Rooth Ira

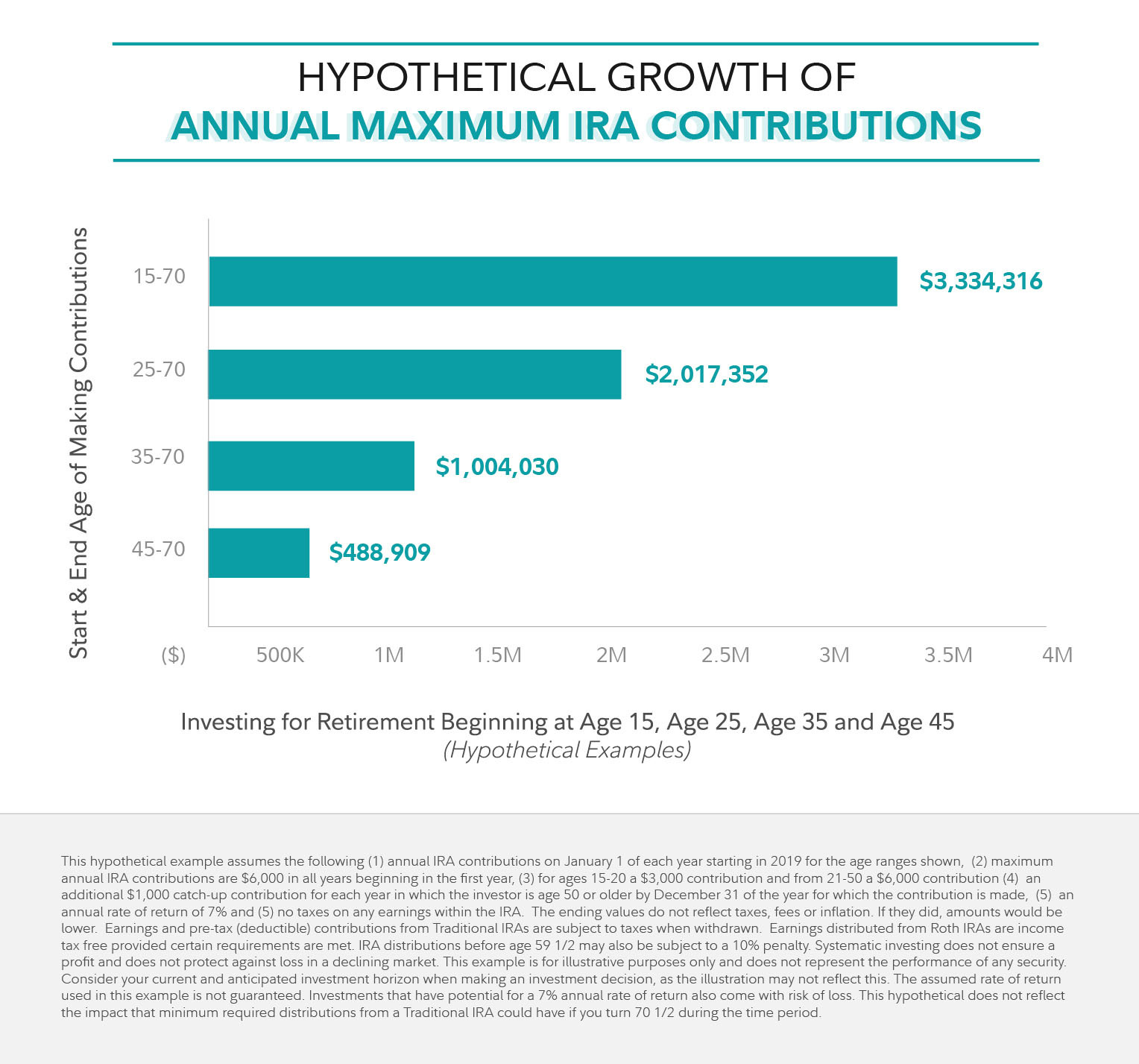

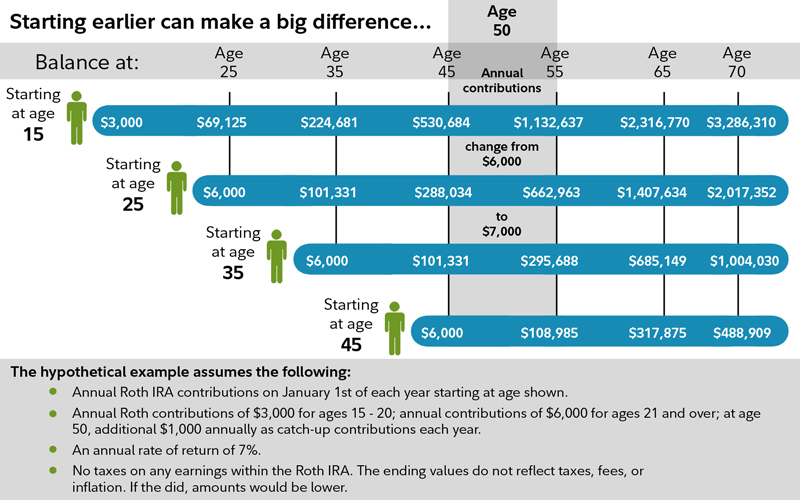

A roth ira individual retirement arrangement is a retirement savings account that allows you to pay taxes on the money you put into it up front.

Rooth ira. Roth ira rules dictate that as long as you ve owned your account for 5 years and you re age 59 or older you can withdraw your money when you want to and you won t owe any federal taxes. Any earnings have the potential to be withdrawn tax free in retirement provided that certain conditions. If you satisfy the requirements qualified distributions are tax free. 196 000 if filing a joint return or qualifying widow er.

Subtract from the amount in 1. A roth ira is a retirement savings account that allows you to withdraw your money tax free. A roth ira is an individual retirement account ira under united states law that is generally not taxed upon distribution provided certain conditions are met. If you like the idea of tax free income in retirement a roth ira is a good idea.

Roth ira with a roth ira you make contributions with money on which you ve already paid taxes. If the amount you can contribute must be reduced figure your reduced contribution limit as follows. You cannot deduct contributions to a roth ira. There is a bit of a.

The withdrawal rules for roth iras are generally more flexible than those for traditional iras and 401 k s. A roth ira is an ira that except as explained below is subject to the rules that apply to a traditional ira. Still you ll want to do your homework before making any roth ira withdrawals. If you want an immediate tax break consider a traditional ira.

How much can you put into a roth ira. You re able to withdraw your contributions tax and penalty free at any time for any reason. Traditional ira the bottom line is this. Start with your modified agi.

Amount of your reduced roth ira contribution. A roth ira is an individual retirement account that offers tax free growth and tax free withdrawals in retirement. The growth in your roth ira and any withdrawals you make after age 59 1 2 are tax free as long as you ve had the account more than five years.

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)