Return Of Premium Term Life

When the return of premium rider is added to a term life insurance policy it guarantees that 100 of all premium payments paid into the life insurance coverage will be refunded at the end of the policy contract.

Return of premium term life. You pay a fixed annual premium. We may collect personal information from you for business marketing and commercial purposes. As the name implies it provides coverage for a specified term such as ten 20 or. An rop plan pays back your premiums in part or in full if you outlive your policy.

It will add a cost to your insurance premium but recall that the additional premium for the return of premium benefit will also be returned if you outlive your policy. A term plan offers only death benefits whereas a term insurance return of premium plan offers the benefit of the return of premium as maturity benefit after the completion of the policy tenure. Return of premium life insurance is a type of coverage that will return the premiums that were paid in for the coverage if the insured on the policy survives throughout the entire term or time period of the policy. Return of premium life insurance sometimes referred to as a rider or add on to a standard term life insurance policy is sold for a set term usually 10 20 or 30 years.

We value your privacy. Return of premium life insurance represents about 2 of term life sales based on annualized premium according to limra an industry research group. A traditional term life insurance policy may give you an option of 15 20 or 30 years. How return of premium policies work.

Return of premium term life insurance offers a level premium while protecting your family then returns your premiums if you outlive the term of the policy. Available for 15 20 25 or 30 year coverage periods just keep your policy and rop benefit in effect by paying your premiums when due. The policyholder makes monthly or annual payments called premiums to keep the policy in force. For assurity term life insurance the optional return of premium benefit is only available for 20 or 30 year terms.

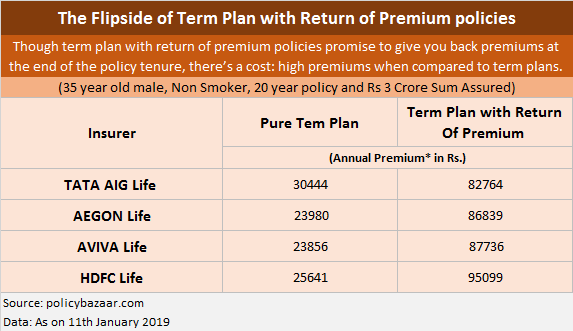

Because of this guaranteed all premiums back feature the premium rate of trop plan is higher than a pure term insurance plan. As mentioned earlier return of premium is a policy rider attached to a term life insurance policy. How term life and return of premium riders work term insurance is less expensive than permanent life insurance. Aaa life s term with return of premium gives back 100 of your payments if you outlive the initial term period.