Transfer Investment Account

Perform a partial or full funds transfer to your cpf ordinary account easily using digibank online.

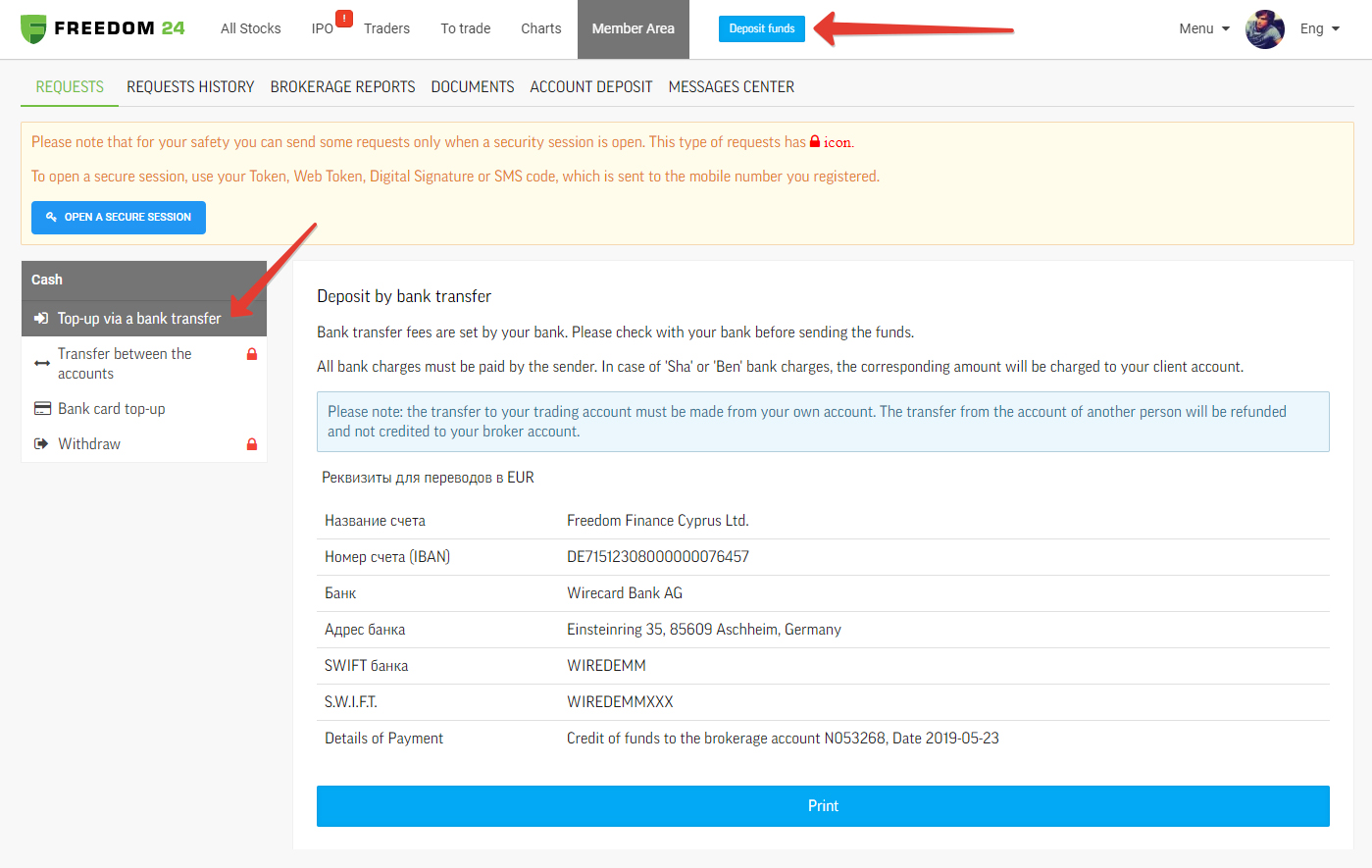

Transfer investment account. Transfer from cpf investment account to cpf ordinary account. The new broker you re eyeing will be more than happy to hold your hand through this process. Transfer fees for some of the most popular discount brokerages are listed below in order of how much they charge for a full account transfer out to another brokerage. How to transfer brokerage accounts.

