Small Business Liability Insurance Cost

Protect your company and employees with the right commercial insurance policies.

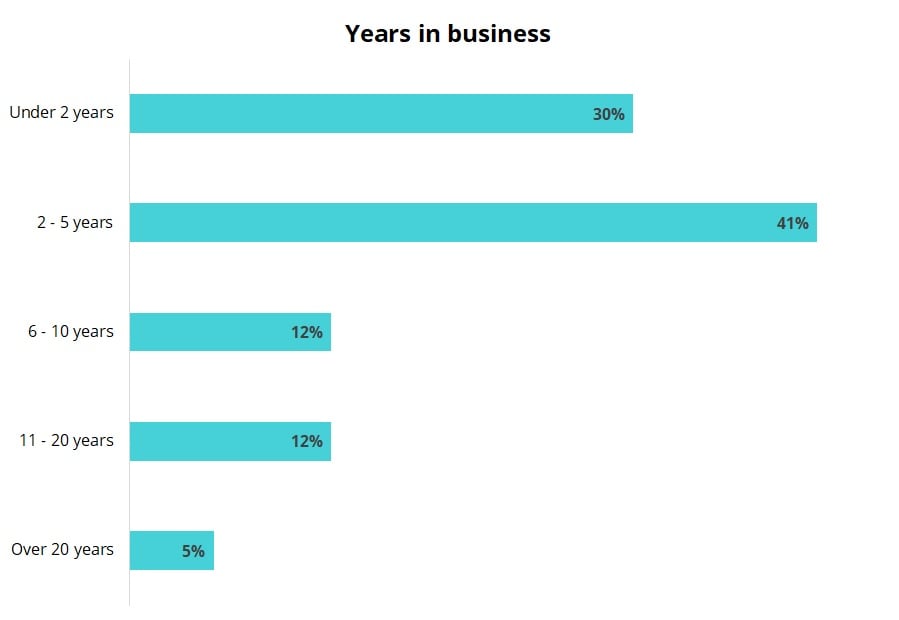

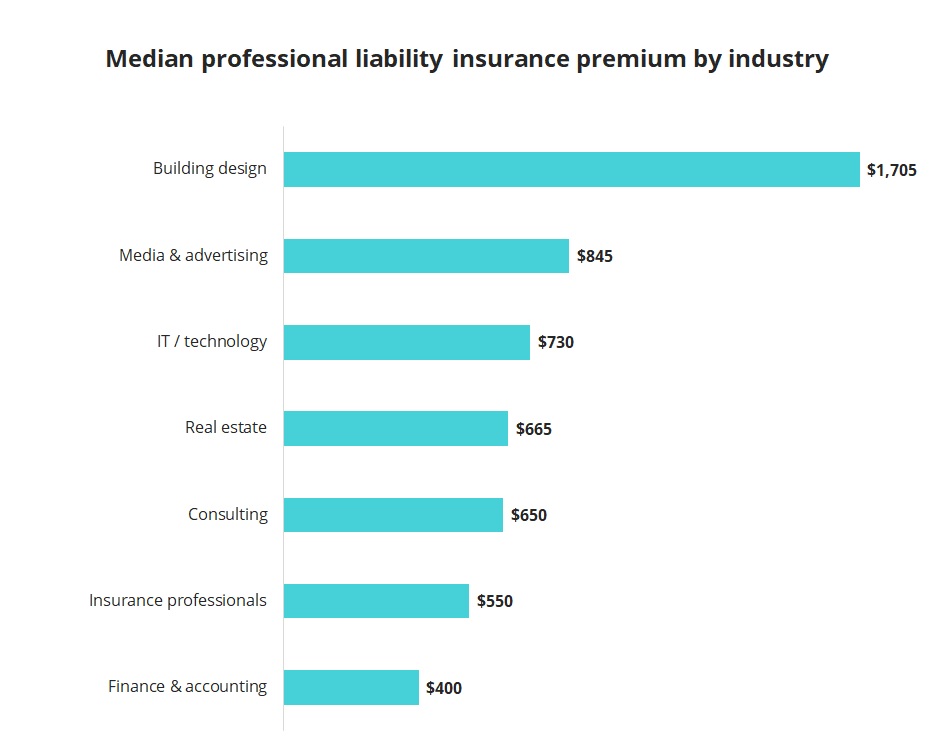

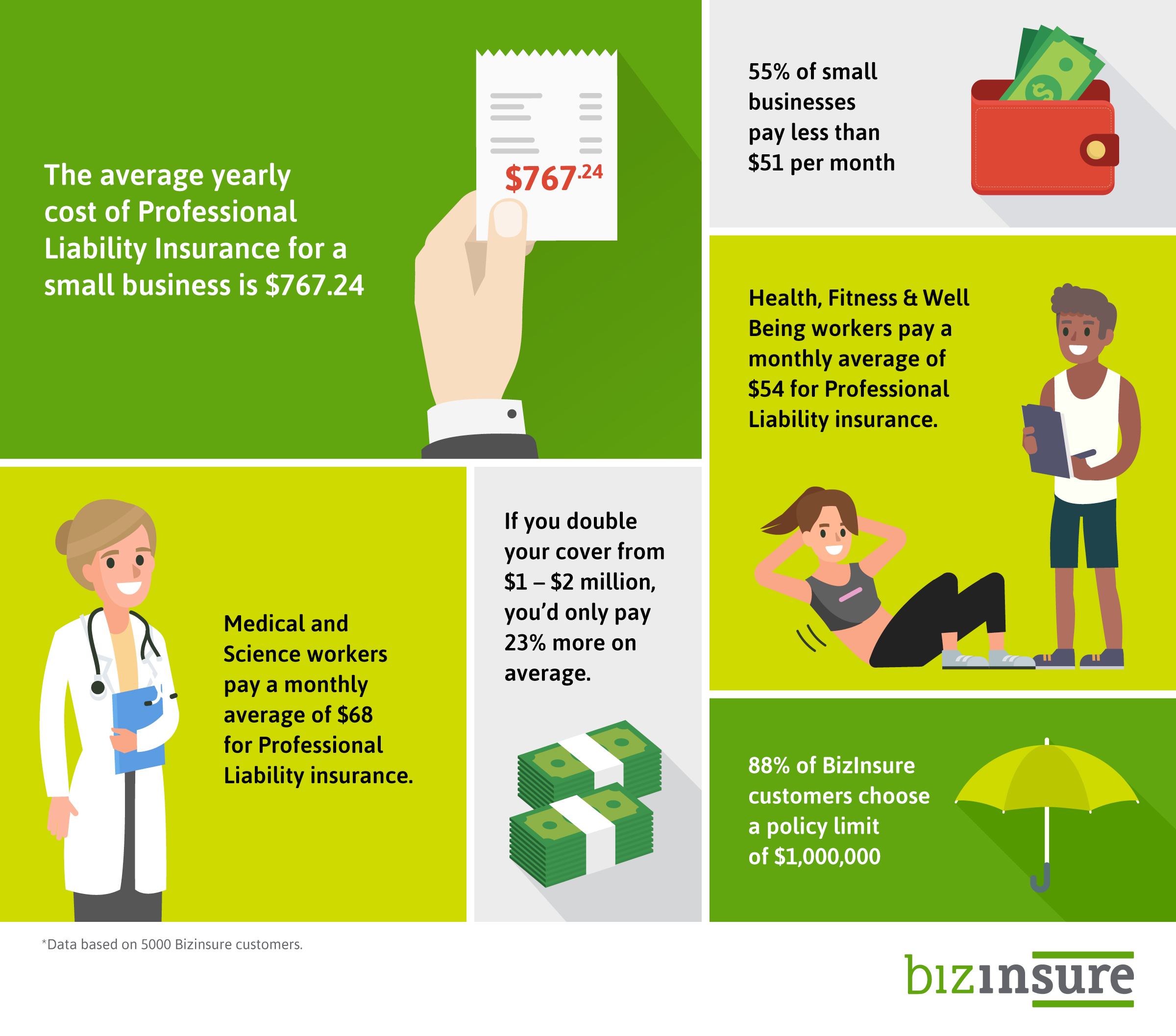

Small business liability insurance cost. Also learn about small business insurance requirements for general liability business property commercial auto workers compensation including small business commercial insurance costs. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums. Business or general liability insurance helps protect businesses from claims that happen as a result of normal business operations. Many of insureon s customers have fewer than five employees and generate less than 100 000 in annual revenue.

