What Does Serious Delinquency On Credit Report Mean

The use of the term delinquency normally refers only to reported monthly delinquencies and not all derogatory information reported to a cra.

What does serious delinquency on credit report mean. Payments become delinquent when they are not received by the due date. Delinquency is like a black eye on your credit report because it signals consumer irresponsibility. Certain cards such as chase require that your credit history is clear of bankruptcy serious delinquencies or denied credit by them for 6 months. Also do you have.

The credit reports might not be identical so it s a good idea to know if the delinquency hasn t fallen off one or all of them. Dear experian are past delinquencies that have been paid off ever removed from the credit report. The account is now being reported as a charge off. Past delinquencies are deleted from credit report.

The most common example of a serious delinquency would be a late payment. November 28 2017 2 min read. I have one serious delinquency being reported on my credit report. Terms such as serious delinquency or major delinquency are not specifically defined under the fcra or the cra credit reporting manual and thus do not have precise definitions.

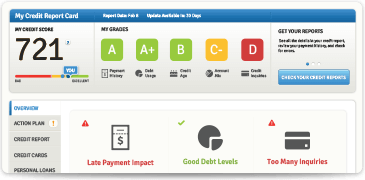

Late payments remain in your credit history for seven years from the original delinquency date which is the date the account first became late. However the more you cover it up with positive usage information the less glaring it becomes. A delinquency can affect your credit score and impact your ability to get approved for any new credit based applications. Credit card delinquency is a status indicating that your payment is past due by 30 days or more.

They cannot be removed after two years but the further in the past the late payments occurred the less impact they will have on credit scores and lending decisions. It was a credit card from when i was young. A delinquency refers to an account that is not being paid on time. And how long do any type of delinquencies stay on your credit report.

Creditors report this information to the credit reporting agencies which add it to the consumer s files. Most of the time their origin is from a mistake caused by improper use of one s credit. If you believe a credit bureau has included a delinquency that is inaccurate or outdated you can file a dispute with the credit bureau. I paid the account in full on august 2014.

/when-do-debt-collections-fall-off-your-credit-report-960584-Final-a5e292f44c64429a9290c7967ca77b79.png)

/remove-debt-collections-from-your-credit-report-960376_FINAL-5ae6517517024613885ec46df1e58ecd.png)

:max_bytes(150000):strip_icc()/how-can-i-remove-a-closed-account-from-my-credit-report-960399-FINAL-5b88130146e0fb0050feded0.png)

/a-background-on-debt-collection-accounts-e88c70aae07e4843bf4c1165f9930f84.png)

/remove-negative-credit-report-960734_final-a6f5398d4fbf4f48a5b2fb8d6c1041eb.png)

/credit-report-157681670-5b740d0246e0fb00502fd857.jpg)