Reverse Merger Into Public Shell

The real purpose of corporate finance.

Reverse merger into public shell. Otc shell for sale. Site map reverse merger with an otc shell. See all the videos. Reverse merger how it works.

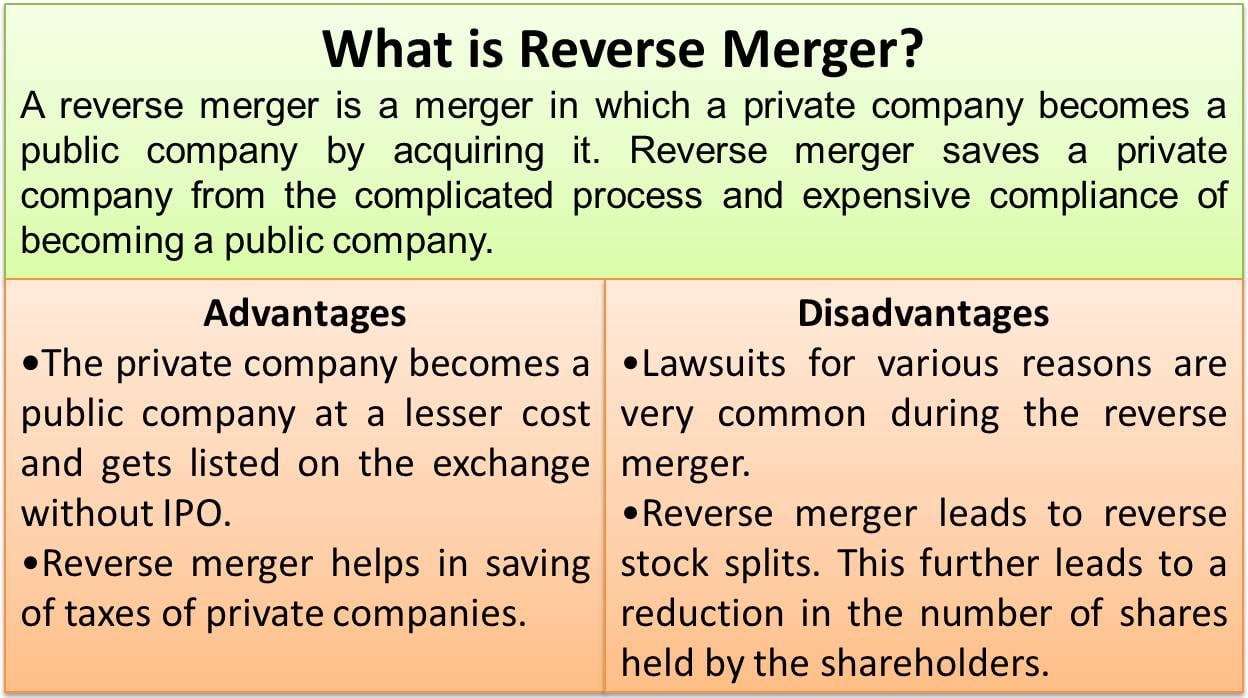

Advantages of reverse mergers. A reverse takeover rto reverse merger or reverse ipo is the acquisition of a private company by an existing public company often a spac so that the private company can bypass the lengthy and complex process of going public. A reverse merger allows a privately held company to go public by acquiring a controlling interest in and merging with a public operating or public shell company. Public shells or otc shells for a reverse merger.

