Tsp Rollover After Retirement

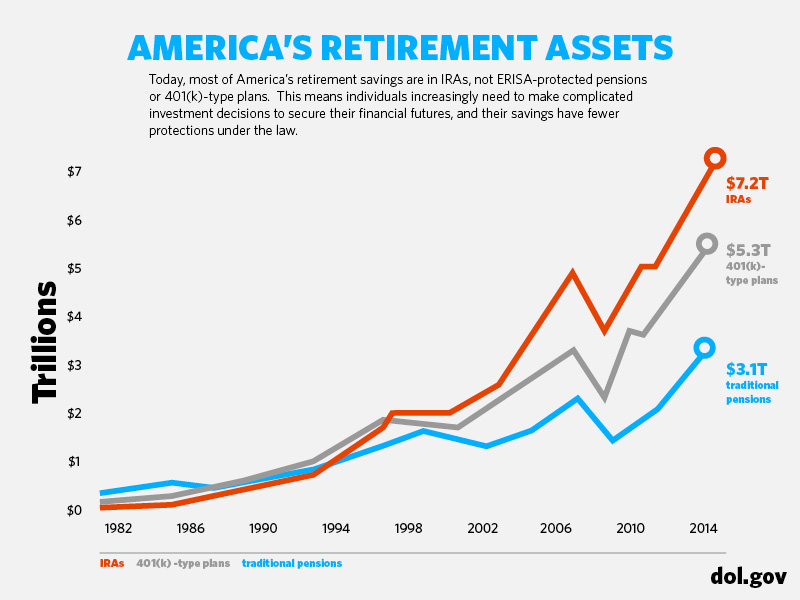

Keep assets in the current plan after termination if the plan allows this roll assets into a.

Tsp rollover after retirement. Tsp fund information card. It also applies to rollover of 403b frs tsp 457 drop and other employer retirement plans. Tsp website and thriftline card. Under the irs basic rollover rule an ira owner does not have to include in income any ira proceeds distributed to the ira owner provided the owner deposits the ira proceeds into another ira or into a qualified retirement plan such as the tsp within 60 days of receiving the ira proceeds.

Ramsey is a well known financial advisor who teaches people about handling money most notably by leading them out of debt and teaching them how to invest and save for retirement. Whether to roll over tsp funds into an ira is at first glance no different than whether a non government employee should rollover their 401k or 403b. Request for a transfer into the tsp. Transfers from the thrift savings plan to eligible retirement plans.

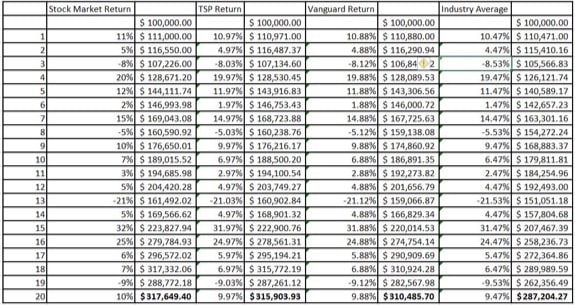

And remember in this example the tsp retirement account was only 100 000. Then you would have to come up with an additional 100 000 to deposit a total of 500 000 in your ira. We found 2 forms and 4 resources about transfers and rollovers. Divide a thrift savings plan tsp account pursuant to a divorce annulment.

The thrift savings plan is a very good accumulation vehicle for federal employees because of the ease of use simplicity and low costs. Tsp would have sent you a check for 400 000 and the irs a check for 100 000. Upon closer examination however there is a. My account plan participation investment funds planning and tools life events and.

Once an employee separates from service and wants to take distributions out of their tsp it becomes an entirely new animal. A woman who had recently retired from her federal job called dave ramsey s national radio show to ask him about rolling over her tsp to an ira. In order to roll money from the tsp into another plan or ira you would use the appropriate tsp form and have the financial. Indirect rollover you must complete the transaction within 60 days may result in taxes withholdings and or penalties if not properly executed.

Retirement plan to the other rollover aka. Forgot your account number or user id. The tsp doesn t have a form that is used specifically for rollovers.