What Refinancing Means

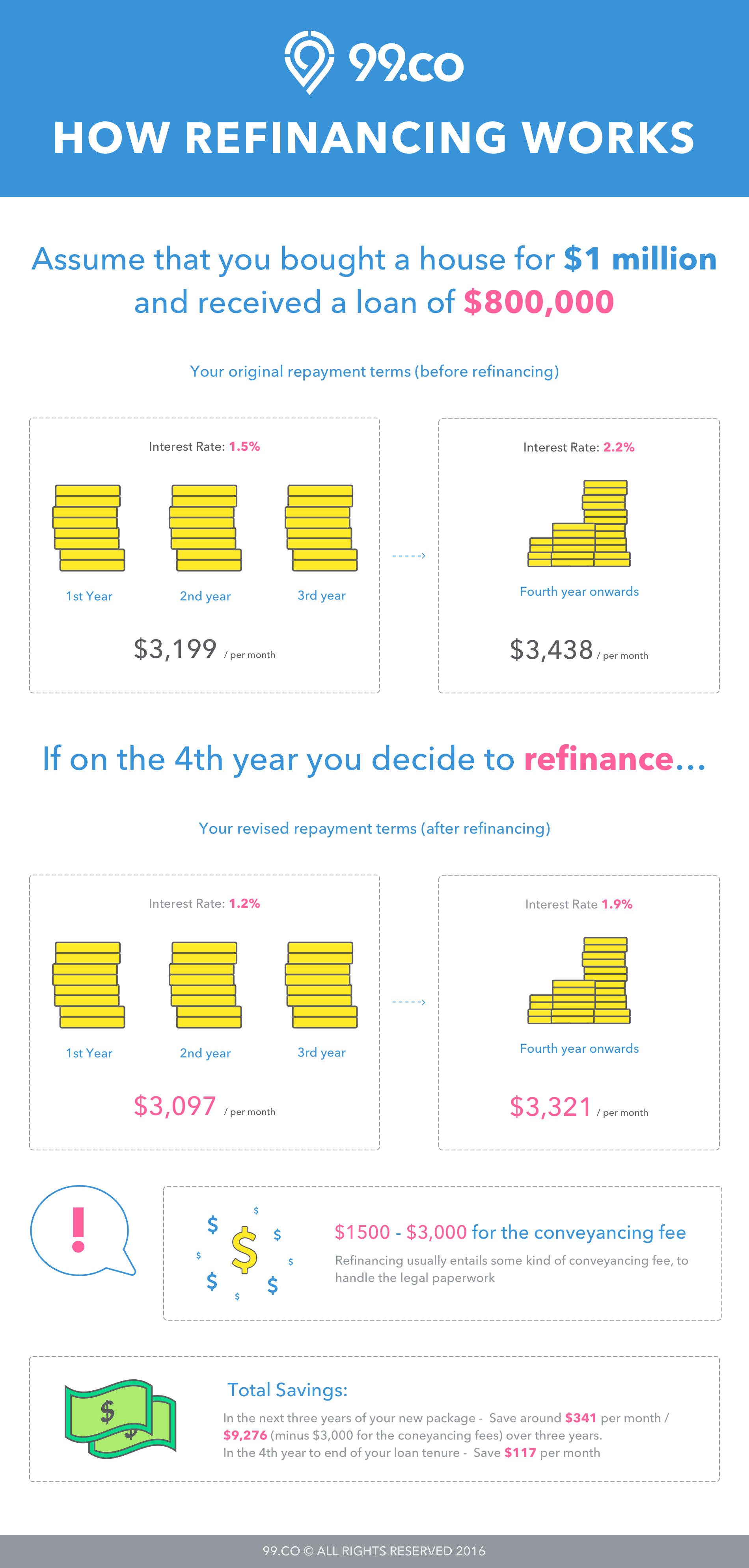

Refinancing is the replacement of an existing debt obligation with another debt obligation under different terms.

What refinancing means. A mortgage refinancing option offered by the united states department of agriculture usda. Over the past decade interest rates for refinancing have typically ranged from 3 to 5 on a 30 year fixed mortgage. Your mortgage loan will likely be amortized which means initial costs are gradually written off over a period of time. The terms and conditions of refinancing may vary widely by country province or state based on several economic factors such as inherent risk projected risk political stability of a nation currency stability banking regulations borrower s credit worthiness and credit rating.

Lenders require new home appraisals for refinance transactions even if the original appraisal is only a few years old. Each of those costs should be put against the savings a homeowner will incur by refinancing but if the pros still outweigh these extra costs then refinancing may be a good idea. The decision to refinance or not depends on interest rates closing costs how many years you will remain in your house and whether. People refinance for many reasons.

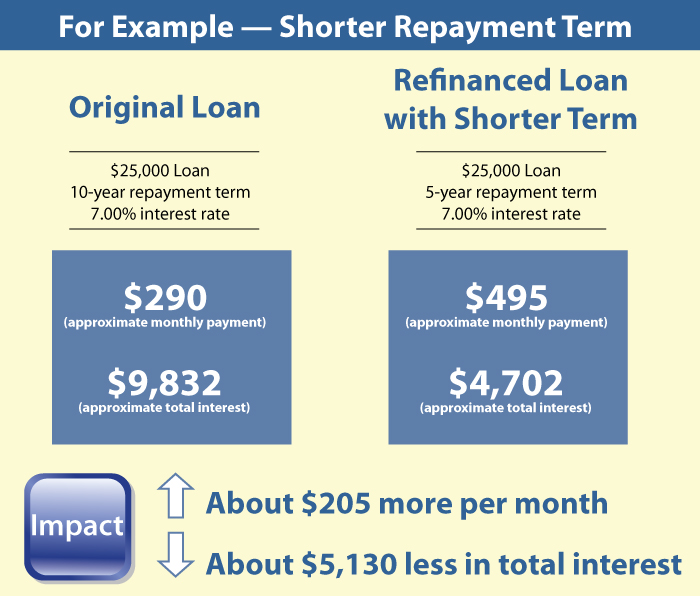

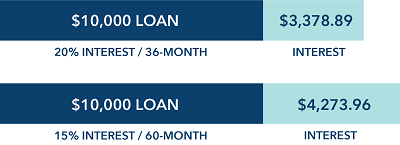

Refinancing can make sense if it will lower your monthly payments by replacing a high interest rate with a lower one. When refinancing it can also benefit you to hire an attorney to decipher the meaning of some of the more complicated paperwork. For debtors struggling to pay off their loans refinancing can also be used to get a longer term loan with lower monthly. Early in your loan term the majority of your principal and interest payment is applied to the interest.

Since refinancing can cost between 2 and 5 of a loan s. Refinancing is the process of obtaining a new mortgage in an effort to reduce monthly payments lower your interest rates. You ll pay all the same closing costs that you did when you took out the first loan and this can add up to thousands of dollars upfront depending on the size of your new loan. That means homeowners will be expected to pay origination fees inspection fees appraisal fees and more.

Refinancing means basically applying for a loan all over again. Usda non streamlined refinancing is available to homeowners who. Borrowers usually refinance in order to receive lower interest rates or to otherwise reduce their repayment amount.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)