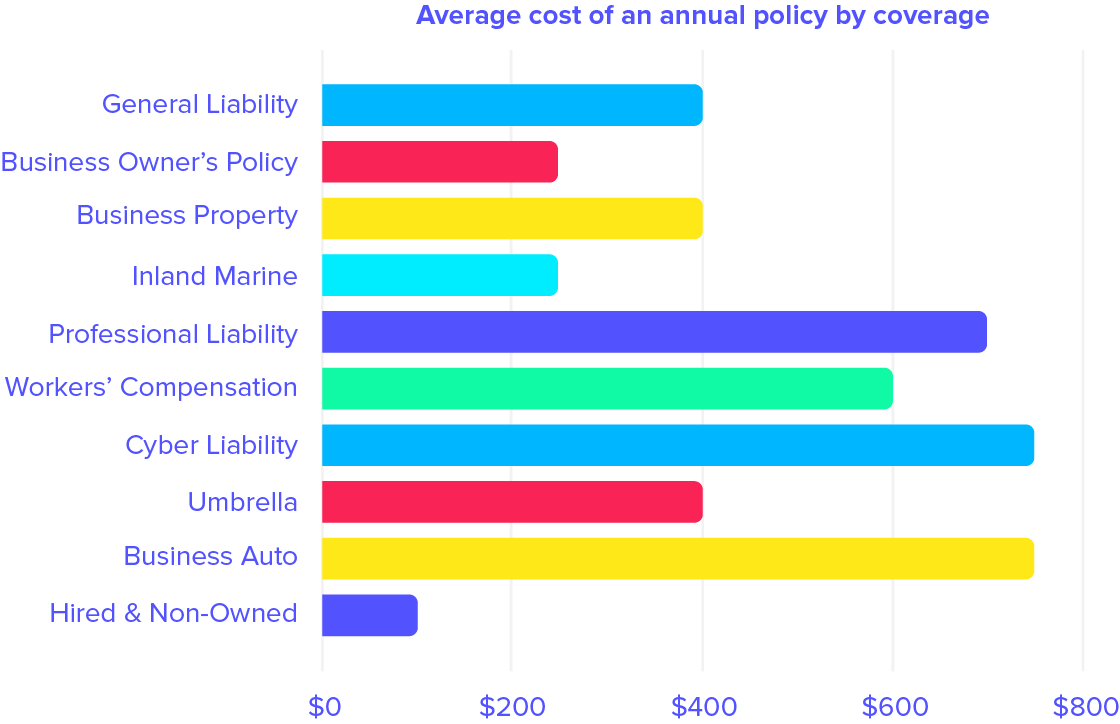

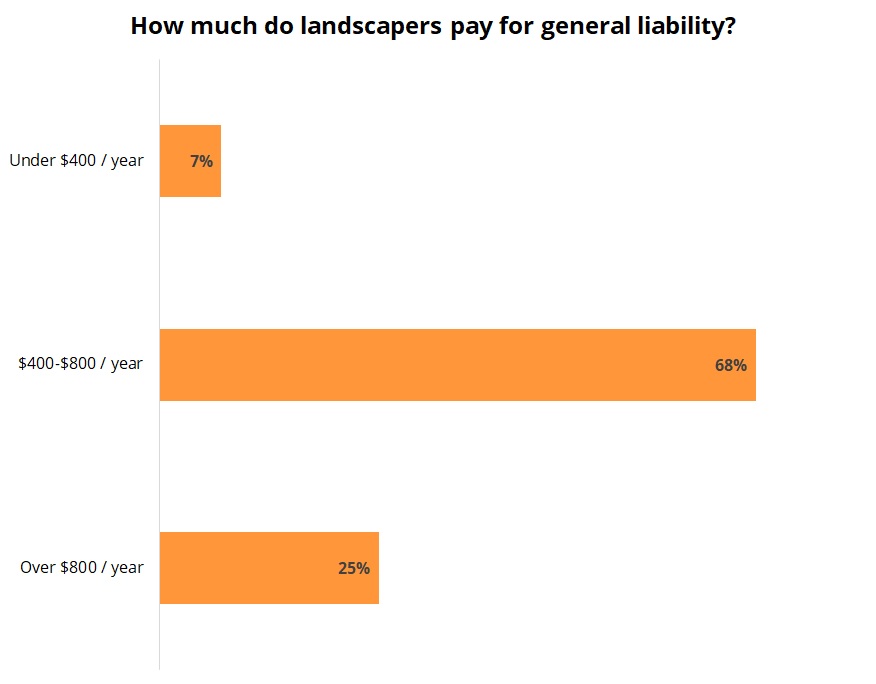

Compare small business insurance. Costs vary depending on your risk but most small businesses pay between 400 and 1 300 per year for coverage. A commercial liability policy for a home based child care business runs 350 700 or. How much liability insurance should cost.

