Small Business Health Insurance

Explore aetna s small group health insurance options to find the right plan and benefits for the needs of small businesses and its employees.

Small business health insurance. Once you ve selected a plan an ehealth agent can walk you through the enrollment process. That s why we ve created our small business guide to health insurance which covers off a number of frequently asked questions. Plus with just a bit of extra paperwork you can set up your health insurance so that your employees can pay their portions of the premium with pre tax money. It can also be for small business employees where the employer offers health insurance options.

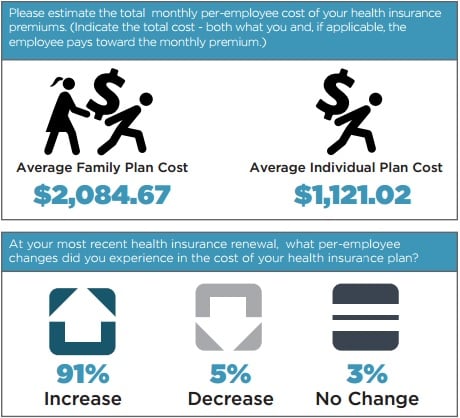

If you ve considered offering small business health insurance to your team it s likely that you have a lot of questions around how it works. The traditional choice of most businesses a group health insurance policy is a plan chosen by the business that provides coverage to employees and potentially employees dependents. Small business health insurance is typically for businesses with 2 50 employees. Health insurance for your business and employees offering health benefits is a major decision for businesses.

Enrollment is the process of getting your employees and their dependents signed up for your new health plan. The small business guide to health insurance. Small business health insurance enrollment process. Small business health insurance is health coverage for those that are self employed and small business owners.

Like all businesses health care coverage comes in all shapes and sizes. And health insurance is a critical factor in retaining and recruiting employees for your small business as well as maintaining productivity and employee satisfaction. Use healthcare gov as a resource to learn more about health insurance products and services for your employees.