Small Business Lines Of Credit

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Business line of credit and term loan interest rate discounts are available to business applicants and co applicants who are enrolled in the program at the time of line of credit or term loan application for a new credit facility excludes specialty lending products that receive customized pricing.

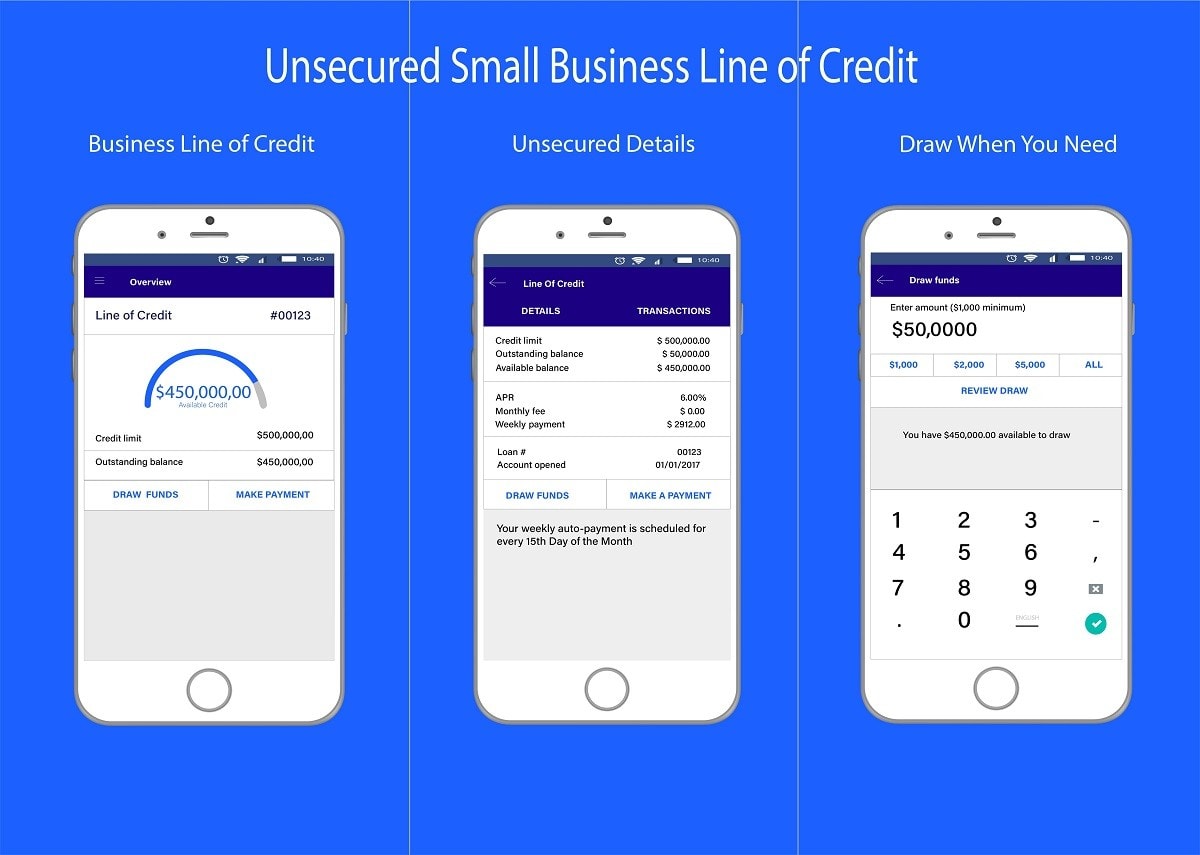

Small business lines of credit. A business line of credit is a type of small business loan that provides flexibility that a regular business loan doesn t. Paying bills covering payroll dealing with cash flow shortages or making short term investments and improvements. A small business line of credit is pretty similar to a personal line of credit like your credit card. Small business administration ideal for businesses in operation for less than 2 years.

Liquidity and cash flow coverage is also important to getting a business loc. With a business line of credit you can borrow up to a certain limit. Understand the different types of credit lines for small businesses and which benefits are best fit your goals. Our picks for the best business lines of credit come with limits ranging from 10 000 to 3 million.

Revolving lines of credit are typically used to help a small business manage the monthly ups and downs of running a business. A business line of credit is a possible option for a small or start up business to get the capital needed to manage cash flow fund day to day operations and take advantage of new opportunities. A bank or lender gives you access to a specific amount of financing set by a credit limit which you can draw from whenever you want or need. The best small business line of credit lenders base the credit limit on various factors including a business owner s credit score time in business annual revenues liquidity and cash flow coverage.

A business line of credit is essentially a business credit card with a higher borrowing limit and lower interest rate. 5 year revolving line of credit no scheduled annual review. A small business line of credit is typically offered as unsecured debt which means you don t need to put up collateral assets that the lender can sell if you default on the debt. Credit lines from 5 000 to 50 000.

If you re looking to cover a few minor recurring expenses a business credit card might be the better choice. Establishing or re building business credit with wells fargo. Find the best options for a business line of credit with u s.