Prices paid and comments from costhelper s team of professional journalists and community of users. Most small business owners 48 pay between 300 and 600 annually for their policies and 17 pay less than 300. General liability insurance costs vs average claim costs. If you employ more workers or generate significantly higher revenue you may pay more than the median indicated.

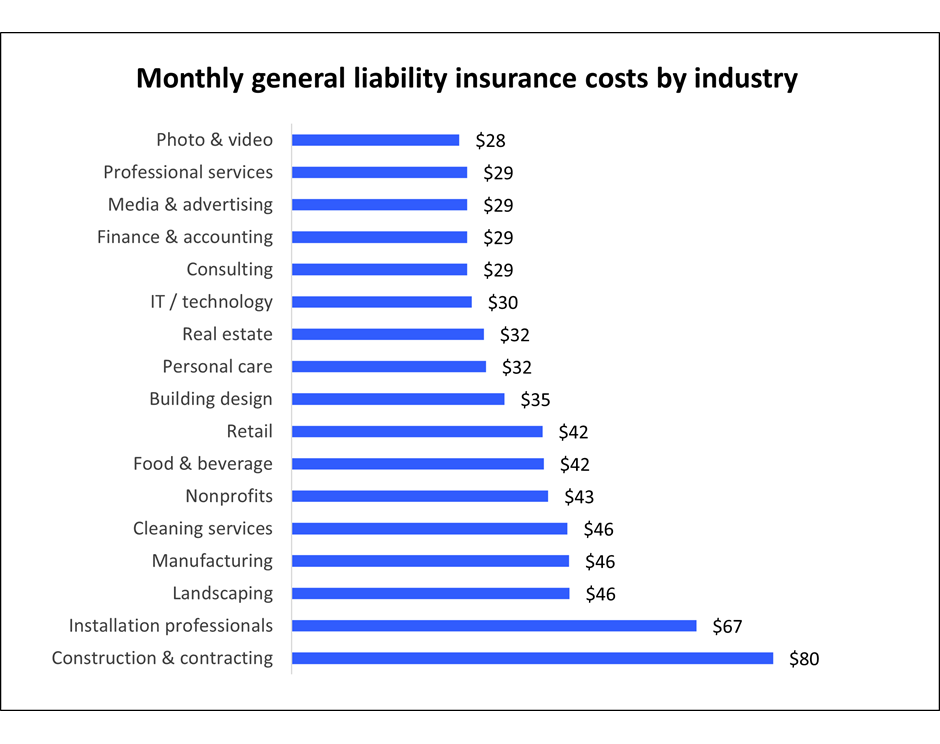

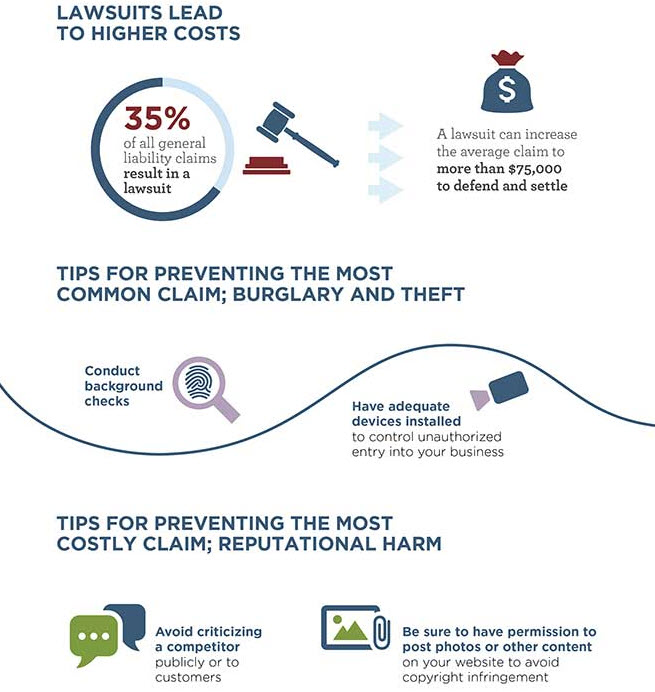

We also learned that 95 of the surveyed small business owners pay less than 50 per month for general liability insurance and just 1 of small businesses pay more than 100 per month. The right public and employers liability cover means you will not have to pay for claims out of your own pocket. Small business owners can use this data to estimate their cost of insurance. Public liability insurance is one of the most popular types of insurance for businesses.

