Small Business Working Capital Loans

A small business can benefit from a working capital loan for a number of reasons.

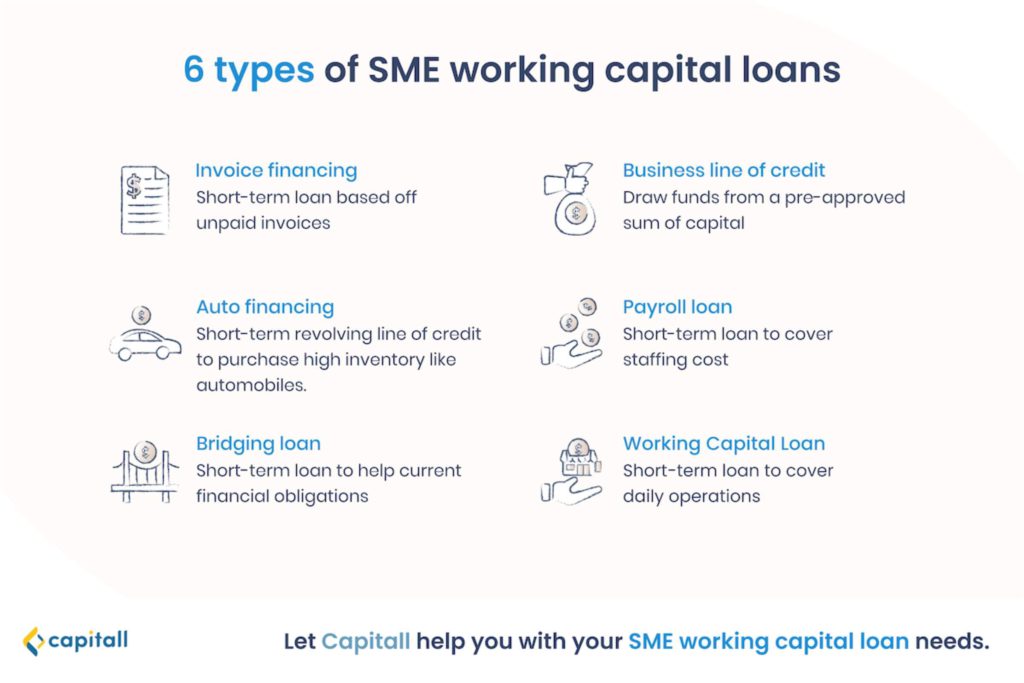

Small business working capital loans. Small business working capital loans services at hunter wolfinstein hunter wolfinstein services provides business owners with a quick and easy way to obtain the working capital needed for your business regardless of prior bank turn downs credit issues or bankruptcy. Working with a lender like quickbridge business owners can rest assured that their cash will arrive in as little as a day of receiving a credit approval. Flexible repayments can be remitted daily weekly or monthly and are deducted automatically via ach automated clearing house from your business banking account. For this reason you can t use a working capital loan for expensive initiatives like developing a new product renovating your physical space adding a new division etc.

They are used to provide working. We can safely fund your. Remember working capital loans work best for short term needs as opposed to investments that may take years to produce results. Learn more and compare options up to 5 million.

Working capital loans are not used to buy long term assets or investments. Our working capital loans are simple and customized to fulfill the exact requirements of your small business. Unsecured business working capital loans provide a fast and flexible private lending solution that can be funded the same day as applying. When your bank s hands are tied.

Plus you have a higher chance of getting approved. Our working capital loans are meant for that type of situations. Use for working capital equipment or expansion even with bad credit short long term financing available. Small business loans provide the opportunity for business owners to get the cash flow they need to run their businesses more efficiently and successfully with less risk to their personal finances.

Working capital our highly personalized service cuts through the red tape. Offers highly personalized service and will help your company cut through the red tape in the financial lending arena that is often involved in securing business loans from banks and other lending institutions. Fast funding for timely business needs. Working capital loans have no collateral requirement.

Working capital loans also offer lower borrowing amounts than business term loans and sba loans. Get a small business loan or sba loan for your startup or established company. With over 30 2 million small businesses in the country according to data by the small business administration sba the average small business begins with 50 000 in capital.