Uber Auto Insurance California

Insurance coverage during period 1.

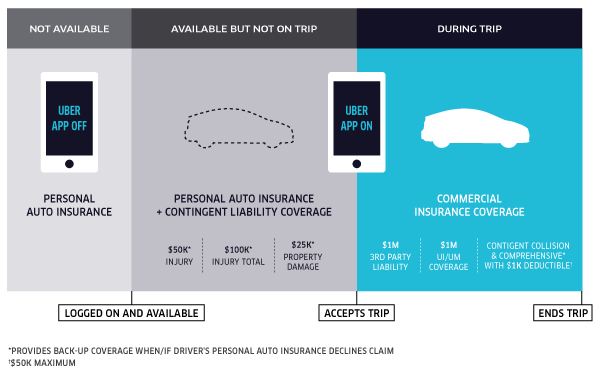

Uber auto insurance california. Uber s driver partner insurance provides different levels of coverage across periods 1 2 and 3. Coverage varies significantly depending on whether a passenger is in your car. Uber maintains the following auto insurance on your behalf in case of a covered accident. Companies such as uber and lyft provide insurance but you may want to consider purchasing your own rideshare insurance to receive all the benefits your personal policy includes.

Driver s insurance requirements you need to maintain automobile liability insurance on all vehicles you operate while driving for uber with insurance limits equal to or greater than the minimum requirements for the state where you drive. Get the right coverage that will have you covered during all periods of your rides as well as your regular personal use. Uber s insurance program coverage starts the instant you tap go on the uber app to wait for a ride request from the time you re online with uber until you. California law requires drivers for transportation network companies tncs to carry auto insurance at all times although requirements vary depending on whether you have a passenger.

As a ride sharing driver you are also required to maintain auto insurance that meets your state s minimum financial responsibility. What uber insurance covers. Best car insurance options for uber drivers and lyft drivers. Because uber is the by far the biggest of these companies we will look at uber insurance requirements and the laws around being insured as a rideshare driver in california.

Get a quick california uber insurance quote online now or call 888 997 8683 to speak with a licensed agent today. As of september 1 2020 the coverage described below is provided by economical insurance in ontario quebec alberta and nova scotia. Onguard insurance offers great low rates on uber insurance in california. Third party liability if your personal auto insurance doesn t apply.

If you re looking for the best rideshare insurance in 2020 we ve made it easy to learn about the options in your state on the page below. Uber provides some auto insurance coverage when the app is on. Here s how it works. When the uber app is off a driver is covered by their own personal car insurance.

Rideshare drivers while logged onto the uber app. Drivers who have a livery or limo business must maintain all compulsory licensing and commercial insurance requirements in accordance with state. Uber requires all their drivers to have car insurance and provides supplemental insurance coverage but only while the app is on. There are still a few states that don t have rideshare friendly.

50 000 in bodily injury per person. 100 000 in bodily injury per accident. 25 000 in property damage per accident. Uber maintains commercial auto insurance to help protect you in case of a covered accident while making a delivery on the uber app.

As an uber driver most insurance companies in ca won t. Uber s liability limits are relatively low during period 1.