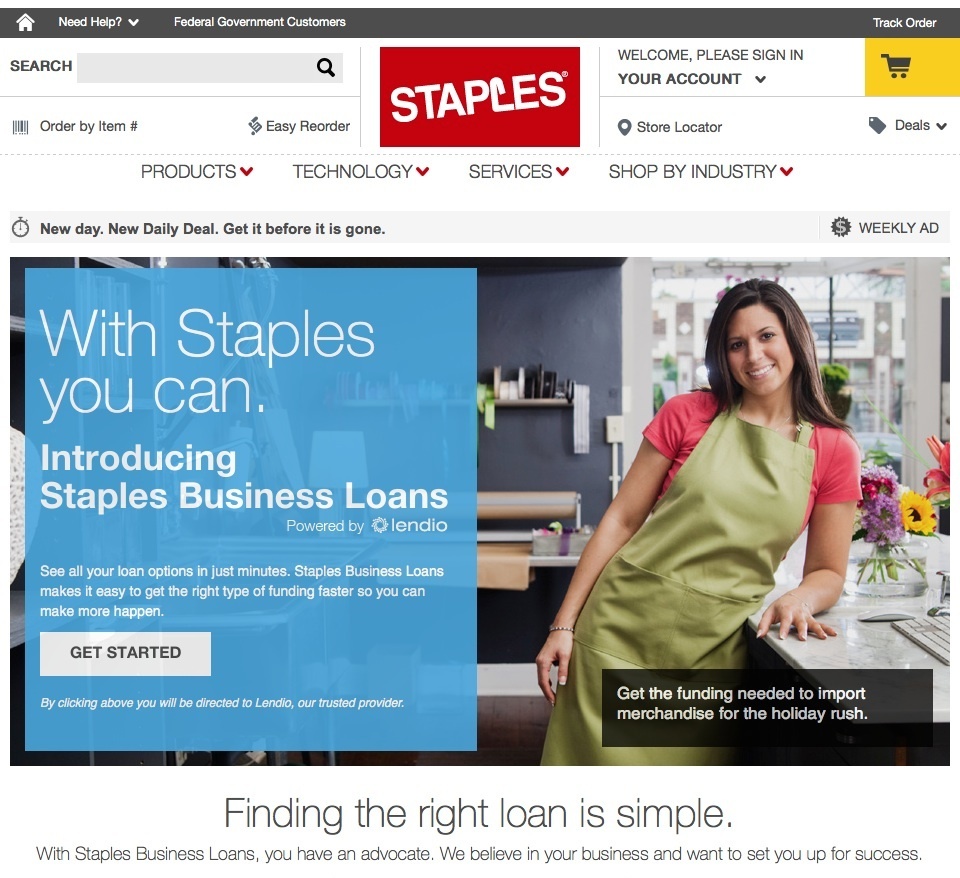

Small Busness Loans

Other small business loans require an equity investment.

Small busness loans. Small businesses are encouraged to do their part to keep their employees customers and themselves healthy. Health and government officials are working together to maintain the safety security and health of the american people. Here are the details. The small business cashflow loan scheme has been extended until the end of 2020.

The total amount of money going in the fund is 349 billion. Start or expand your business with loans guaranteed by the small business administration. It s not just a monthly term loan like you may be used to with a mortgage or auto loan. Kabbage funding s small business loans support all aspects of your small business from marketing expenses new equipment purchases and more.

Applications opened on 12 may 2020 and can now be submitted up to and including 31 december 2020. Organisations and small to medium businesses including sole traders and the self employed may be eligible for a one off loan with a term of 5 years if they have been adversely affected by covid 19. Whether you prefer a secured or unsecured option need funds for an industry specific need or are a minority business owner apply for a small business loan from kabbage funding to learn how much funding you could access in minutes. The law provides clear guidelines on what small businesses are eligible and what their loans will look like.

Get more information about funding your business with a term loan sba loan secured and unsecured lines of credit and more from bank of america. Down payment requirements vary but you should expect to invest at least 10 to 30 of your own capital when taking out a loan. The small business emergency loan program offers 2 500 to 35 000 in loans to cover operating expenses. Use lender match to find lenders that offer loans for your business.

Explore our small business financing options and find out how to use small business loans and credit to finance your business needs. A factor rate is typically used for merchant cash advances and short term business loans to determine how much you will owe in interest. Getting a small business loan can be much more complicated than getting a consumer loan as there are multiple types of small business loans that differ in rate structure term length requirements and more.