What Is Actual Cash Value Home Insurance

Ultimately if you suffer a property loss the insurer will pay the cost to repair or replace your damaged property or its depreciated value whichever is less.

What is actual cash value home insurance. Depending on if you have a replacement cost or an actual cash value acv home insurance policy your payout after a claim varies a lot. Insuring property for its actual cash value means you receive what the item is worth at the moment of the loss not what it. A property insurance term that refers to one of the two primary valuation methods for establishing the value of insured property for purposes of determining the amount the insurer will pay in the event of loss. Replacement cost and actual cash value refer to how your homeowners insurance policy reimburses you for property damage after a covered loss.

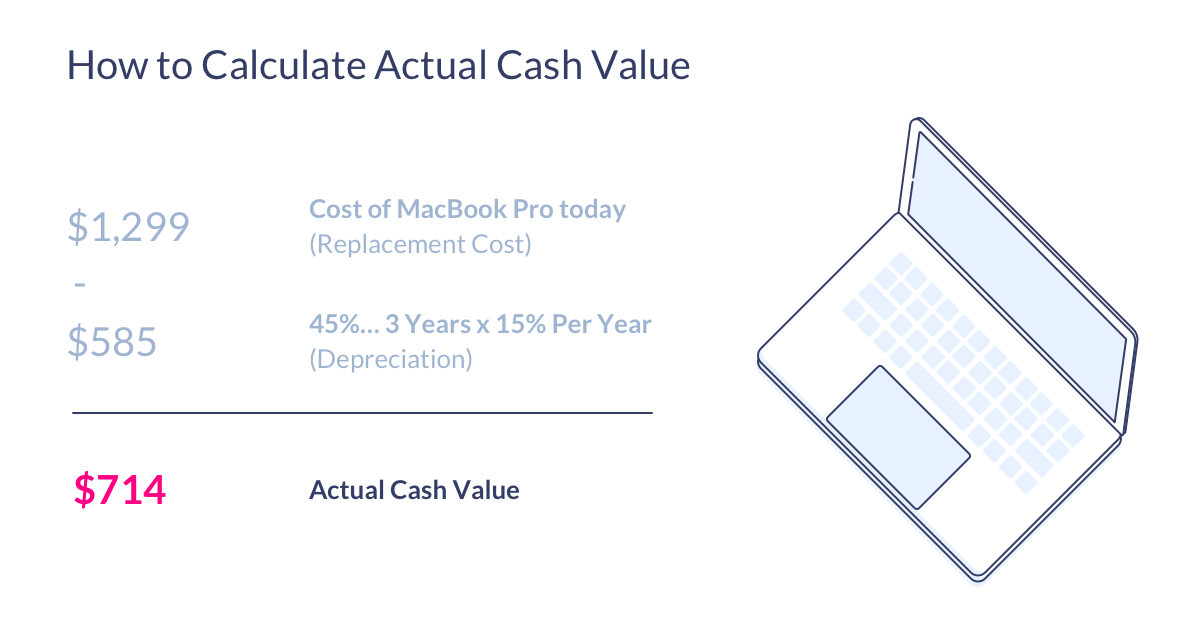

How actual cash value works. Actual cash value is based specifically on an item s depreciated value depreciation is defined by the decreased value of an asset over time due to everyday wear and tear. The actual cash value in a homeowners insurance policy is based on the market value or the initial cost of your home and personal property with depreciation considered. The actual cash value of your home or personal property is calculated by subtracting depreciation from the replacement cost.

In contrast actual cash value acv also known as market value is the standard that insurance companies arguably prefer when reimbursing policyholders for their losses. The other primary valuation method is actual cash value acv. Actual cash value and replacement cost are two different methods insurance companies use to value your personal belongings in your home. What is actual cash value for home insurance.

Replacing your personal contents or even worse your home on an actual cash value or depreciated basis leaves you at a loss compared to replacement cost settlements. Sometimes insurance companies use actual cash value to determine the amount to be paid to a policyholder after loss or damage to the insured property or vehicle. Actual cash value leaves you in a tough position because you won t be able to go out and buy a similar item new at least not without some of the money to replace it coming out of your pocket. Most standard homeowners insurance policies cover the replacement cost of your home s physical structure and the actual cash value of the insured s personal property.

Actual cash value acv is one way insurance carriers determine how much your property is worth. Actual cash value acv is a loss settlement method designed to pay no more than the depreciated value of your home and likely your personal belongings in the event of a loss claim. Actual cash value acv helps with the costs when your home needs to be rebuilt or damaged items need replacing after a covered loss.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Understandingreplacementvalueandactualcashvalueacvinaclaim-59f7bf26845b3400118dc827.jpg)

/commercial-property.tmb-.png?sfvrsn=8)