Simple Ira Contribution Deadline 2016

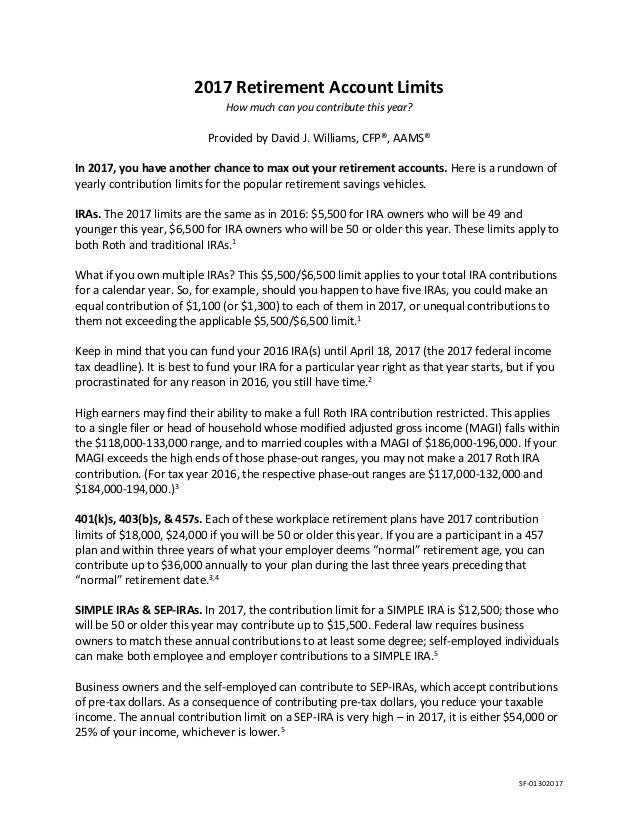

The max contribution for simple iras is 12 500 in 2016 the same as in 2015.

Simple ira contribution deadline 2016. Salary reduction contributions the amount an employee contributes from their salary to a simple ira cannot exceed 13 500 in 2020 13 000 in 2019 and 12 500 in 2015 2018. Employees age 50 or older are eligible for a 3 000 catch up contribution. Keep in mind that roth iras require the first contribution be made at least five years before qualified distributions begin. As a result the simple ira contribution limit for 2016 is 15 500 for participants age 50 or older.

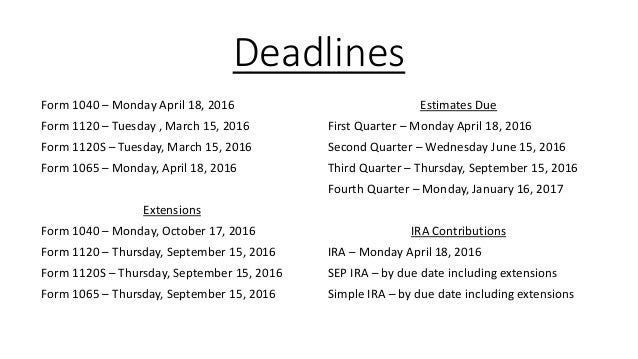

How much may an employee defer under a simple ira plan. If you have or are thinking of starting a roth ira the contribution deadline for the 2016 tax year is the same as a traditional ira you can contribute until april 17 2017. No other contributions can be made to a simple ira plan. This amount is unchanged from 2015.

Catch up contributions for simple iras remain at 3 000 in 2016. An employer may choose to make either matching contributions to an employee s simple ira from 1 to 3 of his or her salary or non elective contributions. The salary reduction contributions under a simple. The deadline for 2016 ira contributions is april 18 2017.

Employees age 50 or over can make a catch up contribution of up to 3 000 in 2016 2020 subject to cost of living adjustments for later years. Retirement savers who own their own business or are self employed will notice ira limits remain unchanged for 2016. An employee may defer up to 13 500 in 2020 13 000 in 2018. His employer can only match up to 3 meaning his 5 000 employee contribution 10 of 50 000 will be matched by a 1 500 employer contribution 3 of 50 000 for a total simple ira deposit of 6 500.

12 500 in 2016 2018 subject to cost of living adjustments for later years. 2016 simple ira contribution limits. Early birds may do better keep in mind that procrastination can be costly. The deadline for making ira contributions for a given tax year is typically april 15 of the following year.

In 2016 the maximum amount employees can generally contribute to a simple ira is 12 500. Here s how to take advantage of that time. Matching contributions up to 3 of compensation employee a earns 50 000 and contributes 10 from every paycheck. Deadlines for employer contributions.