Type Of Life Insurance Coverage

Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder.

Type of life insurance coverage. A whole life insurance policy covers the life assured for whole life or in some cases up to the age of 100 years. If the policyholder survives until the end of the period or term the insurance coverage ceases without value and a payout or death claim cannot be made. With this type of coverage the premium amount is locked in and will remain the same throughout the entire lifetime of the policy. Actual rates may vary.

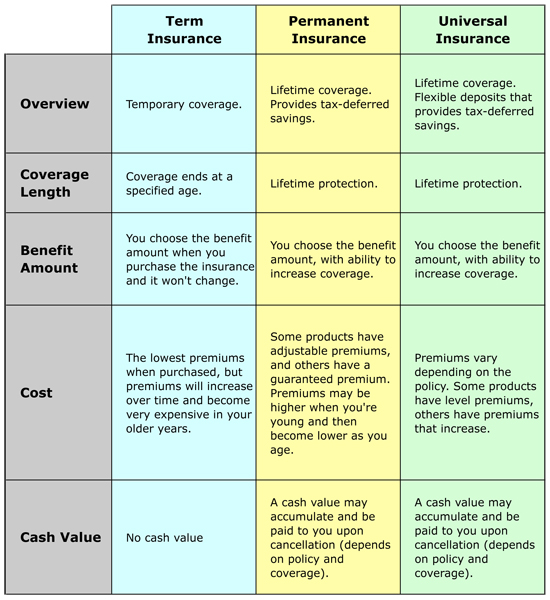

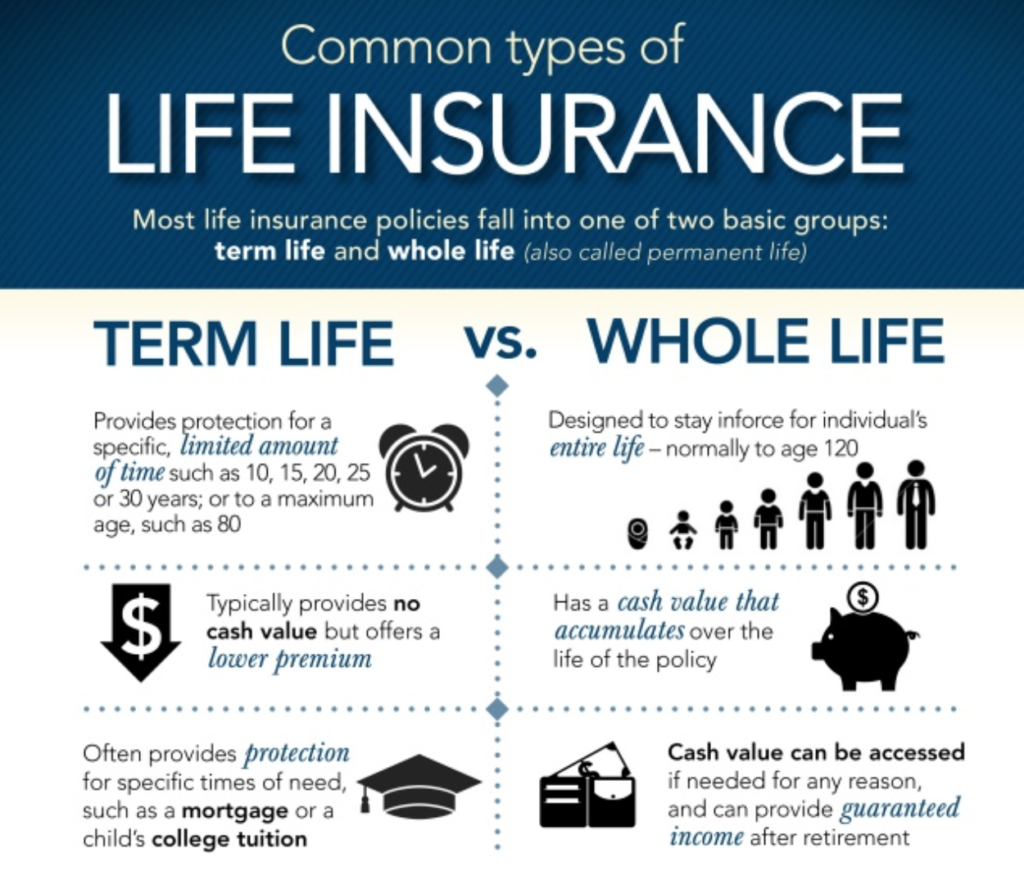

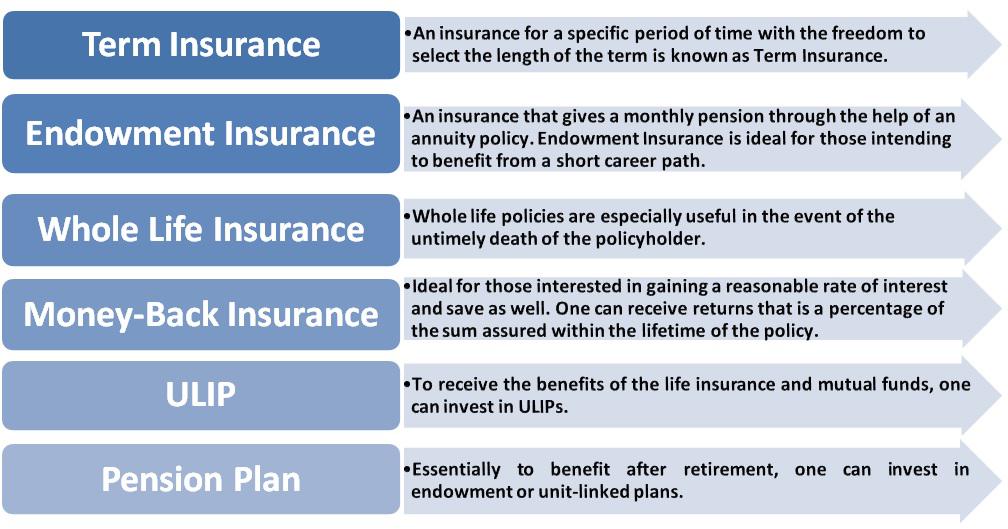

Whole universal and indexed universal. The most basic type of life insurance is called term life insurance where you choose the amount you want to be insured for and the period for which you want cover. It s usually issued only to people of a certain age and the policy is valid only up to a certain age. This can be helpful for those who need to stick to a budget.

