Refi And Cash Out

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)

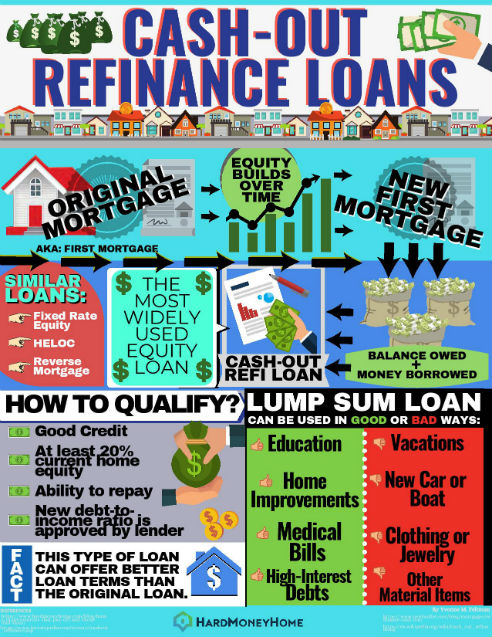

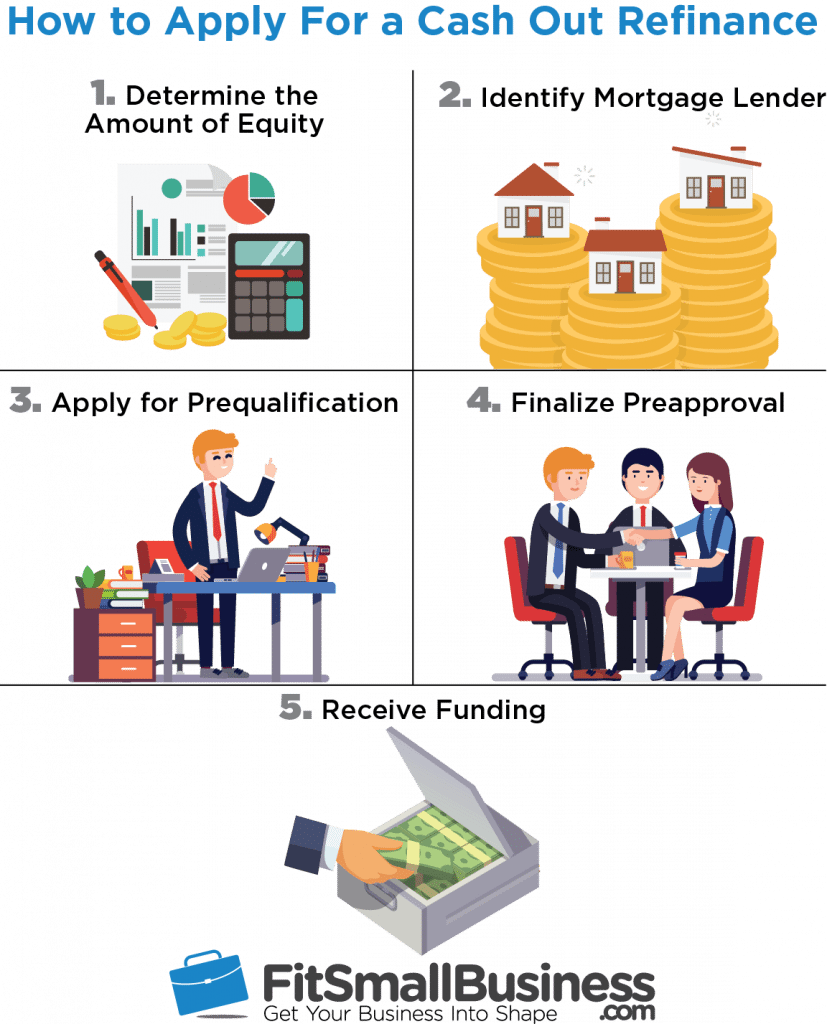

Whether it is for pleasure or investment a cash out refi provides an opportunity to access some much needed cash at interest rates that may be more forgiving than a personal loan credit card advance or even a home equity line of credit.

