Selling House Owner Financing

Owner financing is typically short term.

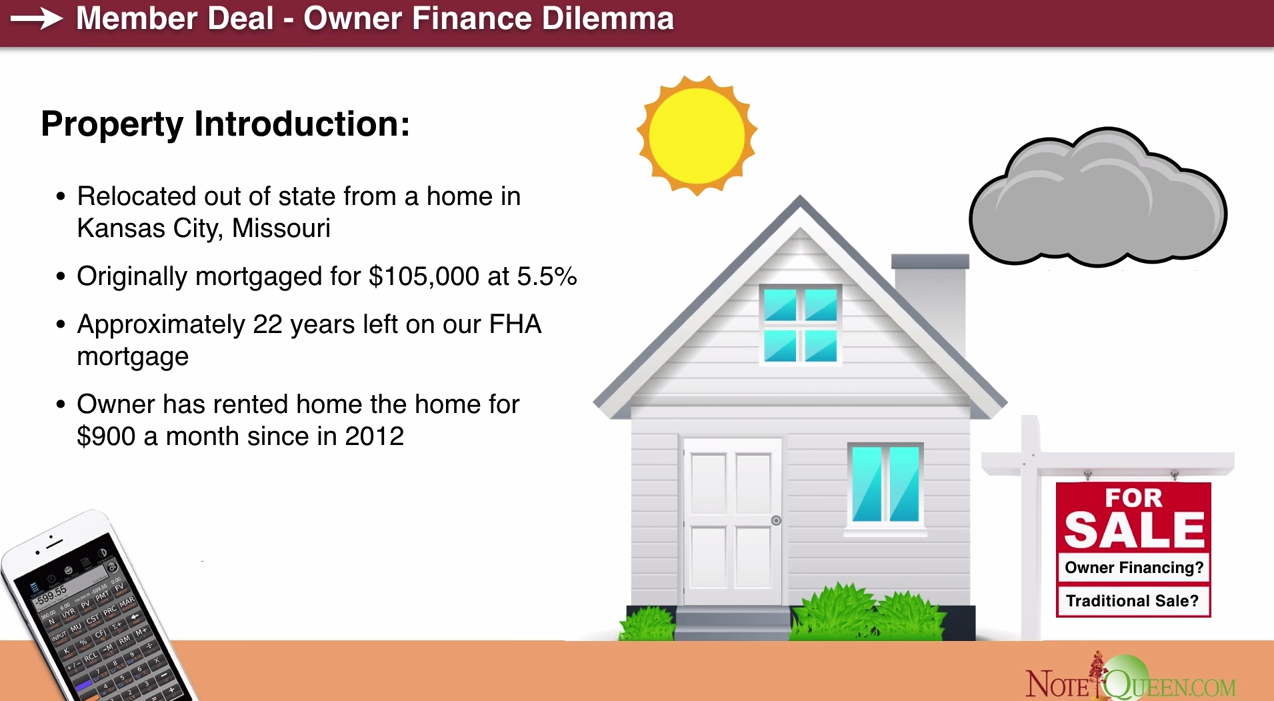

Selling house owner financing. Owner financing is an arrangement in which the seller agrees to accept installment payments directly from the buyer rather than having the buyer obtain a loan from a bank. Owner financing is typically for periods of about five years with interest. So what s an investor to do especially if they d like to sell their place as a for sale by owner or with owner financing. Instead of giving cash to the buyer the seller extends enough credit to the buyer for the purchase price of the home minus any down payment.

