Things Needed For Mortgage Pre Approval

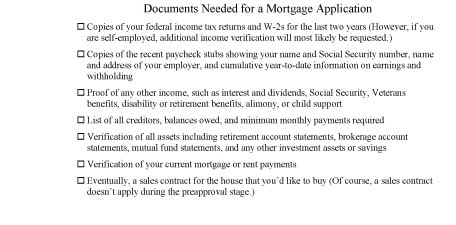

While the industry is gradually adopting paperless procedures such as electronic signatures or e signing there are still plenty of documents required in a typical mortgage pre approval process.

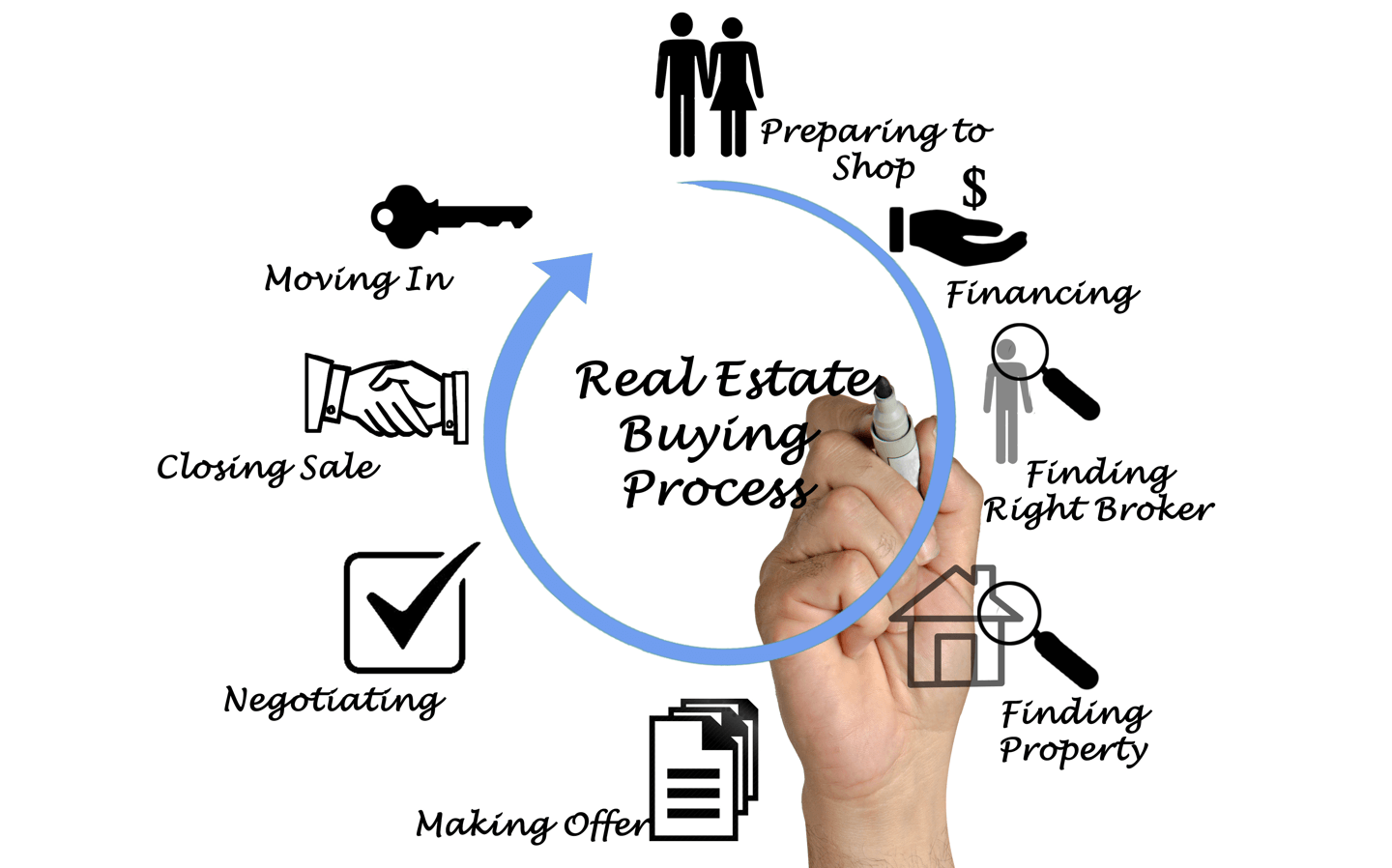

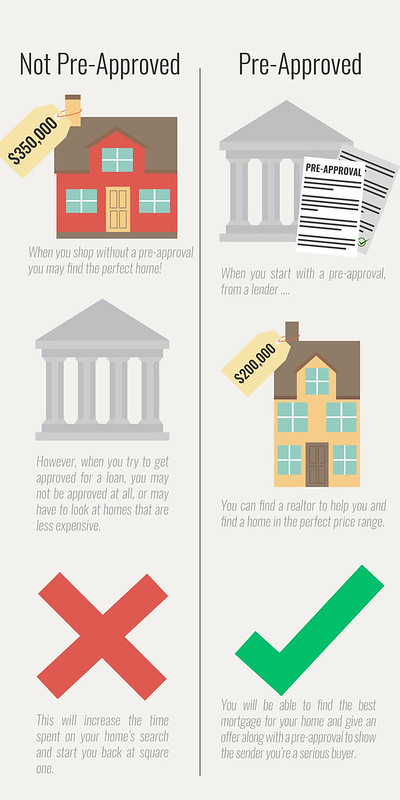

Things needed for mortgage pre approval. They will analyze your finances and determine if you re a good candidate for a mortgage. A mortgage pre approval is a written statement from a lender that signifies a home buyers qualification for a specific home loan. Going through the preapproval process with several lenders allows a home buyer to shop interest rates and find the best deal. A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you.

You don t need to be a u s. Documents needed for mortgage pre approval and underwriting paperwork is the lifeblood of the mortgage industry. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation. Pre approval means that a lender has stated in writing that you qualify for a mortgage loan based on your current income and credit history.

With a pre approval you can. A pre approval usually specifies a term interest rate and mortgage amount. Estimate your mortgage payments. Requirements for pre approval.

Income credit score and debt are just some of the factors that go into the pre approval process. Citizen to be eligible for a mortgage but lenders may ask about your permanent residency and immigration status and may request copies of a green card employee authorization document or an approved visa. A pre approval is typically valid for a brief period of time and usually has a number of conditions that must be met. A mortgage preapproval tells sellers you can back up your offer.

A mortgage pre approval means working with a lender to determine the amount you can borrow so you can purchase your new home. A seller often wants to see a mortgage preapproval letter and in some. Pre qualification provides an estimate of what you can afford based on some basic information you provide to a lender. These two terms may sound alike but they re not created equal.

First things first you need to understand the difference between pre qualification and pre approval. To get a preapproval letter you need documents verifying your income employment assets and debts.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)