What Happens In A Tax Audit

You then have 30 days to either appeal or accept the result.

What happens in a tax audit. Tax audit outcomes many people assume that audits are designed to get them into trouble but this doesn t always happen. The irs will request specific documentation from you. We will keep you fully informed of the audit s progress. The audit process takes 2 3 months.

If we identify additional risks during an audit we may broaden the audit s scope. Accordingly most audits will be of returns filed within the last two years. If an audit is not resolved we may request extending the statute of limitations for assessment tax. But you can take heart because full blown tax audits don t happen that often.

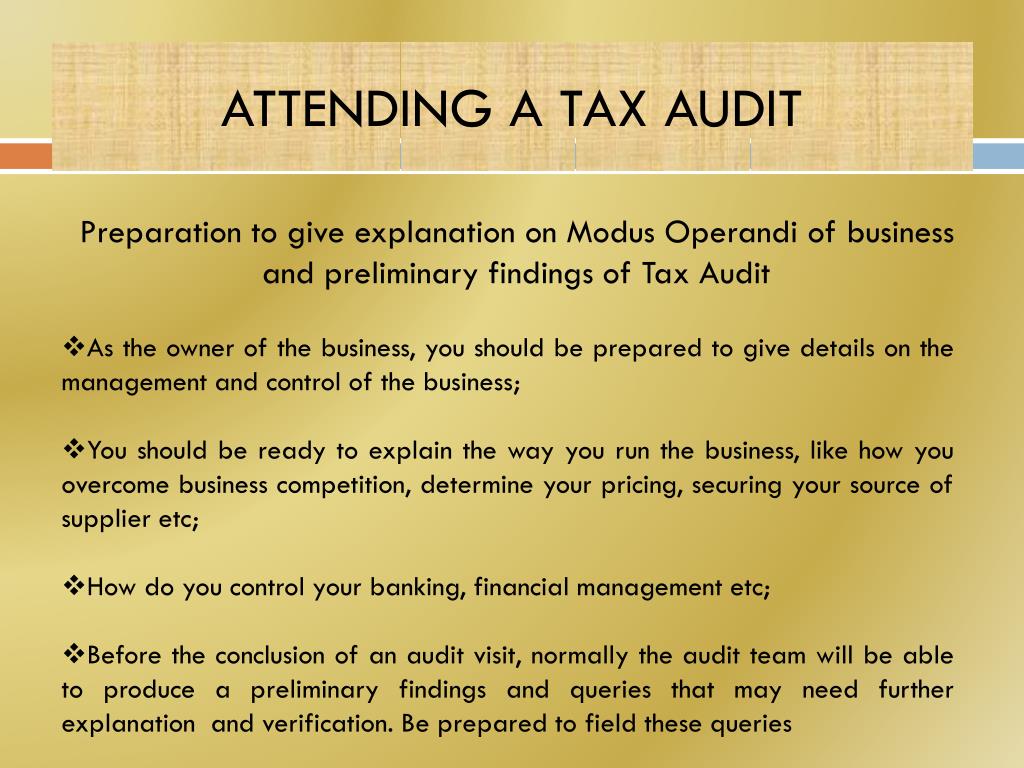

In general being found guilty in an audit means the irs examiner believes you owe additional taxes although you have the right to dispute the findings. An irs tax audit means they will review and substantiate the correctness of the entries on the tax return items such as the income and the deductions. Instead of throwing your hands up this is your first opportunity to take control of the situation. You must have this information ready for the meeting.

The irs tries to audit tax returns as soon as possible after they are filed. For the period under audit the first thing you ll need to do is. The statute of limitations limits the time allowed to assess additional tax. Once this happens you can start preparing for the audit immediately.

Learn what causes tax audits what happens during an audit and what to do if you get an irs letter. It s how your tax pro deals with the irs for you learn the three main benefits of engaging a power of attorney to research your irs account and resolve your tax problems. It is at this time we recommend you bring a tax attorney with you for representation purposes. After a tax audit is complete you ll get a notification of the result within 30 days stating your charges if any.

We will advise you immediately if we decide to broaden the scope of an audit. Studies have shown that preparing a tax return and by extension risking an irs audit can actually raise some people s blood pressure. The audit management plan will contain contact details of an executive level officer for you to contact. There are several outcomes that can arise following an audit.

The taxpayer receives an audit notice in the mail. The irs is auditing fewer returns due to federal budget cuts that have affected staff size. The irs may choose to audit your previous years tax returns for any number of reasons and some returns are even randomly selected for review.

/GettyImages-1041512864-ea5f0f216e9f4f77850e4576541d2cdf.jpg)