Tax Recovery

Hence if you are a partially exempt business you will not be able to claim all your input tax since input tax attributable to the making of exempt supplies is not claimable.

Tax recovery. The eu has developed the world s strongest framework for international tax recovery assistance. You live in a country where the non resident tax on canadian pensions is 25 or more. There are usually many regulations surrounding the details of tax recovery. 2 2 nonetheless it is inevitable to.

Part or your entire oas pension is reduced as a monthly recovery tax. The money collected from taxes goes to many places. We serve both individual and corporate taxpayers. You must pay the recovery tax if.

9 00 am 5 00pm tuesday. 9 00 am 5 00pm thursday. For corporations we help with tax planning and filing requirements. 9 00 am 5 00pm friday.

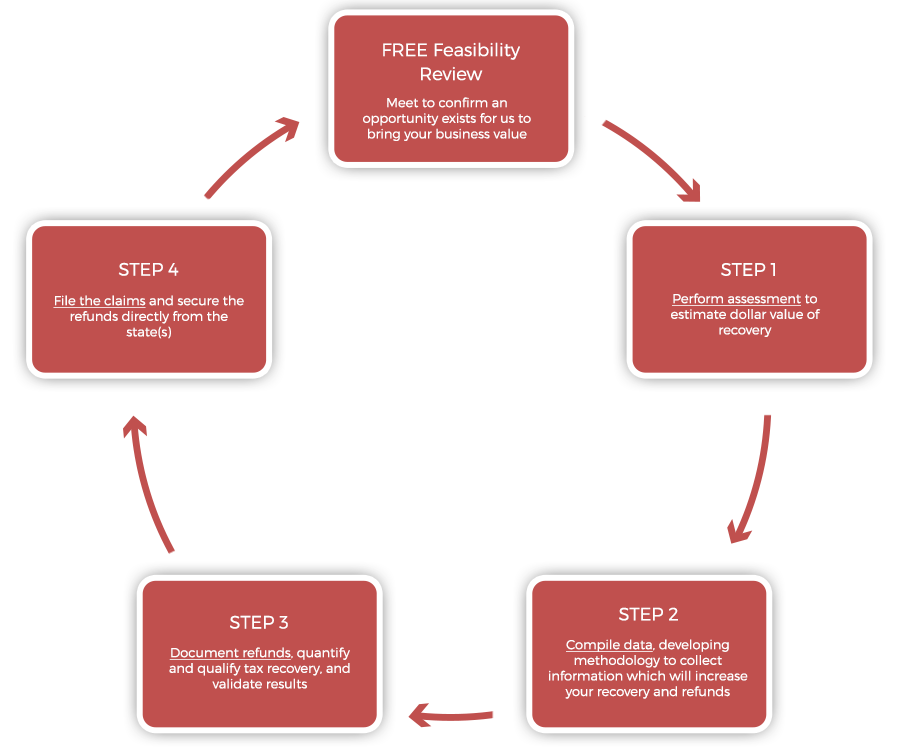

9 00 am 5 00pm wednesday. Tax recovery is the full or partial recovery of tax paid on purchases by a registered establishment to offset the tax collected from sales transactions. Tax recovery inc provides a solution to both your accounting and tax requirements at one place. Business leaders are expecting a difficult climb out of recession and are pushing for a combination of government stimulus to create jobs and reforms to tax and other areas to maximise the recovery.

Your annual net world income is more than 77 580 for 2019 in canadian dollars and. An efficient tax recovery ensures that all taxpayers are paying their fair share of taxes. 9 00 am 5 00pm saturday and sunday. In addition to paying the salaries of government workers tax dollars also.

Organising tax recovery assistance within the eu. Most tax debts are collected timely through spontaneous payment by the debtor. Red tape language barriers and excessively complicated administrative procedures are just a few of the many challenges one faces when pursuing governmental relief. Us tax recovery is a withholding tax recovery service that specializes in casino tax recovery on behalf of canadians and other non us citizens.

2 1 the general input tax recovery rule is that input tax is claimable only if it is attributable to the making of taxable supplies. Statewide tax recovery llc provides delinquent tax collection services for the counties municipalities and school districts of pennsylvania. For individuals we recover backdated taxes and any pending tax filings while evaluating their tax situation in the 10 years.