Receivables Factoring Rates

Get a quote or.

Receivables factoring rates. Call now 24 7 1 800 876 6071 consider accounts receivable financing for your business. Advance rates for the transportation industry are generally higher. Factoring rates are the discount charge used to calculate factoring fees. Factoring fees don t create debt.

The costs typically associated with factoring receivables are as follows. Foreign receivables are usually under served assets. But a number of factors can all affect the actual rate. The most popular options are a flat discount rate for example 1 every 30 days and a flat discount plus margin for example 0 5 every 30 days plus prime 2 interest rate.

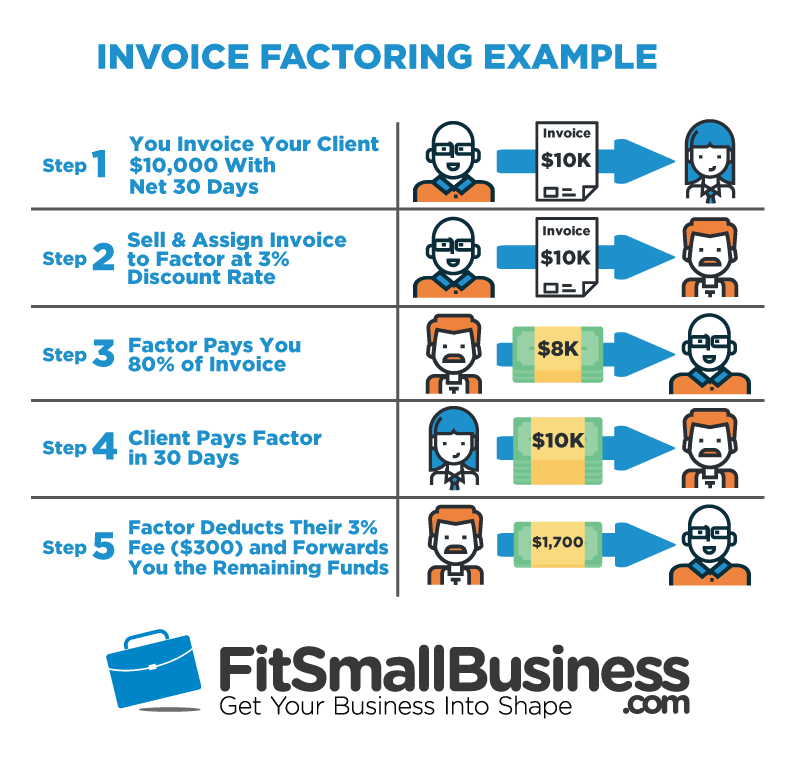

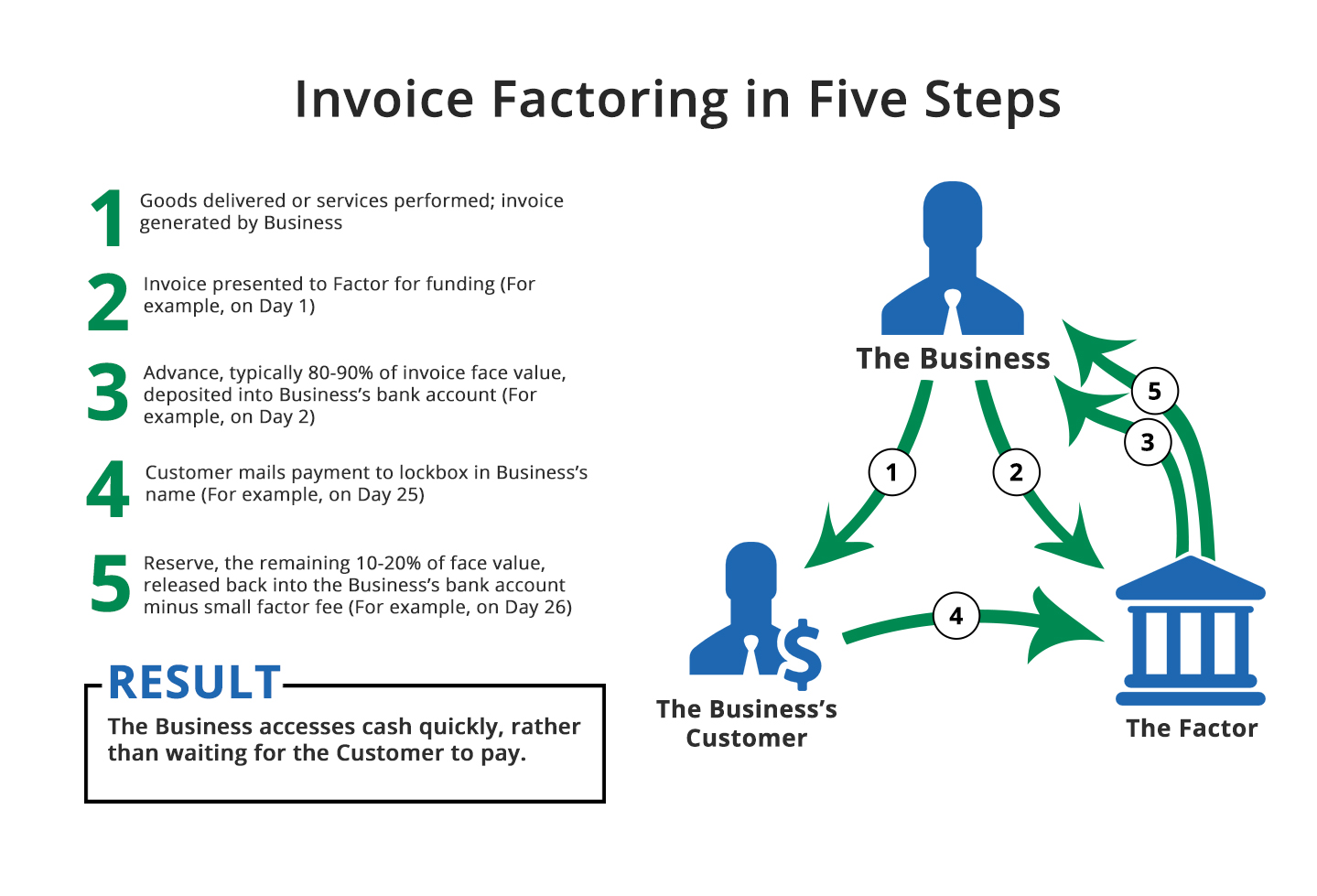

Unlike a business loan invoice factoring is not considered debt on your balance sheet. When we finance your receivables. Typically fees for factoring receivables start at around 2 with a typical advance rate of 80 90 depending on the industry. When the factor is bearing all the risk of bad debts in the case of non recourse factoring a higher rate is charged to compensate for the risk.

Invoice factoring rates aka accounts receivable finance that are applied to the purchase of bills should not be compared with interest rates on loans because these rates are transactional rates and represent the purchase of an asset not the lending of capital. Specifically businesses think that invoice factoring rates should be compared directly against traditional bank interest rates. International factoring allows you to drastically increase your prospective supplier network to all corners of the globe increasing the number of opportunities available to you and making your business infinitely more attractive. With recourse factoring the company selling its receivables still has some liability.

The important thing to remember about financing receivables is that it is not a loan. Most factoring fee rates range between 0 5 to 5 of the invoice amount per month. Factoring rates vary by industry risk transaction workload and volume. What are invoice factoring rates.

As a general rule of thumb the more invoices you factor the lower your fee rate tends. In general you will pay a factoring fee of between 1 and 5 for accounts receivable financing. Factoring rates at 0 69 to 1 59. There are several rate models.

Companies with lower risks whose receivables are easy to manage usually get lower rates and higher advances.