States Where Car Insurance Is Not Mandatory

/GettyImages-941132094-04368c13d238481d9212f34d1658f271.jpg)

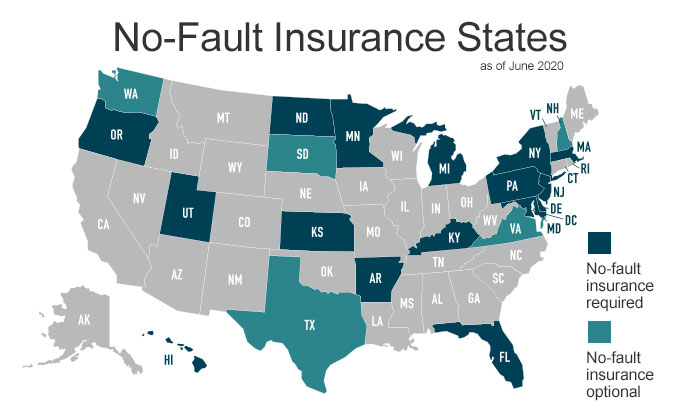

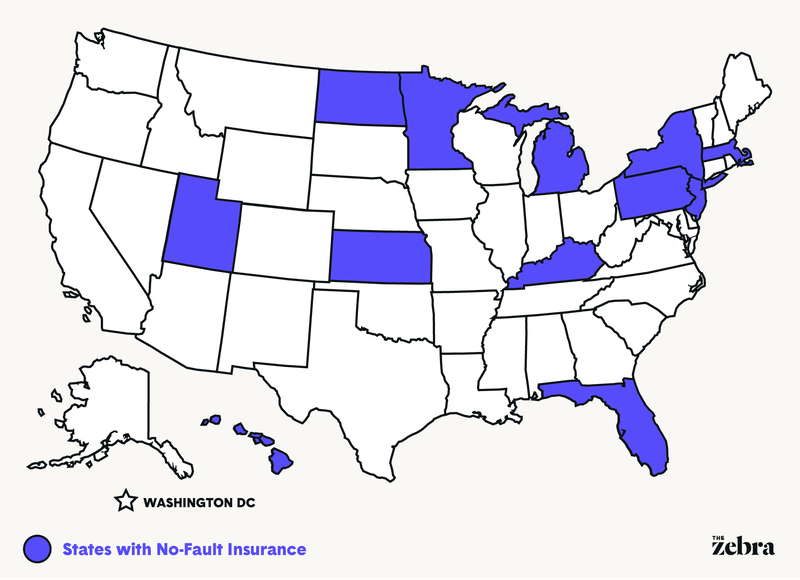

In the united states automotive insurance covering liability for injuries and property damage is compulsory in most states but different states enforce the insurance requirement differently.

States where car insurance is not mandatory. Currently there is no serious movement to change the laws in new hampshire and virginia when it comes to making car insurance mandatory. New hampshire is the only state in which you are not legally required to have car insurance as long as you can show proof of financial responsibility. Car insurance laws are set and enforced at the state level and 49 of the 50 states in america require all drivers to carry an active car insurance policy. Conversely there does not appear to be any widespread movement to remove the necessary requirements for car insurance in the other states and district of columbia.

There is no minimum car insurance requirement for the state of new hampshire however state law does require you to pay for any bodily injury or property damage arising from your operation of a vehicle that you own. In virginia where insurance is not compulsory residents must pay the state a 500 annual fee per vehicle if they choose not to buy liability insurance. Car insurance is not mandatory in new hampshire but residents are still responsible for damages resulting from a car accident. The future of no mandatory car insurance.

Car insurance is not mandatory in new hampshire. Up to 50 000 for liability and 25 000 for property damage.

/hands-up-while-driving-a-convertible-164952484-588e3a1d3df78caebc194118.jpg)

/auto-accident-involving-two-cars-on-a-city-street-970958674-a196dc719c4a464a99c5cf128f2b1aa2.jpg)

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

:max_bytes(150000):strip_icc()/SwitchingCarInsurance_GettyImages-1029356602-0e311271353c47a99e61036d78e0fdff.jpg)