Retirement Planning Ira

There are several types of iras as of 2020.

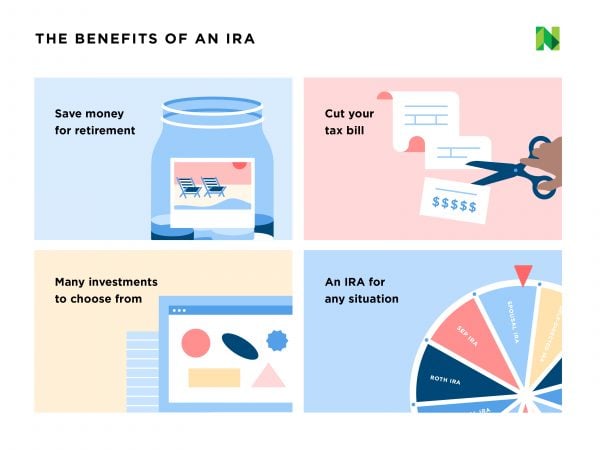

Retirement planning ira. Yes we are here for you and it s easy to meet with us. Waivers of the 60 day rollover requirement. An ira is an account set up at a financial institution that allows an individual to save for retirement with tax free growth or on a tax deferred basis. Guaranteed retirement income in any market.

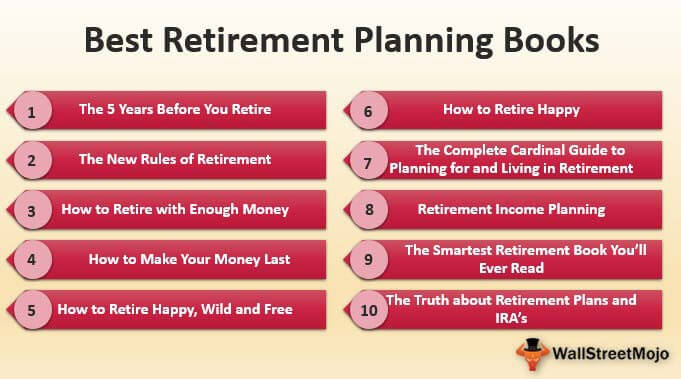

Here are some errors that you can fix thought. A simple ira is an ideal choice for companies that want to make retirement savings possible without a 401 k or other employer sponsored retirement plan. What do you get when you combine a talented cfp professional with a well informed college finance instructor and a well respected estate tax planning attorney if you mix in relevant financial information and a healthy dose of humor you get the retirement and ira show an informative educational and entertaining podcast program focused on retirement topics. The why what how when and where about moving your retirement savings.

From the comfort and safety from your home you can consult with us via phone or video. A simple ira can also be used by s corp owners to reduce tax liability and save for their own retirements. Learn more about iras and how these retirement savings accounts can help you save for your retirement. If you and your spouse don t have a retirement plan available to you at work such as a pension or a 401 k plan then you can deduct your entire contribution to a traditional ira.

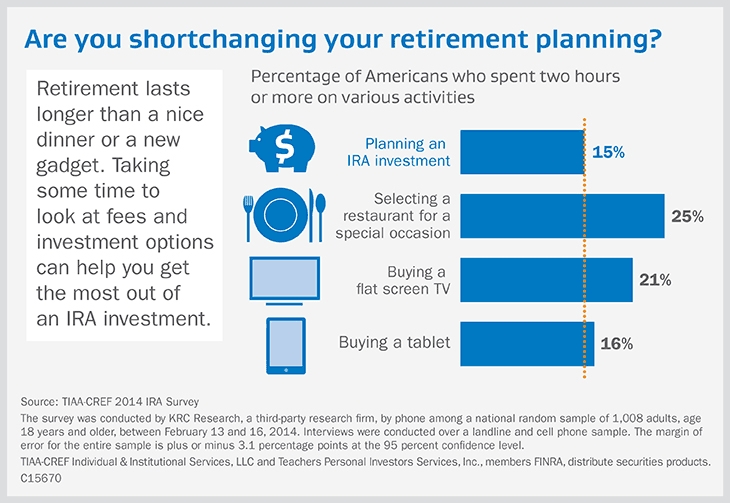

Retirement planning mistakes especially social security 401 k and ira blunders can be costly. Youtube video ira retirement plan 60 day rollover waivers 57 secs youtube video retirement plan and ira rollovers 1 20 mins distributions taking withdrawals from your ira when. Individual retirement accounts iras an ira is a tax favored investment account.

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

:max_bytes(150000):strip_icc()/GettyImages-91837283-49f5b85ed6fd49e0973e2c6a1c37691d.jpg)

/GettyImages-973099588-67d2e83fc430468b93c7ec4be85aeca9.jpg)