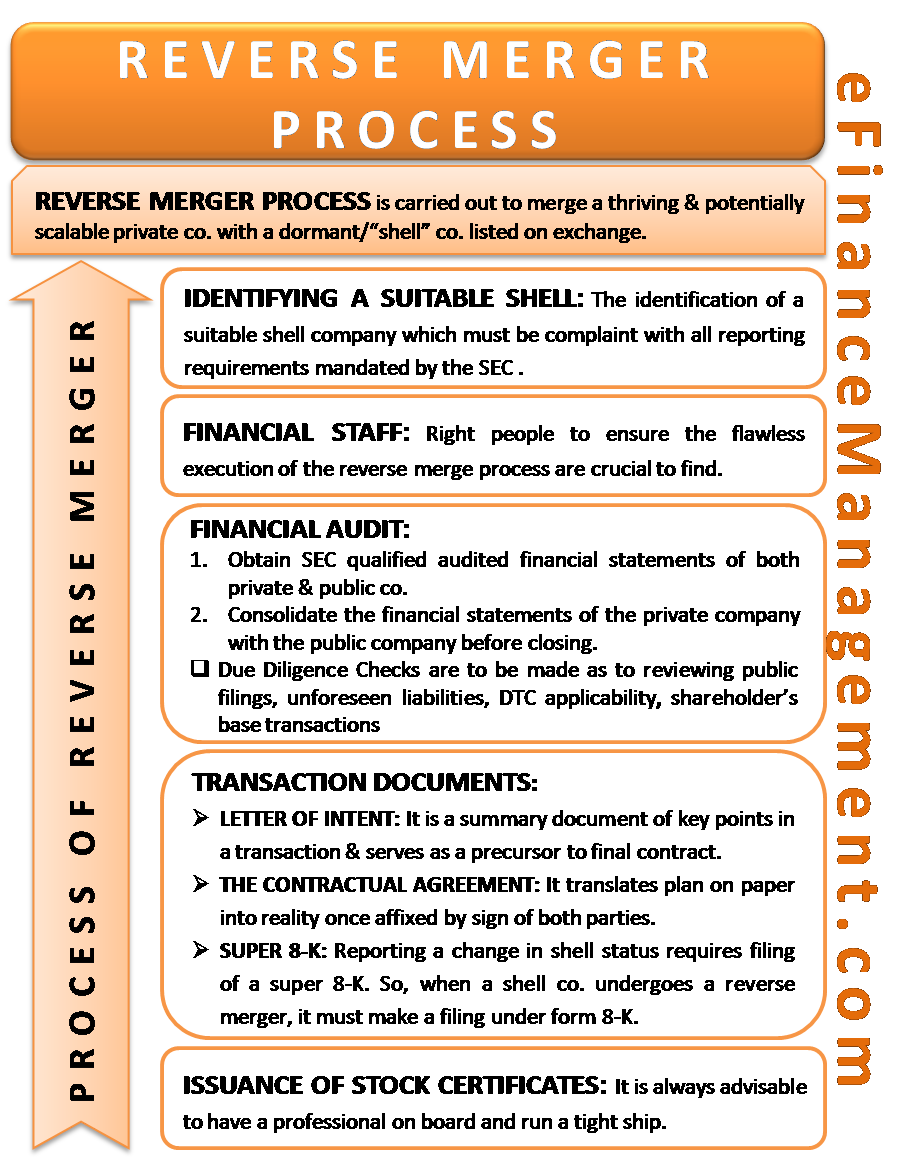

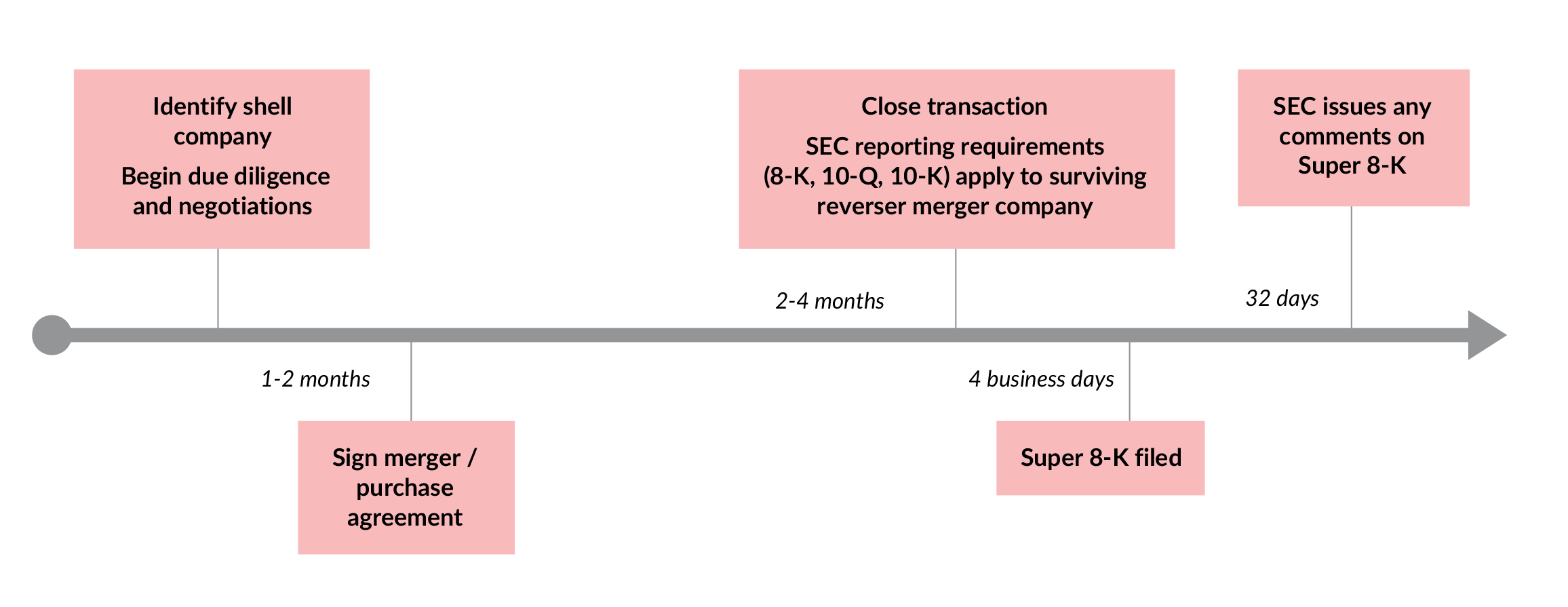

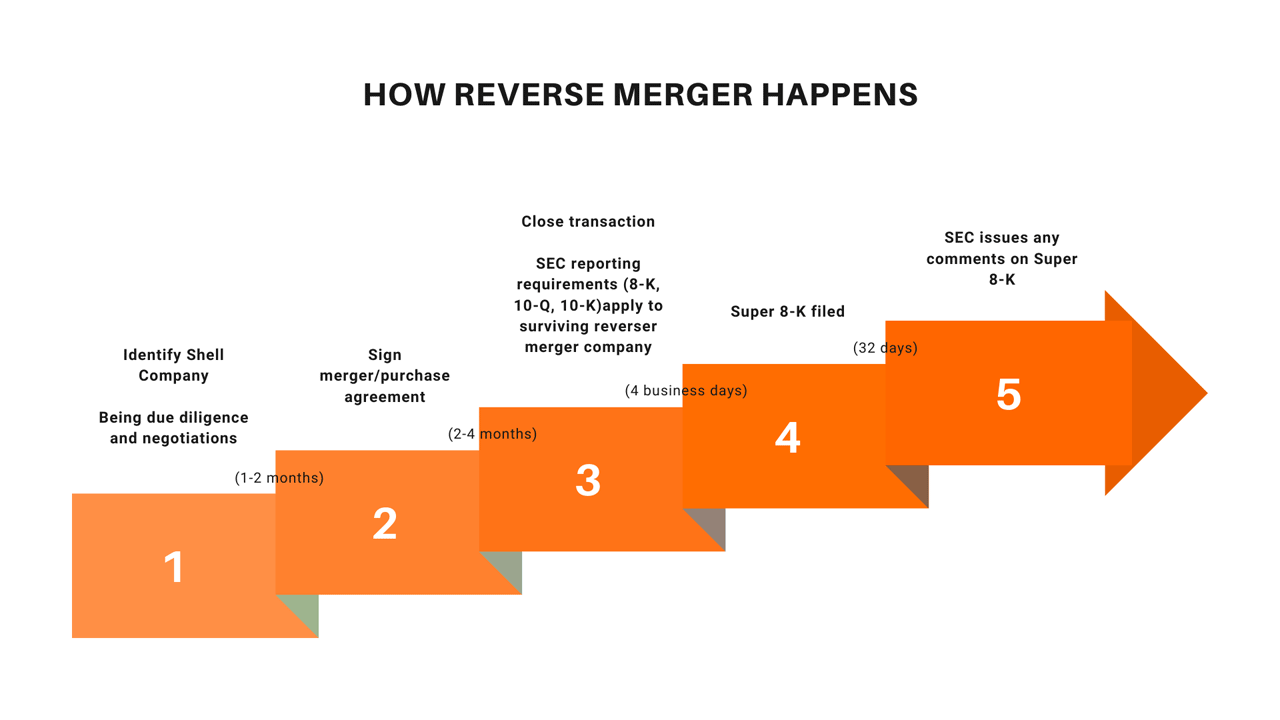

Reverse mergers into public shell companies reverse mergers into public shell companies raise a number of very significant concerns not raised by merging into an operating company including. The faster cheaper alternative to a conventional ipo. Otc shells and reverse mergers the aftermarket. A reverse merger into a public shell occurs when a private company acquires the sluffed off shell of a public company a legal entity still licensed to trade on a public stock exchange even while the former underlying operating business may be defunct or nonexistent.

The vendor in the reverse merger may conceal skeletons in the closet. In a reverse merger an active private company takes control and merges with a dormant public company these dormant public companies are called shell corporations because they rarely have assets. What is an otc shell if a public company becomes inactive its stock is still registered and in public. They correctly believe that going public is a good way to grow their companies but fail to realize while buying a shell and using a reverse merger to go public may seem easy and quick in reality the process is not necessarily straightforward.

Most public shell companies were formed by sponsors or promoters that have undisclosed financial interests. An alternative to venture capital funding give control to the company. Problems with using a public shell or otc shell to go public with a reverse merger. Sometimes conversely the public company is bought by the private company through an asset swap and share issue.