Va Mortgage Loans Qualifications

The eligibility requirements to obtain a coe are listed below for servicemembers and veterans spouses and other eligible beneficiaries.

Va mortgage loans qualifications. It confirms for your lender that you qualify for the va home loan benefit. Va home loan appraisal requirements. You must have satisfactory credit sufficient income and a valid certificate of eligibility coe to be eligible for a va guaranteed home loan. The home must be for your own personal occupancy.

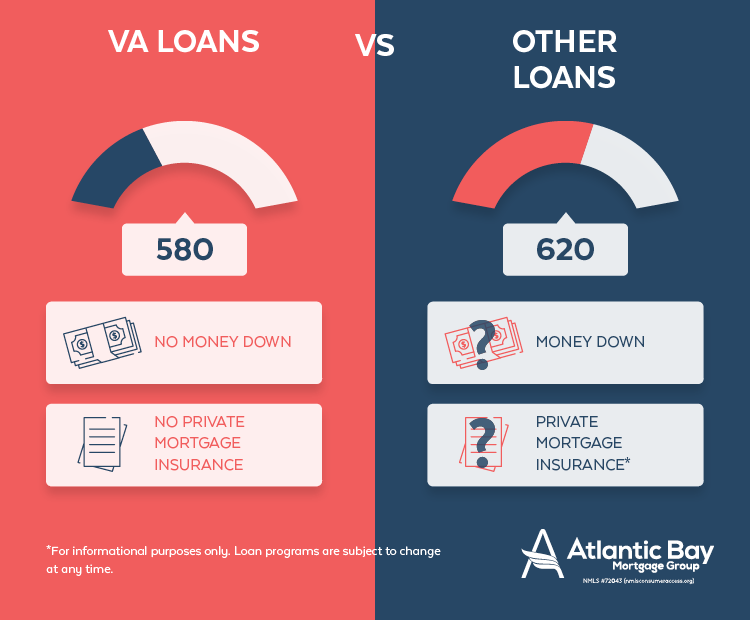

Current minimum requirements for a va loan. This means that va borrowers might be able to buy homes with va financing rather than a jumbo loan or financing for loans that exceed conventional loan limits. Learn how to apply for a va home loan certificate of eligibility coe. Va loans got turbocharged in 2020.

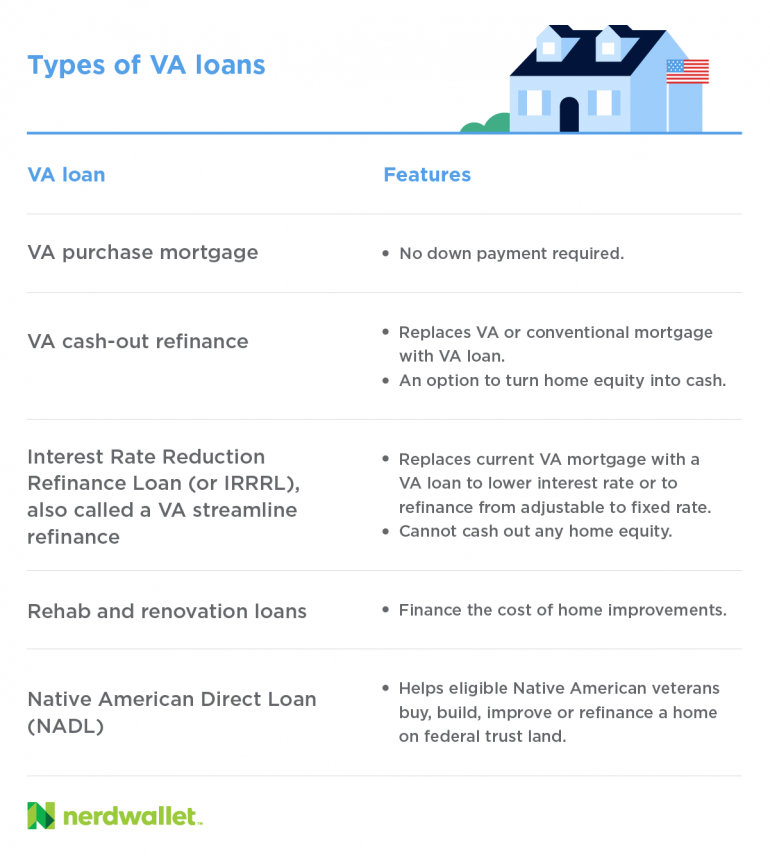

While the va does not lend money for va loans it backs loans made by private lenders banks savings and loans or mortgage companies to veterans active military personnel and military spouses who qualify. Va loan refinance rates. Your coe provides the lender with confirmation that you qualify for va loan benefits. A va loan is a mortgage loan that s backed by the department of veterans affairs va for those who have served or are presently serving in the u s.

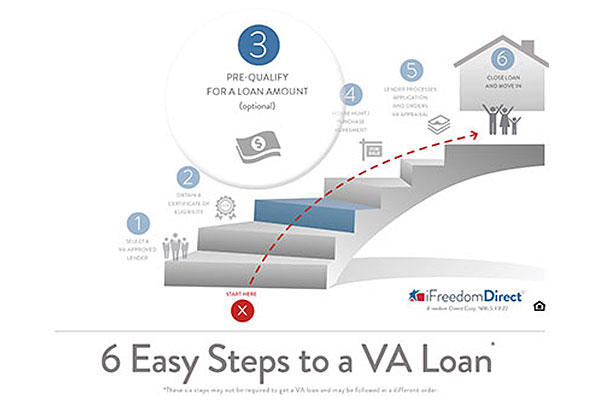

This is the first step in getting a va backed home loan or native american direct loan. In contrast loan providers who choose to make nonconforming loans are exercising a greater threat tolerance and do so knowing that they deal with more obstacle in marketing the loan. Learn about va home loan eligibility requirements for a va direct or va backed loan. Again it is not necessary to obtain your coe before applying for a va loan as most va lenders are able to instantly pull your.

In 2020 va mortgages no longer have loan limits. Find out how to apply for a certificate of eligibility coe to show your lender that you qualify based on your service history and duty status. One of the most common home loan in canada is the five year fixed rate shut home loan as opposed to the u s. The va appraisal is a tool for the lender to insure the home meets minimum standards and to establish a fair market value of the real estate by doing a basic review of the home s condition and comparing that property to others on the market that may be similar to it.

This page describes the evidence you submit to verify your eligibility for a va home loan and how to submit the evidence and obtain a coe. Then choose your loan type and learn about the rest of the loan application process. After establishing that you are eligible you will need a certificate of eligibility coe the coe verifies to the lender that you are eligible for a va backed loan.