Reverse Mortgage Gov

As a guide add 1 for each year over 60.

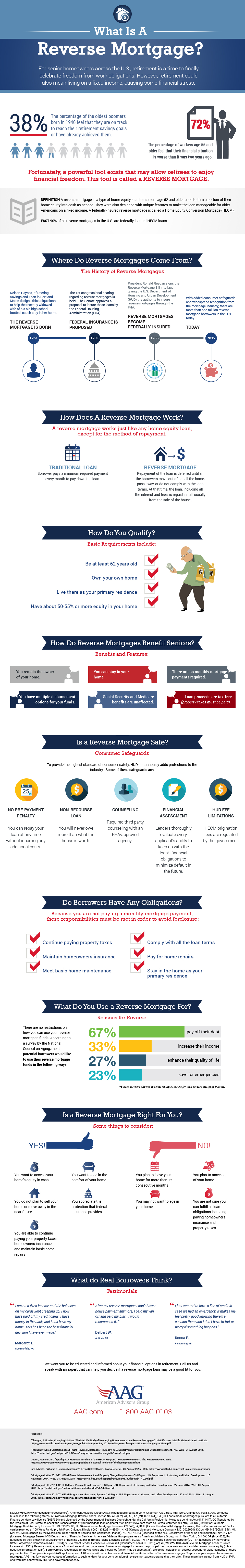

Reverse mortgage gov. The counselor also must explain the possible alternatives to a hecm like government and non profit programs or a single purpose or proprietary reverse mortgage. Interest will be charged until the loan is paid off in full. If you re age 60 the most you can borrow is likely to be 15 20 of the value of your home. The australian government has been offering the pension loans scheme through the centrelink as a voluntary reverse equity mortgage for older australians who need to supplement their.

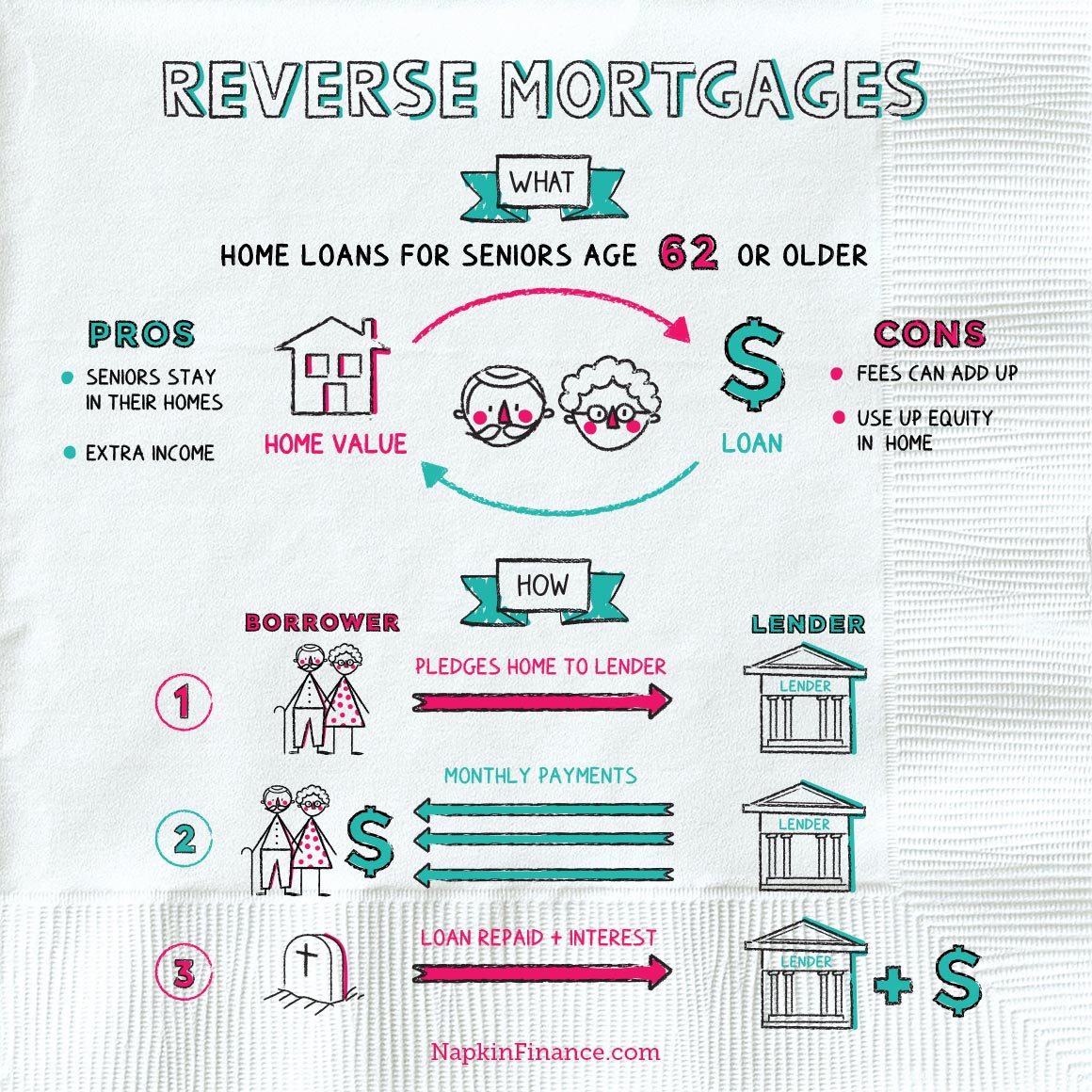

Homeowners who are at least 62 years old are eligible. A reverse mortgage is a loan available to homeowners 62 years or older that allows them to convert part of the equity in their homes into cash. A reverse mortgage allows you to borrow money using the equity in your home as security. By borrowing against their equity seniors get access to cash to.

The counselor also should be able to help you compare the costs of different types of reverse mortgages and tell you how different payment options fees and other costs affect the total cost of the loan over time. A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. The advice for children of seniors. A reverse mortgage is a home loan that you do not have to pay back for as long as you live in your home.

You have the option to repay the principal and interest in full at any time. You only repay the loan when you die sell your home or permanently move away. However you may be charged a fee to pay off your reverse mortgage early. Australian seniors with full age pension entitlements can now access the government funded pension loans scheme at a max of 17 800 annually as part of the key changes introduced in the 2018 federal budget.

You might find reverse mortgage originators that offer higher or lower margins and various credits on lender fees or closing costs. Also like a traditional mortgage when you take out a reverse mortgage loan the title to your home remains in your name. Repaying the money you borrow with a reverse mortgage. A reverse mortgage loan like a traditional mortgage allows homeowners to borrow money using their home as security for the loan.

Upon choosing a lender and applying for a hecm the consumer will receive from the loan originator additional required cost of credit disclosures providing further explanations of the costs and terms of the reverse mortgages offered by that originator and or.