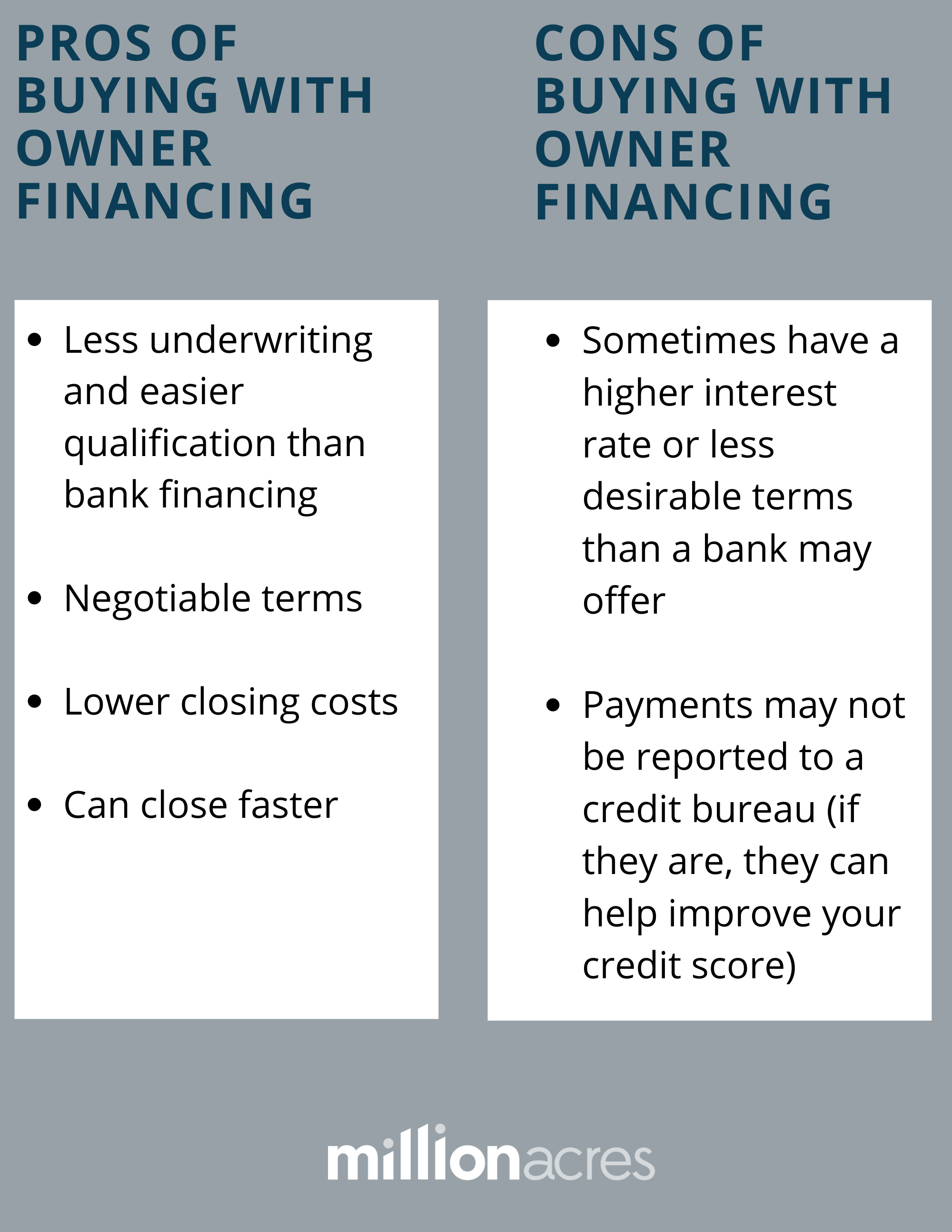

Owner financing sometimes referred to as seller financing often provides buyers with easier qualification and more flexible repayment terms than a traditional mortgage while providing sellers with monthly. Also known as seller financing it s especially popular if the local real estate scene is a buyer s market. Seller financed sales thereby eliminate third party lenders from the transaction. Asking a seller to help you buy their home is not something most homeowners or even their listing agents usually consider however for a seller whose home isn t selling or for a buyer having trouble with traditional lender guidelines owner financing is definitely a viable option.