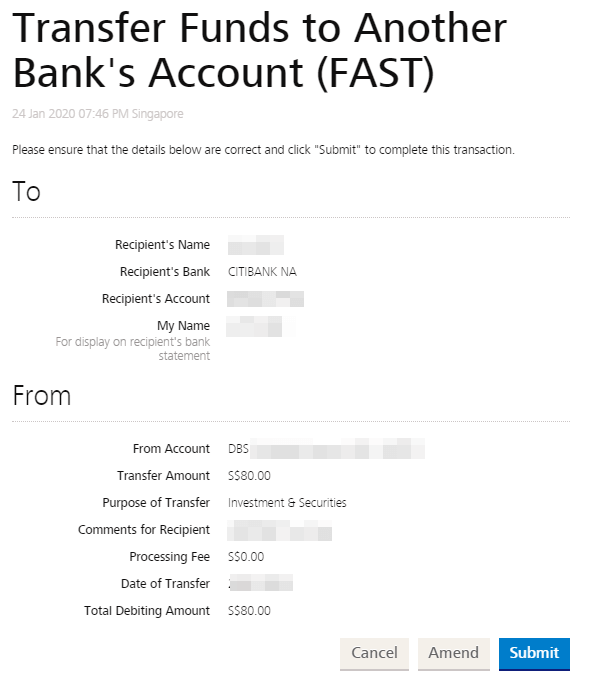

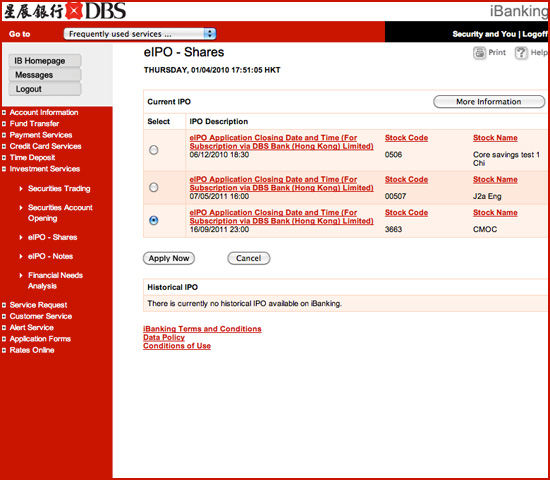

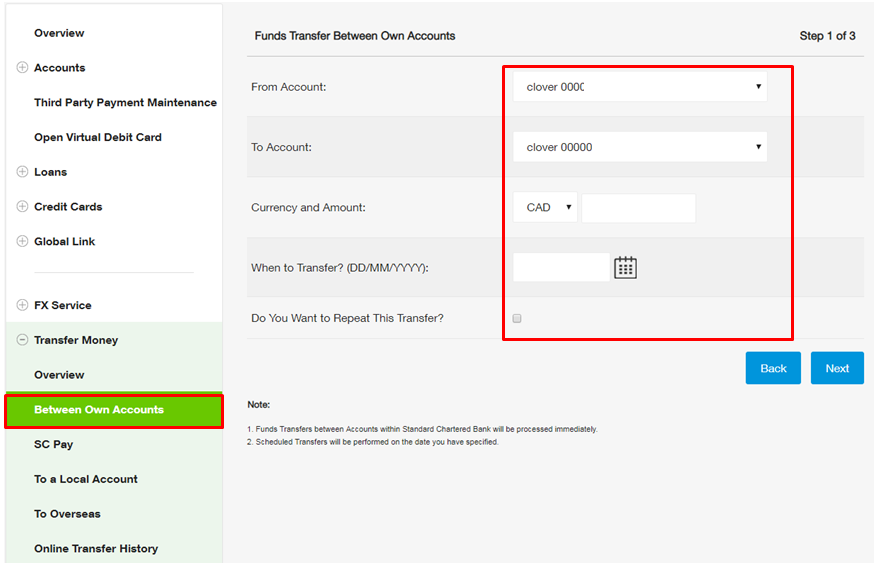

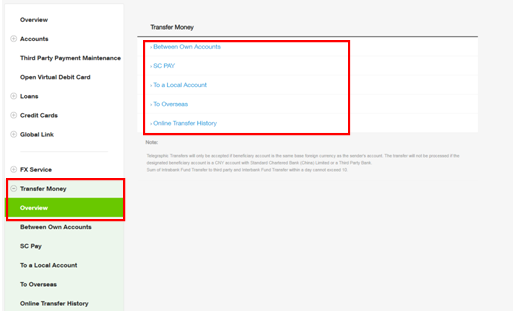

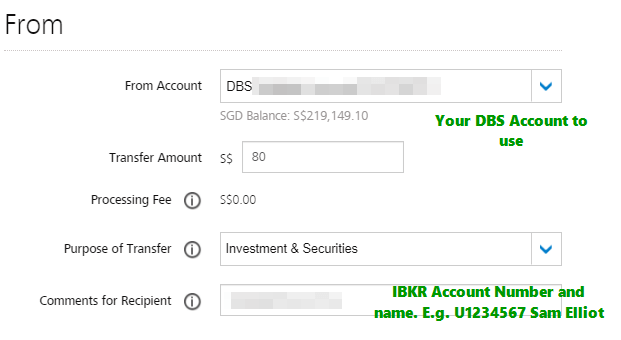

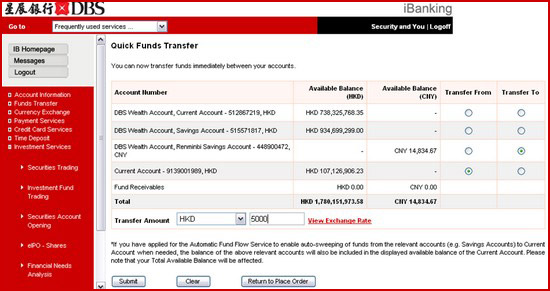

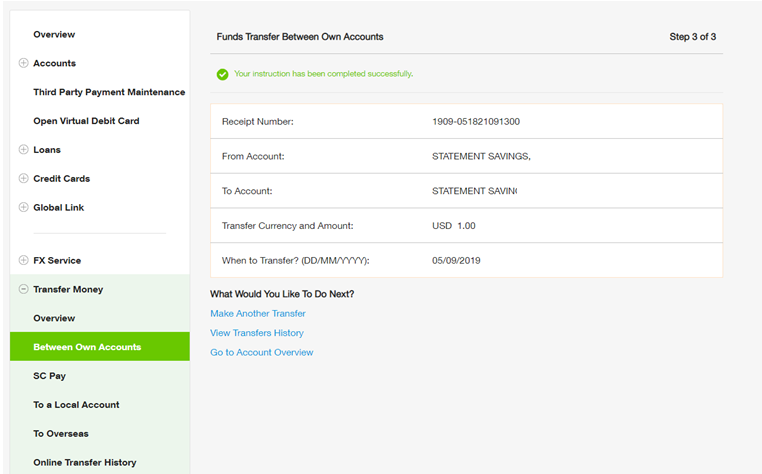

That way you can just get a check or electronic funds transfer for the cash and then deposit it into your new brokerage account and purchase the same investments you had in the original account. Select more investment services under the invest tab on the top navigation. It wants your money and is keen to help you move it over. The interest rate on balances in the cpf investment account which are not invested is currently 0 050 p a.

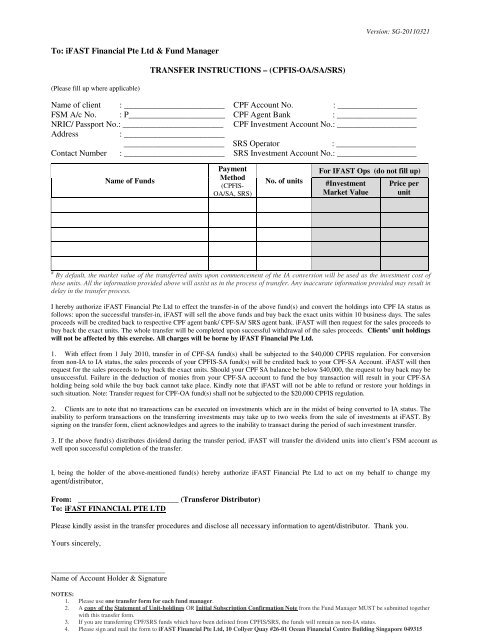

Transferring an investment account from one broker to another is a specialized process so you re better off letting the brokerage firms work it out between themselves. After you have logged in to digibank online follow these steps. The cpf investment scheme cpfis self awareness questionnaire saq helps you assess if you have basic financial knowledge and whether cpfis is suitable for you. You may apply to close your cpf investment account and transfer your shares to your own central depository account after you have reached 55 years old and have set aside your full retirement sum frs in the retirement account ra.

At least the basic retirement sum and property. From 1 april 2008 only monies in excess of 20 000 in your ordinary account can be invested. Investible savings refer to the total balances in cpf ordinary account plus monies already withdrawn for investments education. From 1 october 2018 if you are a new cpfis investor you must will need to take the saq before you can start investing under cpfis.