Using Ira To Pay Student Loans

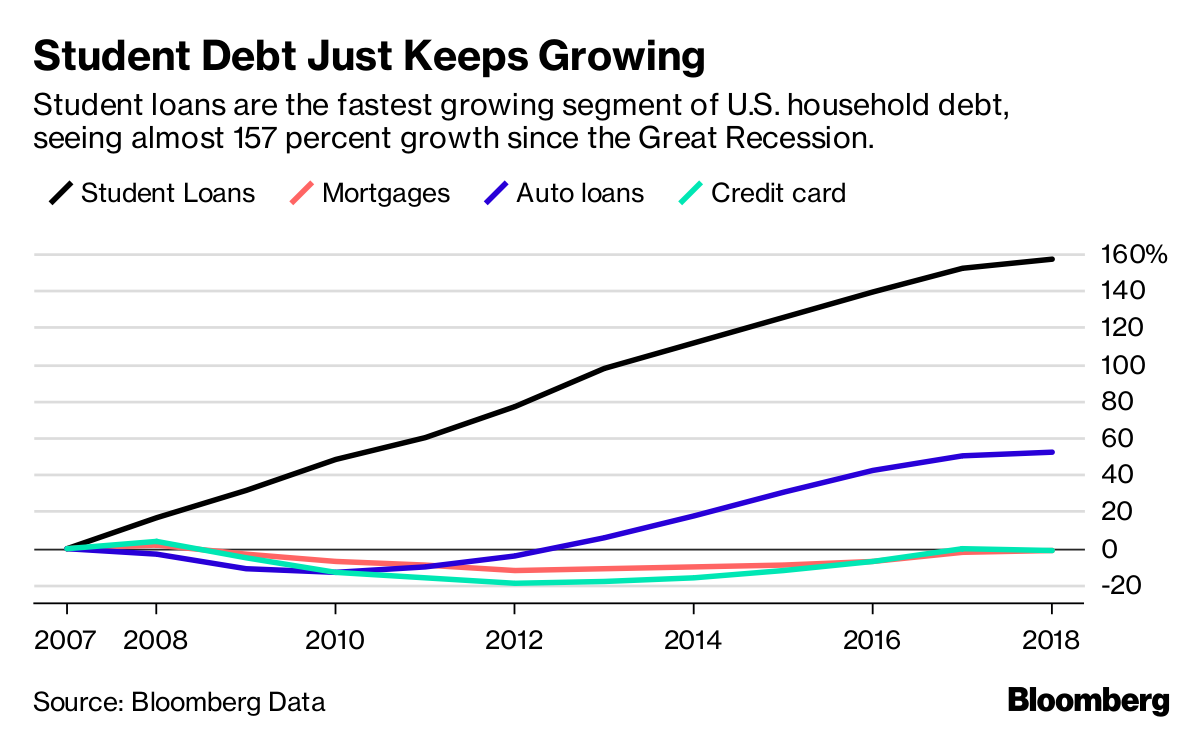

Would it be a smart idea to utilize the cares act to access my roth ira penalty free and use the money to pay my student loans off in full.

Using ira to pay student loans. If you are 59 or older you may withdraw funds from a traditional ira to pay off your student loans at any time. Using an early distribution from your ira to pay down the loan doesn t meet that standard with one possible but unlikely exception which i ll get to below. Yes an early distribution penalty will apply when using an ira to pay student loans. Withdrawing funds from a roth ira might be an option to pay off your student loan debt.

You can instead use ira money penalty free to pay tuition directly. An exception to the penalty applies to ira distributions used to pay for current educational expenses. Know the tax implications and consider holding off until the pay as you earn plan rolls out in 2015. Complete the ira custodian s paperwork and request a check or direct deposit of the withdrawal amount.