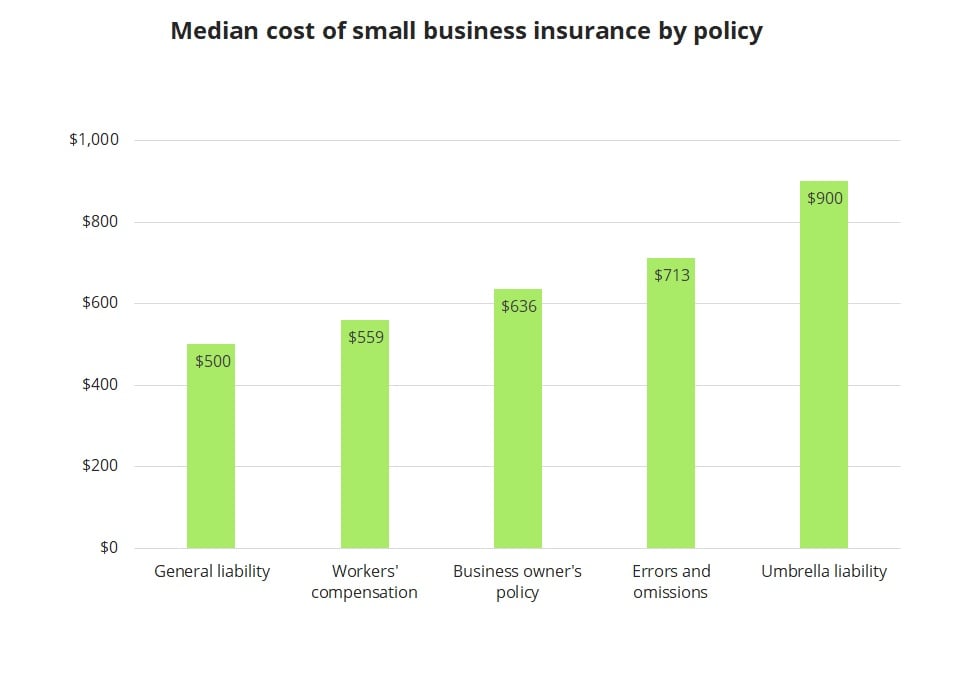

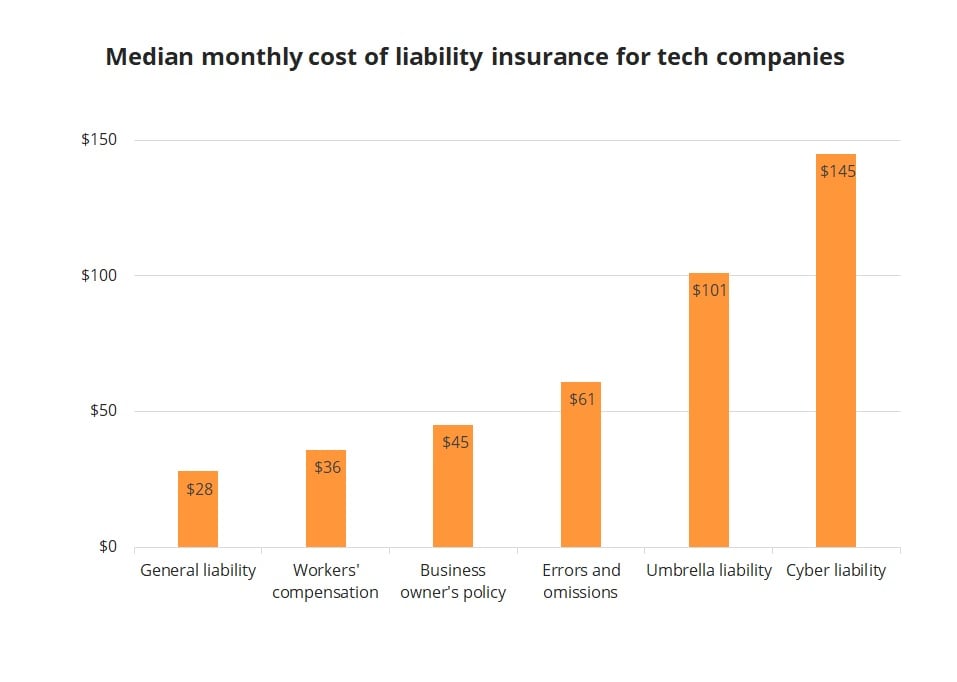

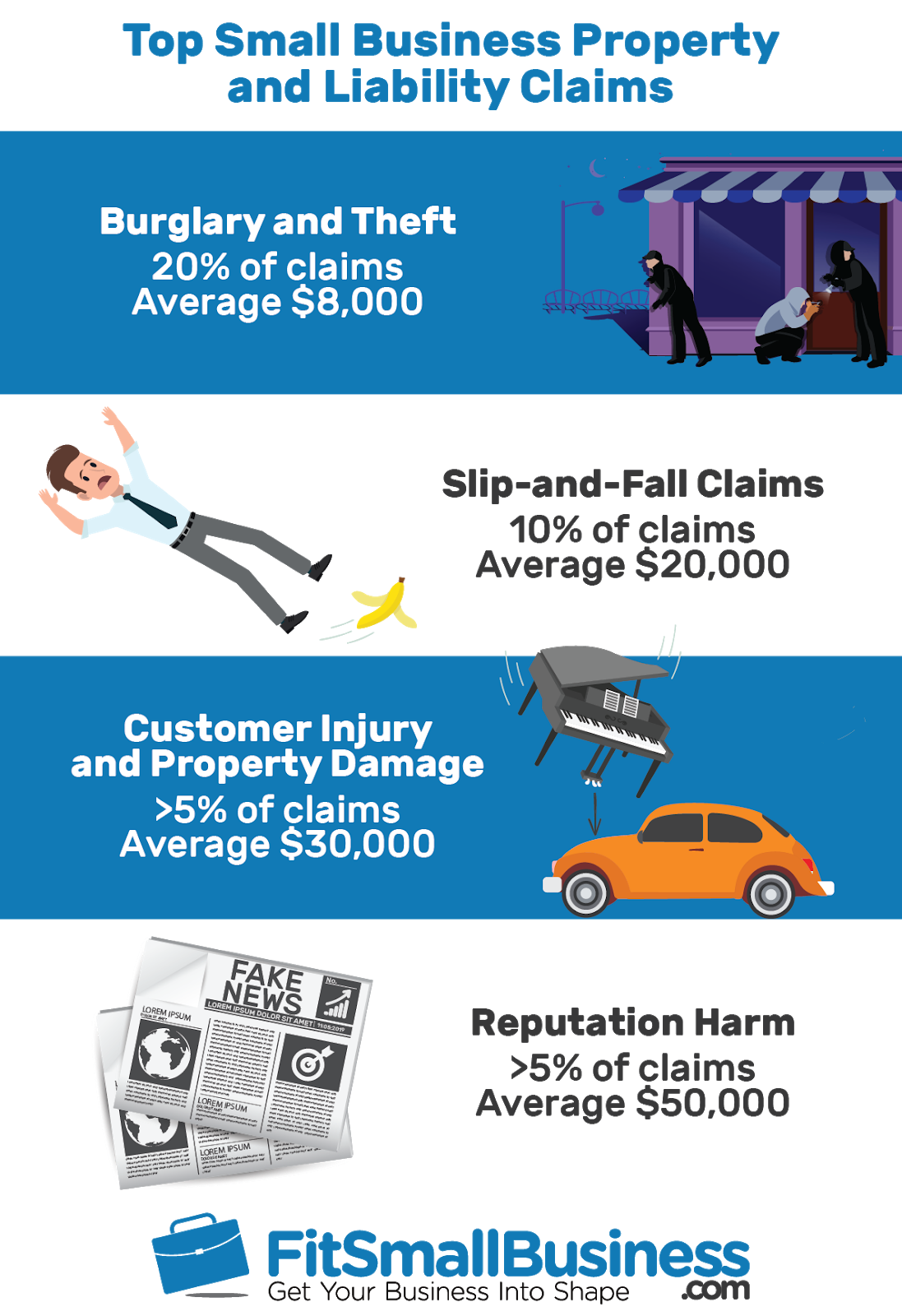

Compare insurance policies that can cover your small business for less. The first policy that most business owners need and also the least expensive one is general liability insurance in an analysis of 28 000 small business owners who purchased commercial insurance through insureon the median cost of general liability insurance was 42 per month or 500 per year the median cost of a business owner s policy which bundles general liability with property. General liability gl insurance typically provides insurance coverage to small businesses for among other things third party bodily injuries medical payments and advertising injuries. Premiums for liability insurance vary widely depending on the size of the business in square footage and or payroll the risks involved and the exact type of coverage.

General liability insurance is a fundamental business policy because it covers events that may happen to any business owner like injuries and property damage you cause people who aren t your employees. Call us 855 767 7828. In fact it is important for almost every kind of business from those that operate in the trades and service industries to businesses that are predominantly office based such as consultancy.