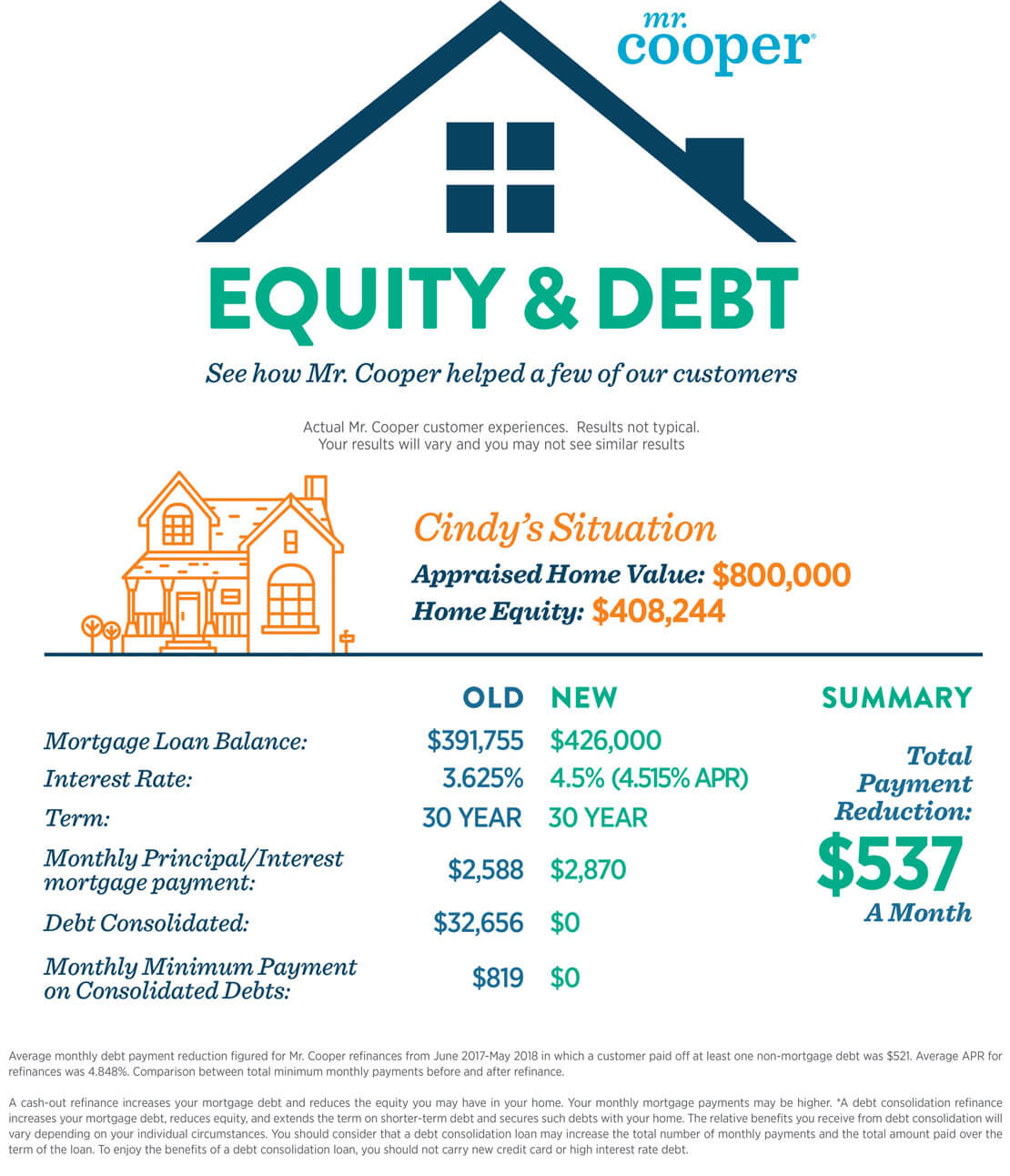

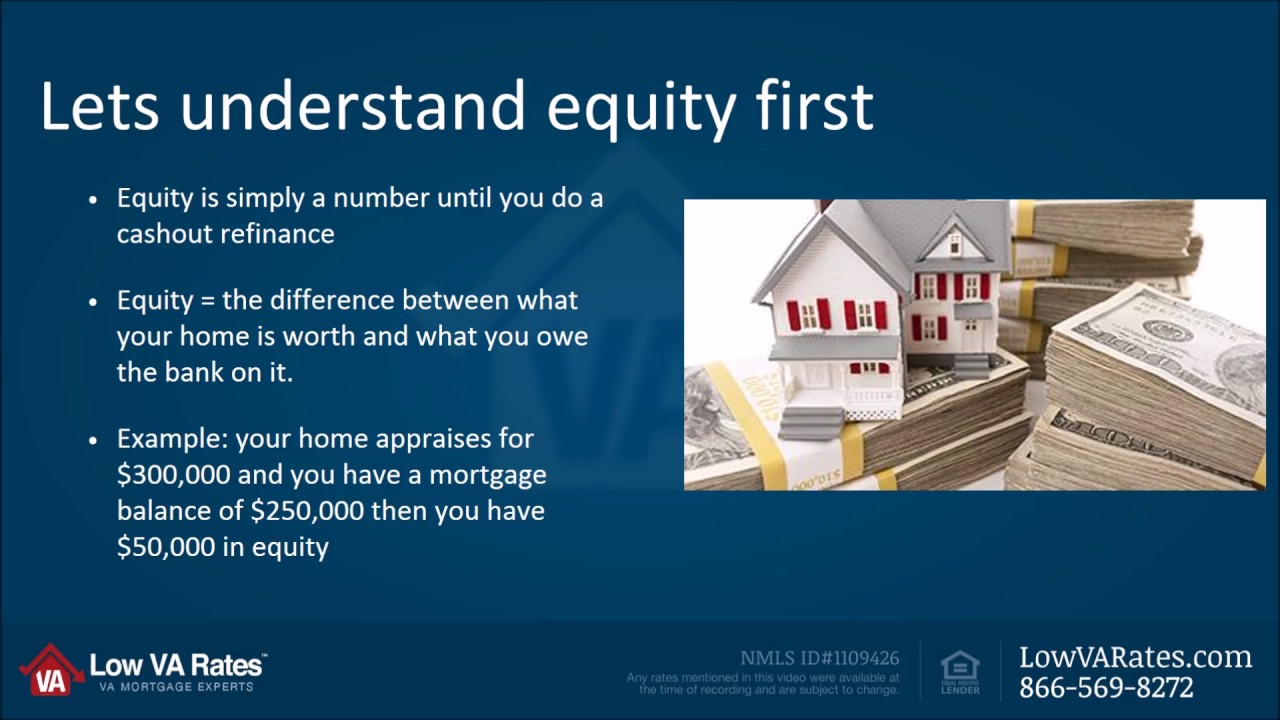

Refi and cash out. A cash out refinance is a refinancing of an existing mortgage loan where the new mortgage loan is for a larger amount than the existing mortgage loan and you the borrower get the difference between the two loans in cash. In other words with a cash out refinance you borrow more than you owe on your mortgage and pocket the difference. Any remaining funds are yours to use as you wish. You ll be borrowing what you owe on your existing loan plus the cash you take out from your home s equity.

A cash out refinance is when you take out a new home loan for more money than you owe on your current loan and receive the difference in cash. Cash out refinancing makes sense. A cash out refinance replaces your current home loan with a new mortgage that s higher than your outstanding loan balance. A cash out refinance takes advantage of the equity you ve built over time and gives you cash in exchange for taking on a larger mortgage.

Cash out refinance gives you a lump sum when you close your refinance loan. It allows you to tap into the equity in your home. Basically homeowners do cash out refinances so they can turn some of the equity they ve built up in their home into cash. That s because a cash out refi is a primary mortgage rather than a second mortgage as is the.

In a cash out refinance a new mortgage is for more than your previous mortgage balance and the difference is paid to you in cash. A mortgage refinance typically offers a lower interest rate than a home equity line of credit or heloc or a home equity loan. A cash out refinance is a new loan replacing your current mortgage. Pros of a cash out refinance lower interest rates.

You withdraw the difference between the two mortgages in cash and put the.