What Is A Balance Transfer Fee On Credit Card

The fee is charged by the company that issues the credit card you transfer the debt to.

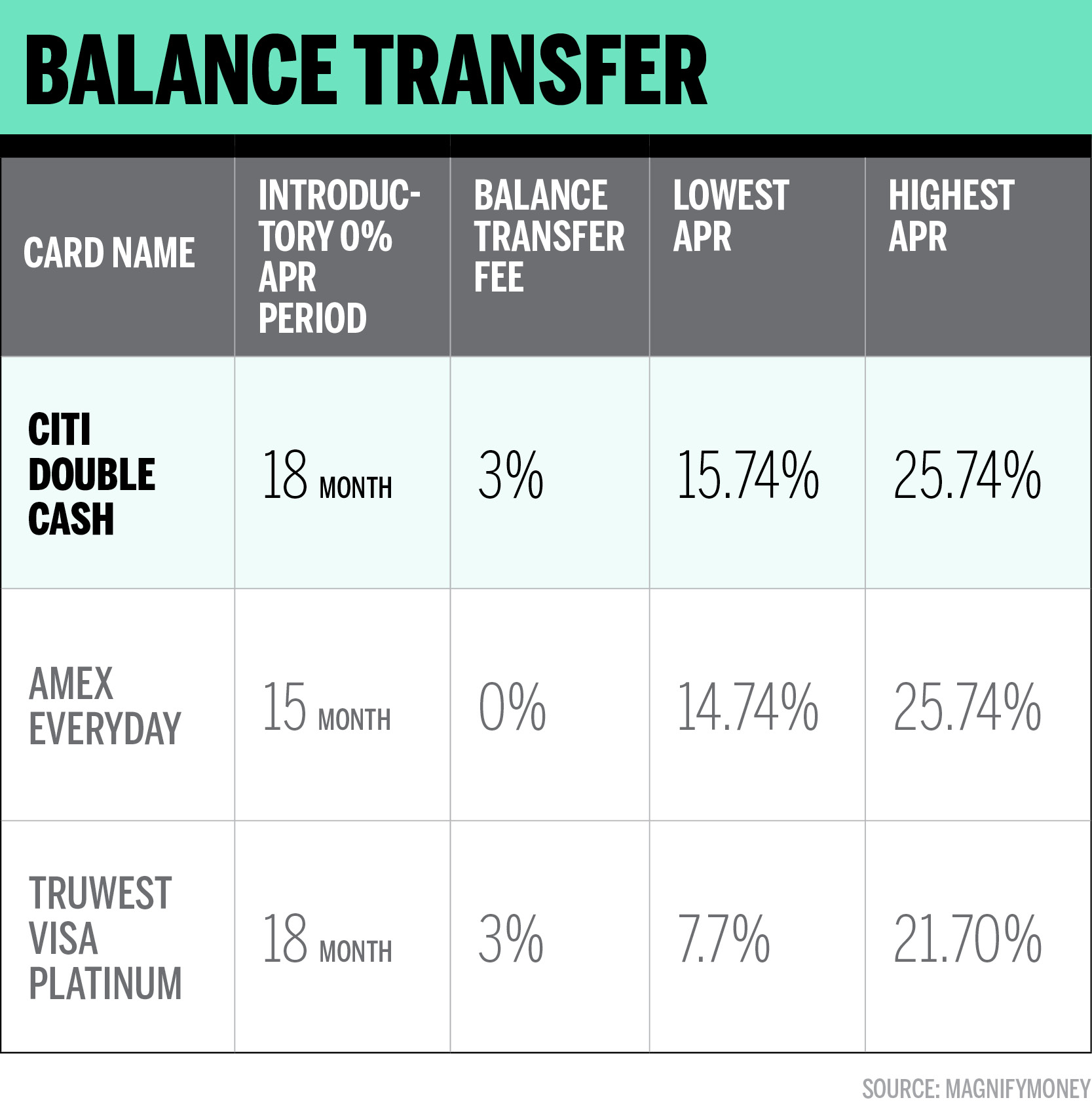

What is a balance transfer fee on credit card. A balance transfer fee is a one time charge usually 1 3 of the total amount you ll have to pay to move existing debt onto a new credit card. However there are some options that don t. A fee levied by a credit card issuer when a balance is transferred to its credit card. Naturally that includes balance transfers.

If you transferred that amount to a balance transfer card with a 3 fee you d pay around 186. If you keep the balance on your current card at 15 percent apr and make only minimum payments you ll accumulate more than 1 400 in interest in one year. Most credit card transactions that aren t purchases are charged a fee. A balance transfer fee is a one time fee you pay when you transfer a balance from one credit card to another.

It s usually around 3 5 of the total amount you transfer typically with a minimum fee of a few dollars often 5 10. You don t have to worry about any ongoing fees. If you have debt on a credit card at a typical interest rate of 18 it could quickly become difficult to keep up the payments. Fortunately the balance transfer fee is only charged when you make the transaction.

A balance transfer fee can range from a low of 1 to as high as 5 of the transferred. A balance transfer credit card is the tool that you use to do this. With a 3 percent balance transfer fee it would cost you 300 to transfer the balance to a new card. This fee is represented on the balance of the credit card receiving the balance transfer.