But if you left that ira alone the original 50 000 invested at a 12 rate of return for 20 years would be worth over 544 000. Can i use my ira to pay my student loans. D when you put money in a traditional individual retirement account the tax on that money is deferred until you exit the workforce if you withdraw the money before retirement you ll be taxed and penalized 10 percent of the amount withdrawn unless your withdrawal falls under a list of irs exceptions. Peruse 401 k loan possibilities some employers with a 401 k plan allow workers to.

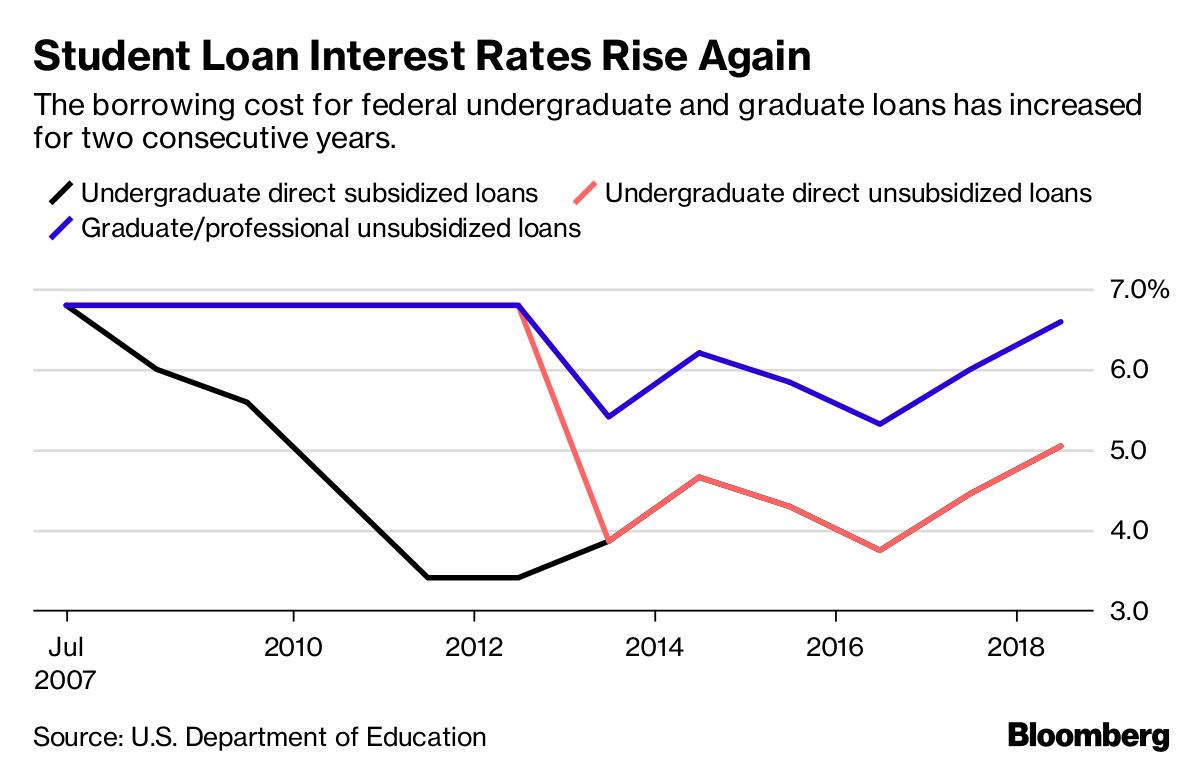

You could end up paying about 5 000 in penalties and around another 15 000 in taxes leaving you with only 30 000. You can withdraw money from an ira to repay student loans but you might have to pay taxes and penalties for early withdrawals. While you cannot take ira funds to pay off student loans after graduation you can withdraw your savings to offset the impact of loan payments while you or your family member is in school. I m 33 years old and have 24 000 in federal student loan debt with a 6 8 percent interest rate.

If you are younger than 59 you can still use your traditional ira funds to pay. You must pay the 10 additional tax on the portion of your iras you withdrew to pay student loans. Use the following criteria to help you decide if using a 401 k to pay off student loans is the best strategy.

/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)