Starting A Brokerage Account

It s generally a good idea to help start your children down the path to financial independence early on in their lives but an underage person cannot open a brokerage account on his or her own.

Starting a brokerage account. Why to start saving now. Most brokers allow investors to open a brokerage account online in a few quick steps. In this in depth guide we 39 ll walk you through each step of the process. Whether you are a hands on investor or one who prefers your assets to be managed for you consider these.

1 a brokerage account with a stock brokerage firm. Opening a brokerage account is the first big step to jump starting your investing journey. If you are creating retirement accounts like an ira the bonuses are going into those accounts so you won t owe taxes on them. Once you ve opened and funded your investment account you can buy stocks just as you would through your personal brokerage account.

No matter which type of brokerage account you decide to open for your kids you ll need to start by finding a broker. Offer valid for new e trade securities customers opening one new eligible retirement or brokerage account by 12 31 2020 and funded within 60 days of account opening with 5 000 or more. If you want to invest beyond your basic 401 k or roth ira you are going to need to open something known as a brokerage account now i want to talk to you about five things you may want to consider before you open a brokerage account so you are ultimately happy with the decision you make about not only the type of account you open but the firm with which you establish a relationship. To find the brokerage account that s right for your child look for an.

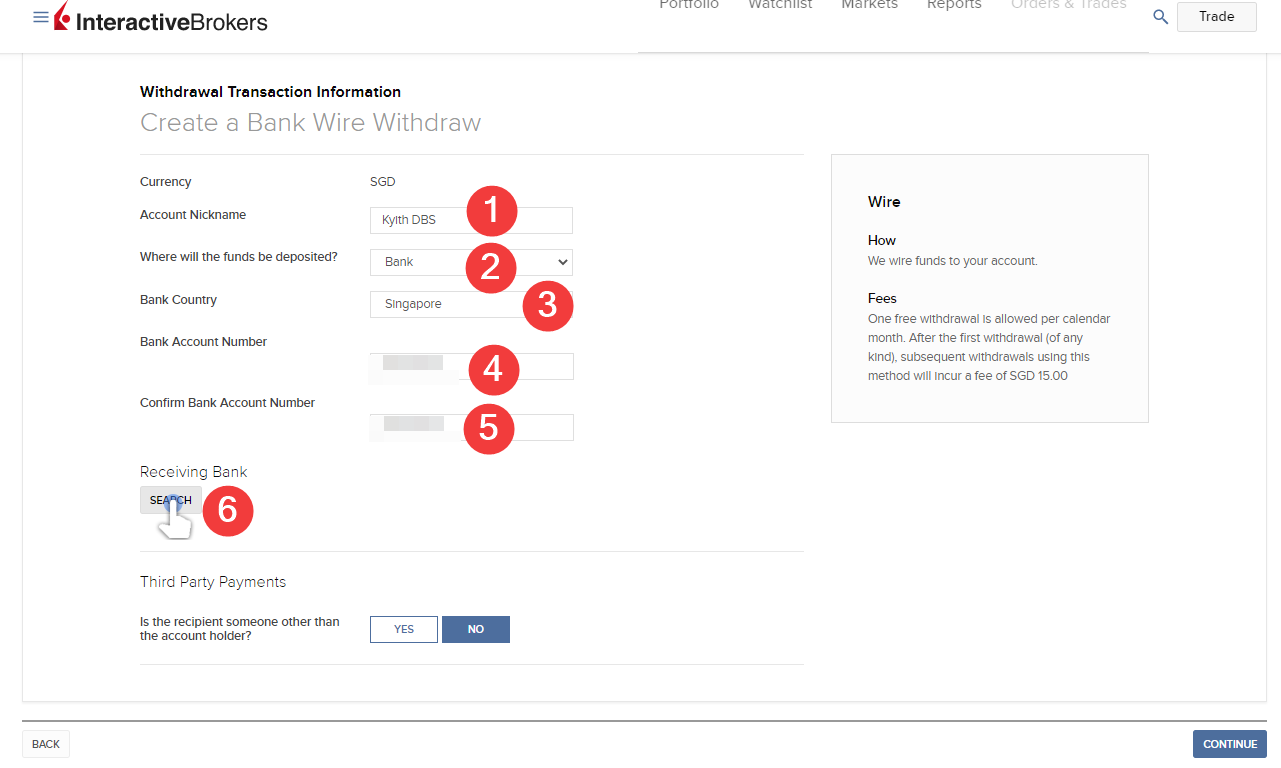

The first and most important thing to know is that you need to open two separate accounts. Opening a brokerage account can seem like a daunting task but it doesn 39 t have to be. For traditional iras you ll just be taxed when you start taking distributions. If you are creating new taxable brokerage accounts the bonuses will be reported and you will have to claim them on your taxes as income.