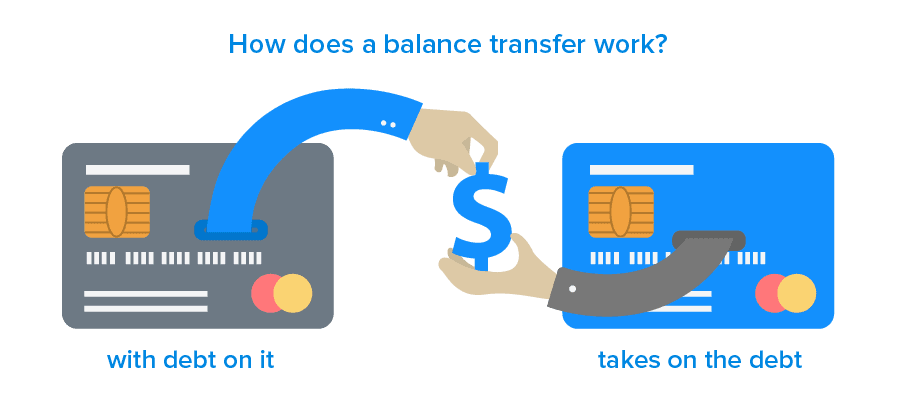

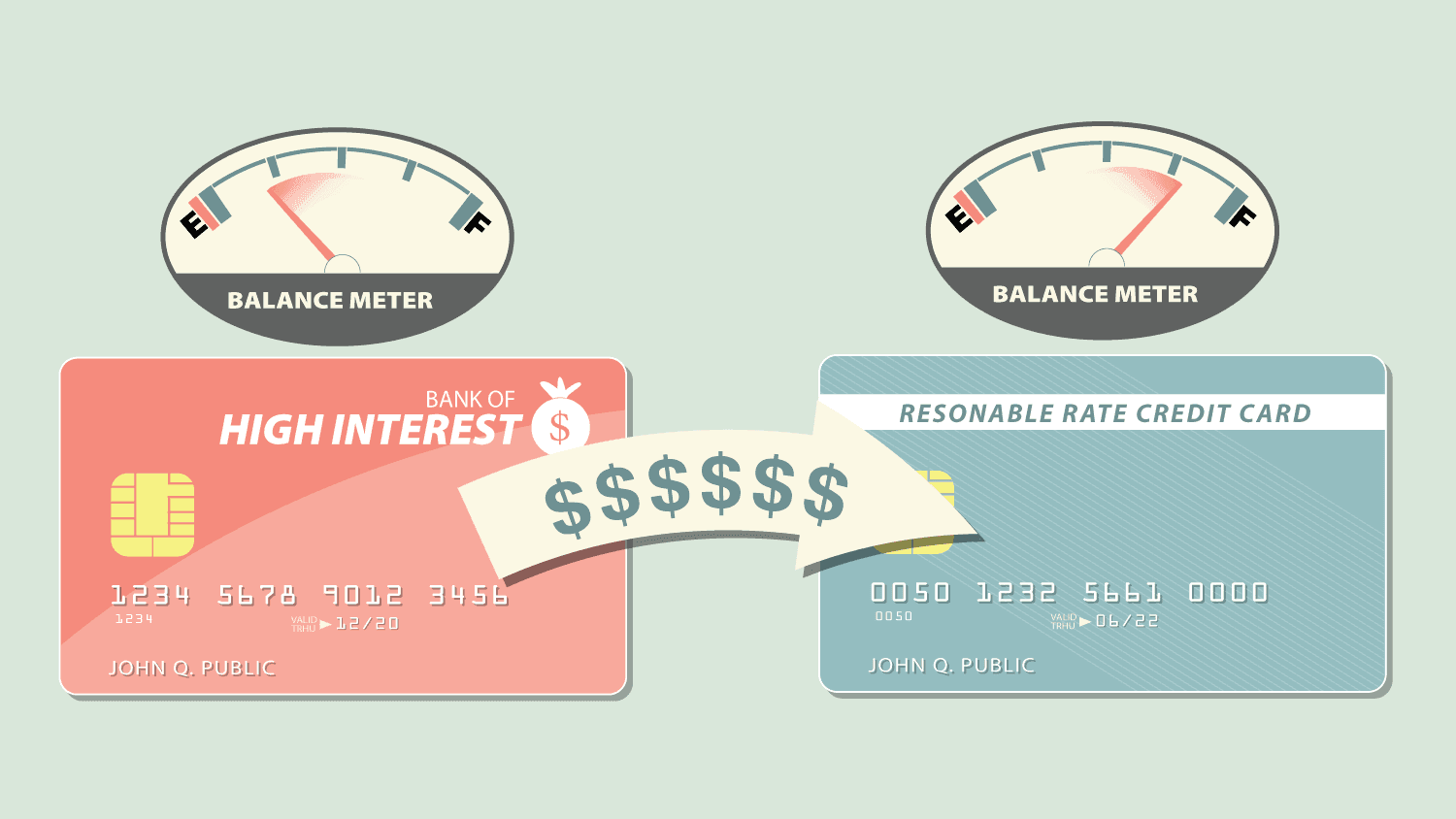

The average american has 6 194 in credit card debt. For example let s say you have a credit card with a balance of 10 000. A balance transfer fee is a fee that s charged when you transfer credit card debt from one card to another. The balance of your old card is paid off by your new card effectively swapping who you have to repay.

You have a 3 000 balance on a credit card with an 18 percent apr.