Will Car Insurance Cover Stolen Items

/GettyImages-526745055-56d885d85f9b5854a9c4b188.jpg)

The good news is comprehensive insurance covers damage to your car in the event of a break in.

Will car insurance cover stolen items. Homeowners or renters insurance when it comes to having your personal property insured you can usually rely on your homeowners insurance or renters insurance policy. Personal items such as a laptop phone or handbag stolen from your car are generally not covered by your standard comprehensive car insurance. Unfortunately car insurance does not cover most items stored in your vehicle. However some providers may offer separate add on.

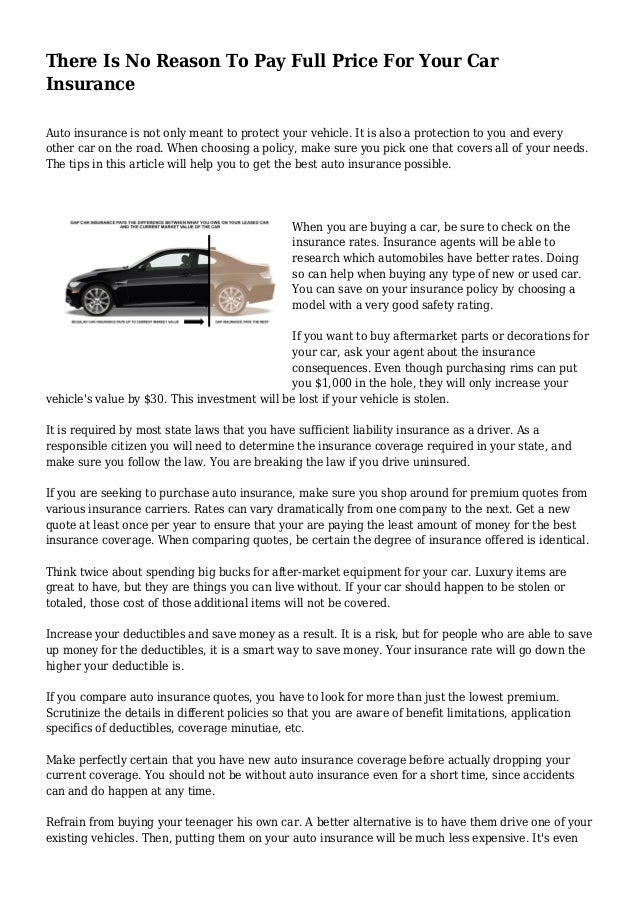

If your car or another vehicle was stolen however the car or vehicle itself is usually not covered by homeowners insurance. So things like a broken window damaged glove box and jimmied lock are covered. Comprehensive coverage protects your car from a variety of threats including storms natural disasters falling objects theft of the car not its contents hitting an animal and broken glass. For stuff kept in your car.

So does car insurance cover stolen items. A stolen cell phone is typically not covered by comprehensive car insurance though comprehensive insurance will cover theft of items attached to the vehicle. In a situation where your car is stolen or broken into then your car insurance may not cover your stolen personal items. Liability insurance covers the costs of damage you cause to others and to property as a result of a car accident.

Homeowners insurance covers a stolen car or vehicles. You ll need a homeowners renters or condo policy to protect any belongings stolen out of your car. Items stolen out of your vehicle like a laptop briefcase or phone are not covered under your auto insurance. Comprehensive auto insurance will only cover the components and features that are permanent pre installed parts of the car.

If your car or another vehicle was broken into and items were stolen from it those items are usually covered by homeowners insurance to cover for theft. Unfortunately it does not. Collision insurance will help pay for damage your car sustains in an accident. However these items would likely be covered by a homeowners or.

However there are times where your car may be stolen or broken into and your personal items may be stolen damaged or otherwise lost during the process. Meaning you will need to look at other coverage options. Car insurance covers your vehicle and the occupants inside it but that coverage does not extend to laptops luggage or other personal belongings within your vehicle. Any items you have in your car that are stolen such as laptops will generally not be covered by comprehensive coverage.

The average cost of comprehensive coverage is 160 a year or 13 a month.