When Should You Refinance Your Home Loan

Using bankrate s mortgage refinance calculator you can figure out.

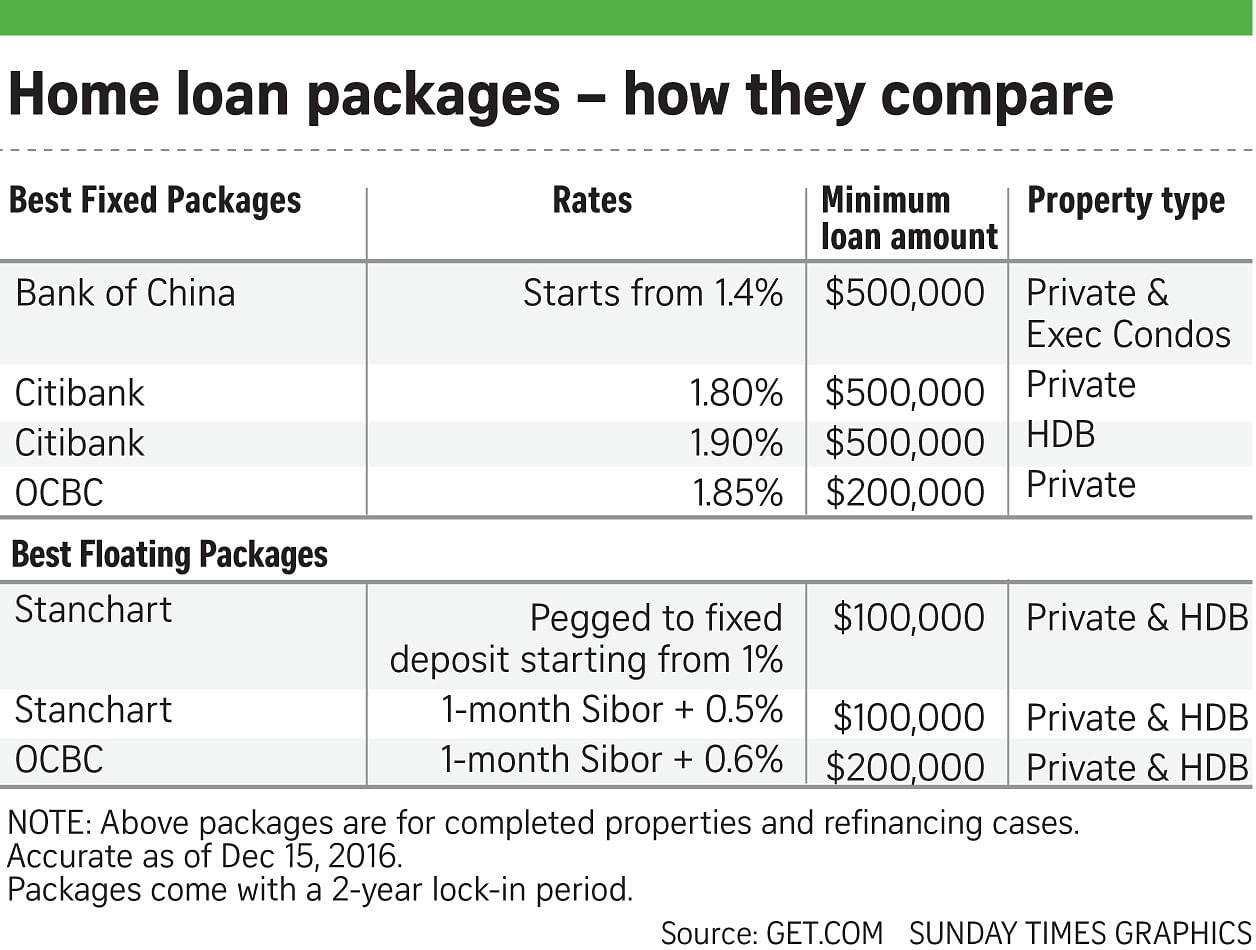

When should you refinance your home loan. Try our easy to use refinance calculator and see if you could save by refinancing. Refinancing a home loan or moving your mortgage to a new provider can sometimes save you real money. Let s say in 2011 you bought a home for 120k and after your 20k downpayment you were left with a 30 year 100k mortgage loan at a rate of 4 5. Streamline refinancing some consumers may be eligible for refinancing options which close quicker and at lower costs than a typical refinance.