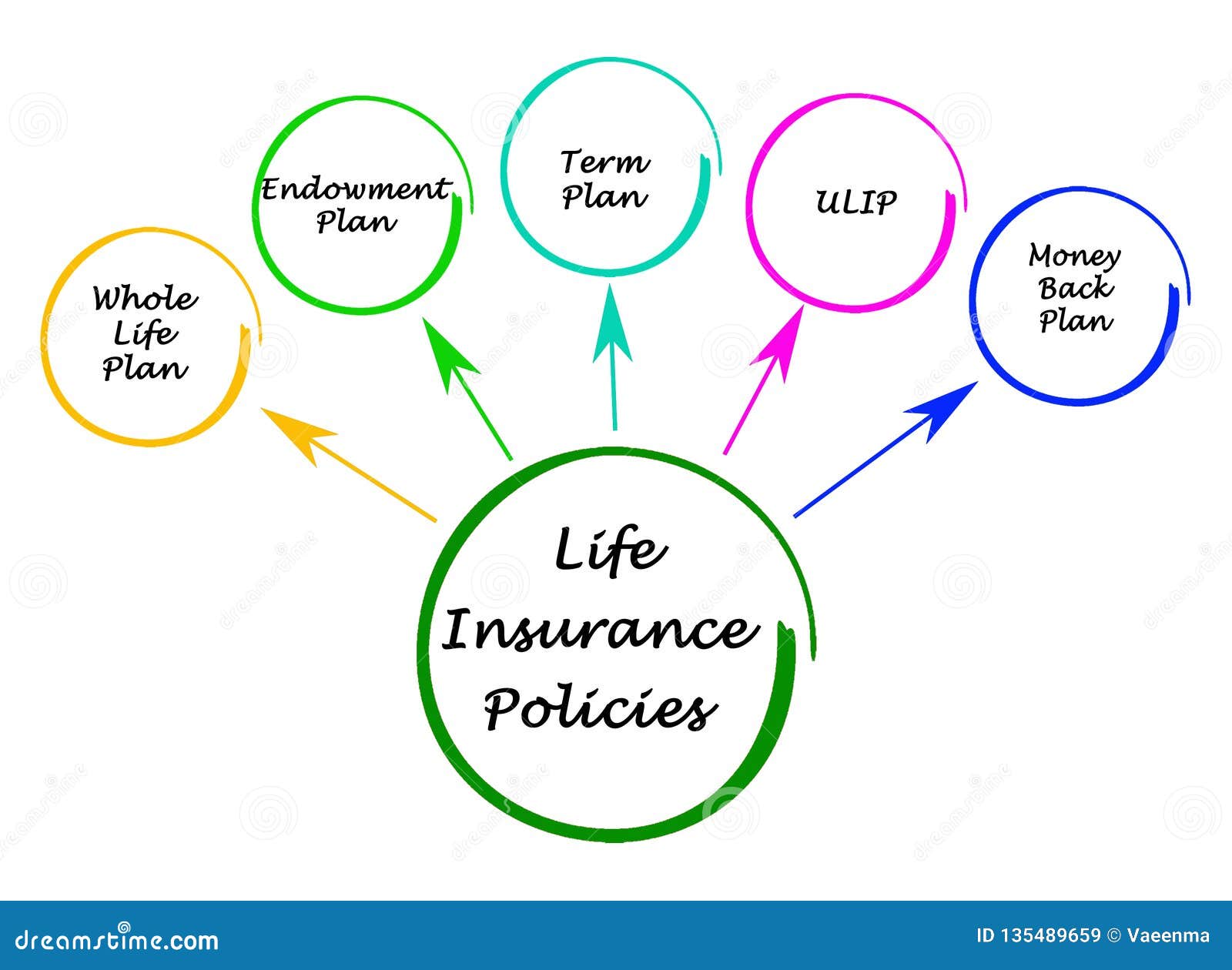

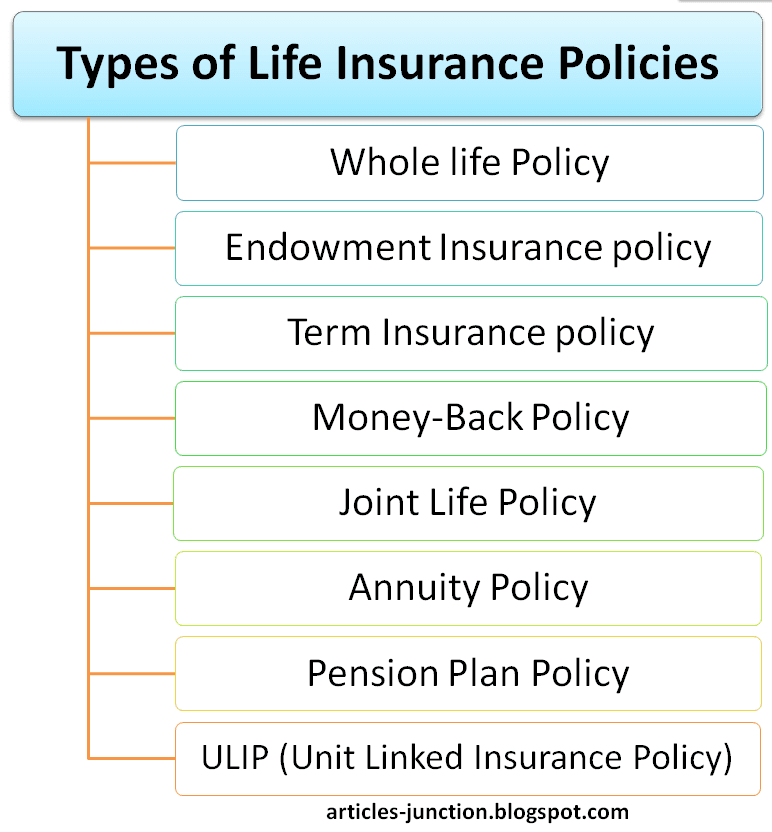

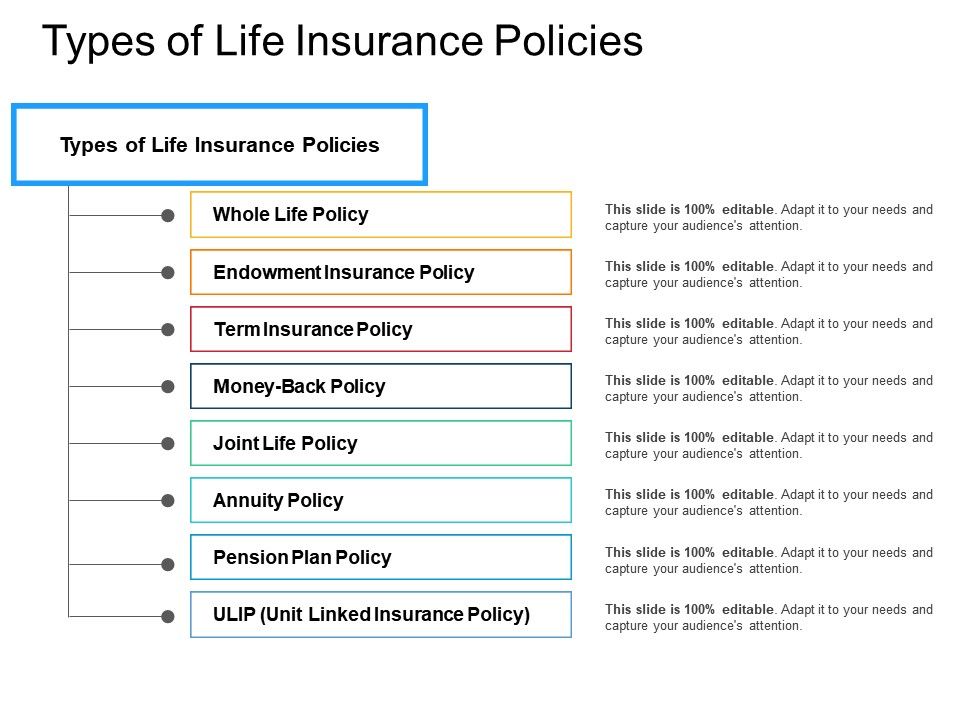

Whole life policies a type of permanent insurance combine life coverage with an investment fund. Life insurance rates are based on age health policy type and more. The two main types of life insurance are term and permanent. But within these two categories there are various types of policies to choose from.

Joint life insurance also called first to die insurance yikes is a cash value policy marketed to couples who want to share a policy between them. There are three different kinds of life insurance that fall under the permanent life insurance category. Unlike term plans which are for a specified term. It covers the cost of anything associated with your death whether it s medical costs a funeral or cremation whatever your literal final expenses are.

Depending on the contract other events such as terminal illness. Whole life insurance coverage the simplest type of permanent life insurance coverage is whole life. Unlike term life insurance permanent life insurance is designed to cover you for life. Think of joint life insurance policies as the joint checking account of the life insurance world.

Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period. Here you re buying a policy that pays a stated fixed amount on your death and part of your.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)