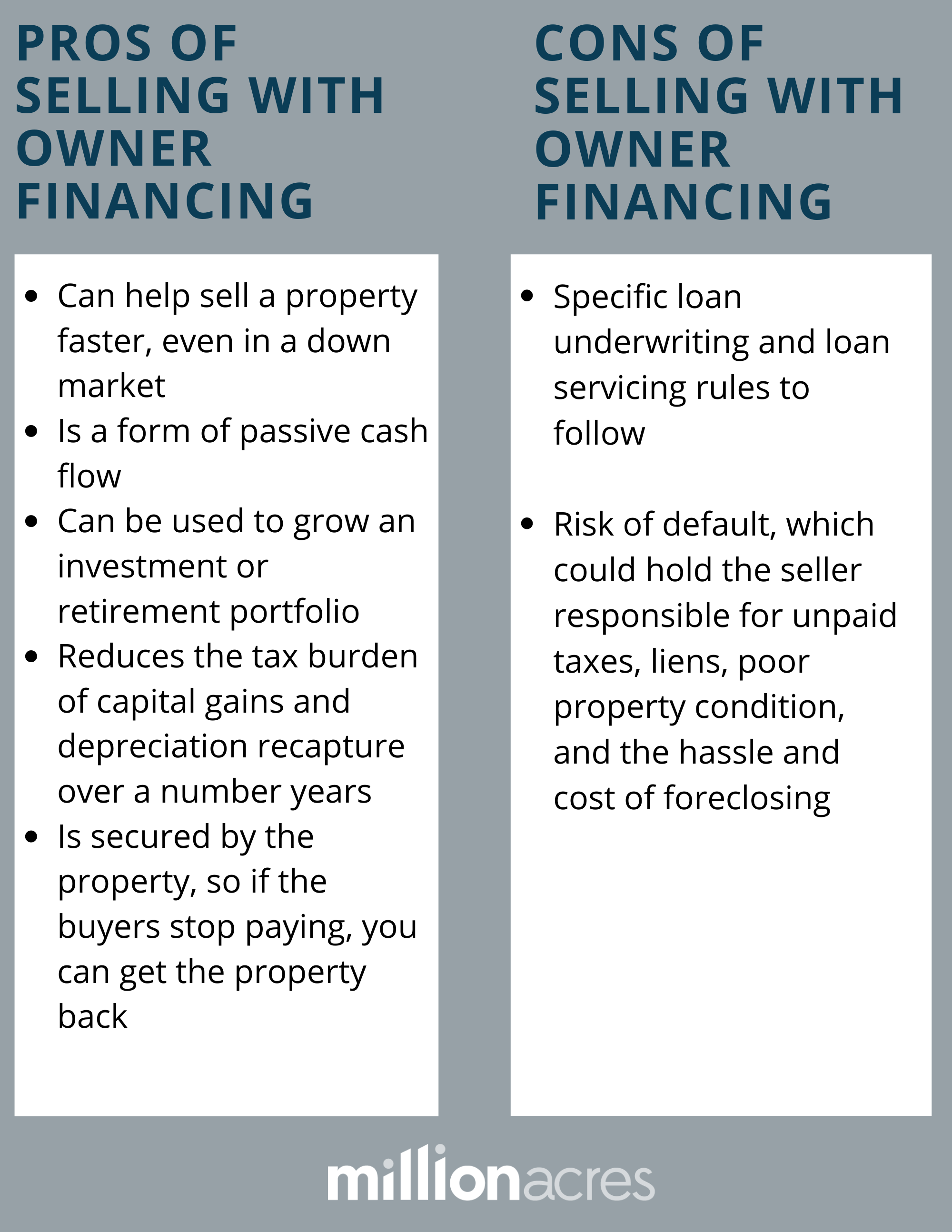

Doing so avoids dodd frank requirements altogether and since it s a commercial loan usury laws don t apply either. Pros of selling property with owner financing spread out capital gains taxes over time. A transaction where the seller also acts as the lender to the buyer. You don t want to be collecting on your house sale for the rest of your life.

Buyers will likely pay higher interest than with a. Known as a for sale by owner or fsbo listing selling a house without a realtor requires time ambition and drive says sissy lappin a houston based real estate broker and author of. In seller financing the seller takes on the role of the lender. The sale of property can trigger depreciation recapture and capital gains tax which is a tax on the gains.

The mechanics of seller financing. The buyer and seller sign a promissory note which contains the terms of the loan. Owner financing can help sellers sell faster and help buyers get into homes even if they would be unable to secure a traditional mortgage. Generally the only limitation on your right to sell would come from a lockout clause or prepayment penalty in the financing just as would happen with a similarly written mortgage from a traditional lender.

/A-Guide-to-Owner-Financing-1798416-final-277ef91b6afa404eb05d4bd4b5c857db.png)

:max_bytes(150000):strip_icc()/GettyImages-1081824390-6409d443df27492c9d4de21e76d64659.jpg)