This is something that can make sense especially given how. Now you want to refinance the remaining 139 581 of your principal balance with a new 30 year fixed rate loan of 4 5 percent. 9 things to know before you refinance your mortgage. However before you send off the application check your.

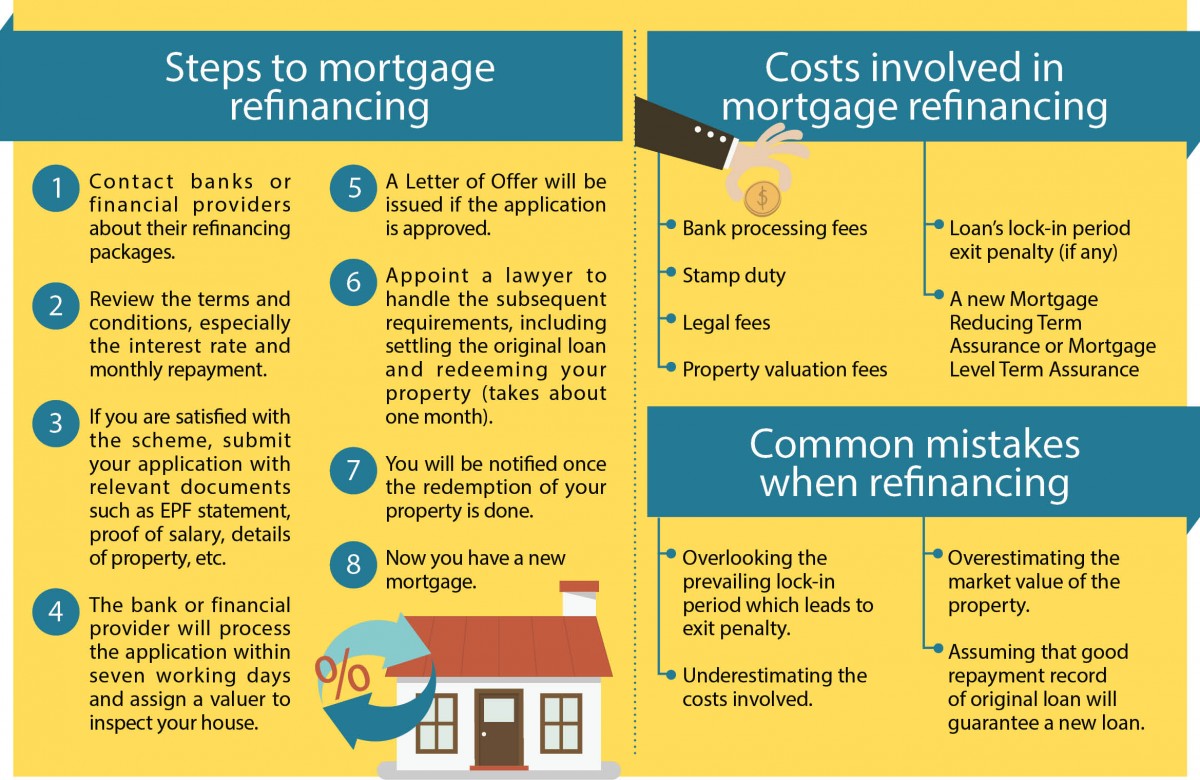

The fees you pay to refinance. Refinancing your mortgage means you take out a new loan your new lender pays off your old loan and you now owe the new lender instead. To move into a longer term loan while refinancing into a mortgage with a lower interest rate can save you money each month be sure to look at the overall cost of the loan. Estimate your new monthly mortgage payment savings and breakeven point.

Today you are approved for a 3 rate. Refinancing happens when you move your home loan from your current lender to a new one. Common ones are discharge fees paid when you close a loan application fees paid when. Given the large amounts typically involved a slight decrease in interest rates can result in significant savings.

Saving your home in chapter 13 bankruptcy how refinancing your mortgage can actually help you while in chapter 13 bankruptcy. But you should always look beyond the headline interest rate to work out the real cost of switching. For a 30 year fixed rate mortgage on a 100 000 home refinancing from 9 to 5 5 can cut the term in half to 15 years with only a slight.

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)