Rollover Tsp To Ira

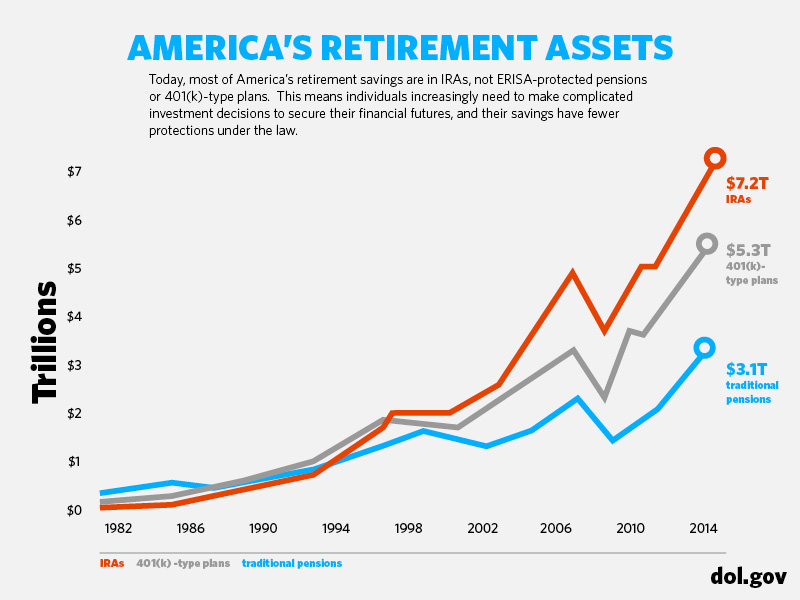

The thrift savings plan known as tsp is a retirement account exclusively for federal employees or members of the armed forces.

Rollover tsp to ira. Use form tsp 60 request for a transfer into the tsp to roll over. A thrift savings plan rollover into an ira can also be complicated so get help from an investment professional if needed. Request for a transfer into the tsp. Roth tsp balance.

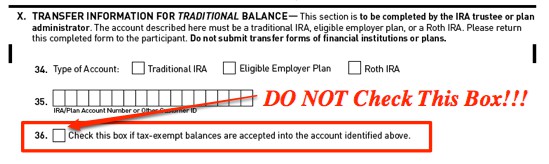

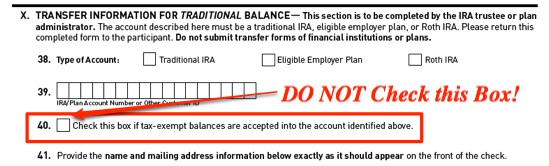

Managing your account for beneficiary participants. Employer plan roth acct roth ira transfers only rollovers not permitted to designated roth accounts in employer plans. You cannot roll over roth money into the tsp and you must complete your rollover within 60 days from the date you receive your funds. If you decide to roll your thrift savings plan assets into an ira then you have a few options to consider.

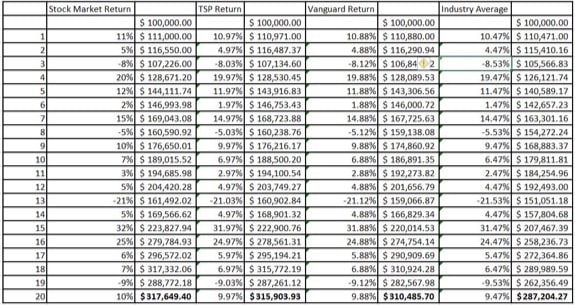

The thrift savings plan and iras. Cannot transfer rollover roth education and inherited ira into the tsp. How to roll over tsp into a roth ira. To start with the tsp is actually one of the best retirement plans available due to the low expense ratios for the funds.

Under the irs basic rollover rule an ira owner does not have to include in income any ira proceeds distributed to the ira owner provided the owner deposits the ira proceeds into another ira or into a qualified retirement plan such as the tsp within 60 days of receiving the ira proceeds. We found 2 forms and 4 resources about transfers and rollovers. Employer plan pre tax traditional ira roth ira. The first thing you will need to do is open an ira if you don t already have one.

Here is a list of places to help you get started. Upon closer examination however there is a. The tax deferred investment. If you decide to rollover a tsp account into an ira.

Traditional tsp balance.