Traditional Ira Contribution Age Limit

One of the most significant changes affecting iras as a result of the setting every community up for retirement enhancement secure act part of the further consolidated appropriations act 2020 enacted late december 2019 is the repeal of the age limit on traditional ira contributions.

Traditional ira contribution age limit. 2019 amount of roth ira contributions you can make for 2019. The end to the age limit on traditional ira contributions means retirees would have more time to add to their savings and raising the rmd age is complementary to this change. Americans 50 years of age or older can contribute an additional 1 000 in catch up contributions. You should still be able to make what is called a spousal ira contribution to their traditional ira which would allow you to use the tax deduction for the ira contribution.

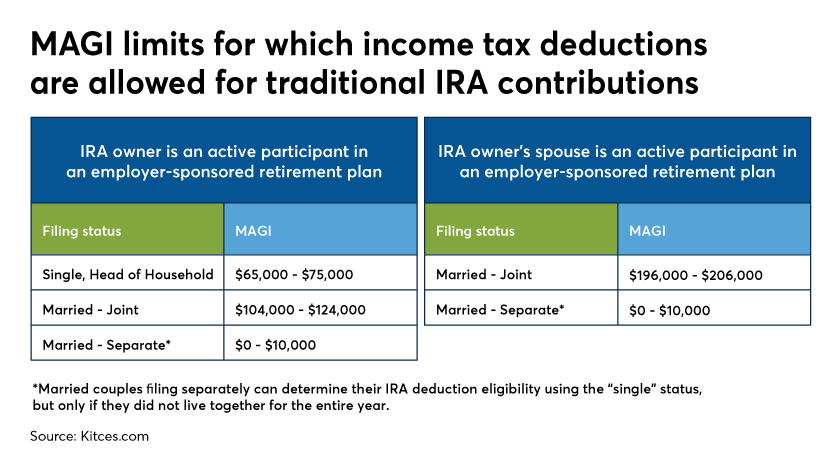

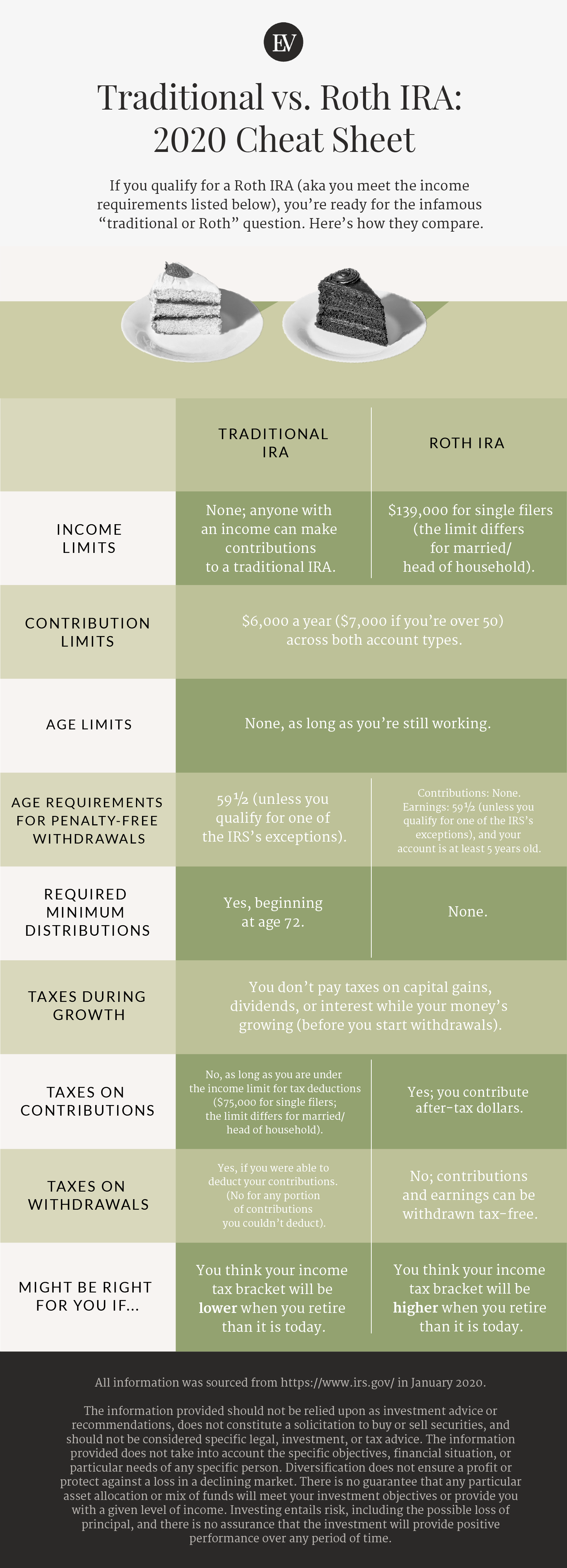

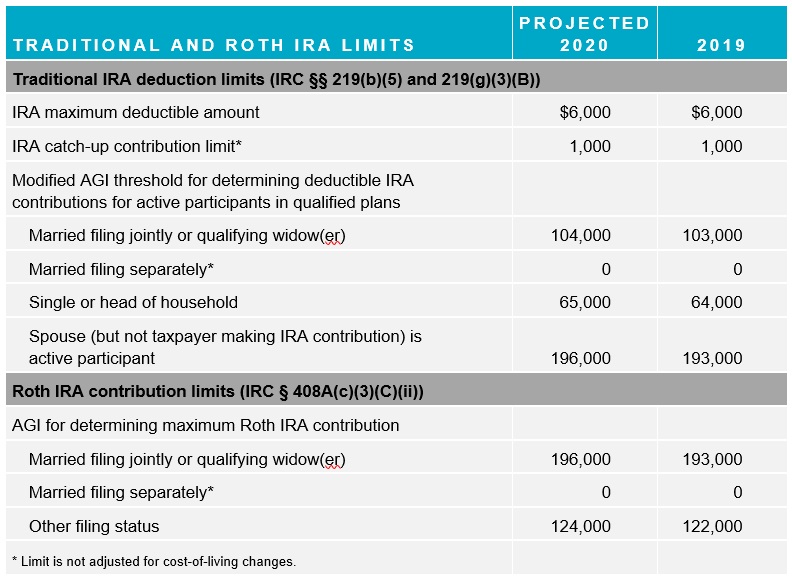

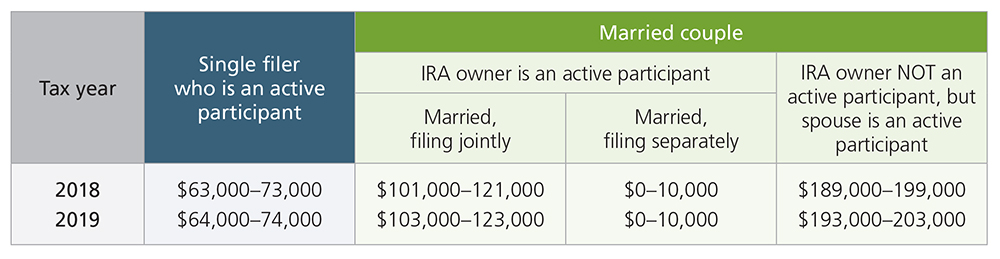

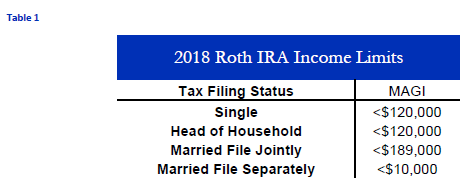

Workers age 50 and older can add an extra 1 000 per year as a catch up contribution. Your roth ira contributions may also be limited based on your filing status and income. The maximum amount you can contribute to a traditional ira for 2020 is 6 000 if you re younger than age 50. The contribution limits for traditional ira contributions that you can deduct on your tax return are the most stringent.

If you will be 50 or older by the end. 6 000 or your taxable compensation whichever is lower. See ira contribution limits. Roth ira contributions are allowable at a higher income limit.

For 2019 if you re 70 or older you can t make a regular contribution to a traditional ira. Ira contributions after age 70. For example let s assume you have reached the traditional ira age limit of 70 and can t contribute but your spouse is younger than you. The ira contribution limit is 6 000.

Roth ira contribution limits. 401 k participants with incomes below 75 000 124 000 for couples are. The annual contribution limit for 2020 is 6 000 or 7 000 if you re age 50 or older same as 2019 limit. For 2020 and later there is no age limit on making regular contributions to traditional or roth iras.

Contribution limits for iras. The ira catch up contribution limit will remain 1 000 for those age 50 and older. The 2019 contribution limit for traditional and roth iras is 6 000 or your taxable income for the year if less than 6 000.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/150337672-F-56a635fa5f9b58b7d0e06beb.jpg)

/GettyImages-973099588-be87e9a3056f48e7bd6e875ce1aa9b8d.jpg)