environment a person can be classified as an employee or a contractor. A shorthand way to consider this employment relationship is 1099 vs. Wages paid fed tax withheld state tax withheld city tax withheld if any also shown is the amount of fica social security withheld. W2 employees because contractors receive the 1099 tax form at the end of each year while employees receive a w2 form.

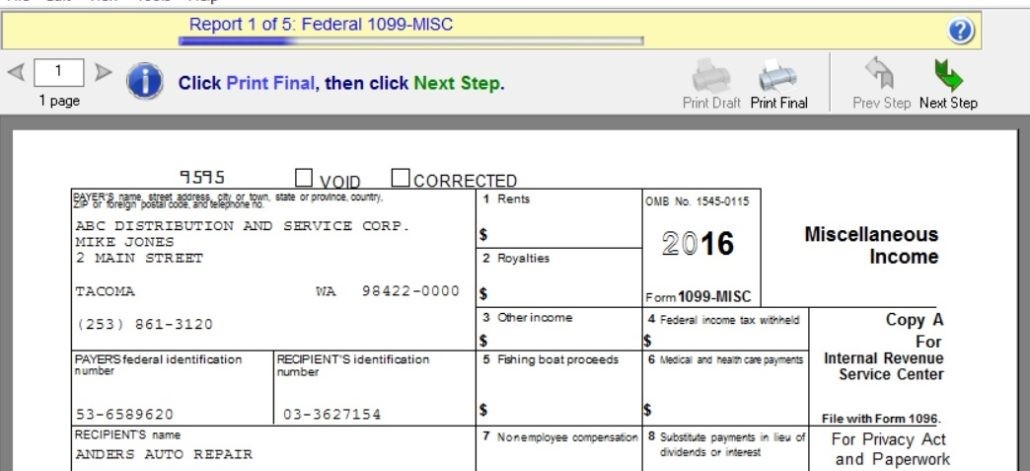

The employer deducts taxes from the employee s pay matches them in some. If you re an employee you receive a w 2. Form w 2 is a form that the employer must submit on each employee paid wages during the year. What does it mean to work under a w2 contract.

An employee is a person who is supervised within a business and is subject to its work rules. You may get additional employment. A copy goes to the federal gov t state govt some cities and to the employee himself. Our modern economy has shifted toward contract work as acceptable employment.

They have all the benefits of employment including being on the payroll vacations benefits overtime etc. When you hire an employee to work for you you can either pay them as a contractor or as an employee. W2 means you will be an payroll as an employee. Hence they are often hired for a particular task or project on which they can apply their expertise or.

A full time employee is an employee of the company that works there full time.

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)