Recievable Finance

Accounts receivable financing allows companies to receive early payment on their outstanding invoices.

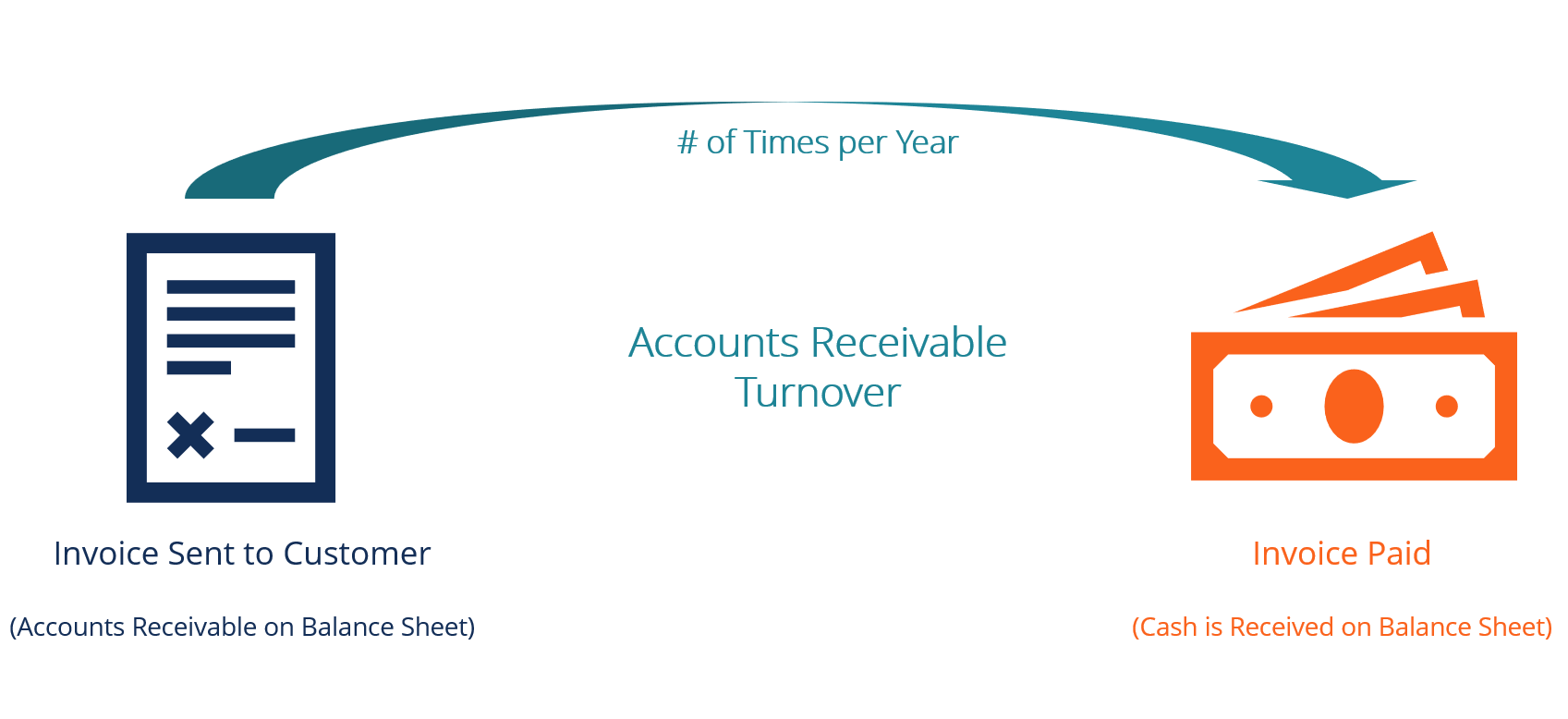

Recievable finance. To measure how effectively a company extends credit and collects debt on that credit fundamental analysts look at various. If qualified access up to 90 per cent of invoice values as soon as they are issued. A unit within a company s accounting department that deals with accounts. The numbers found on a company s financial statements balance sheet income.

Money that a customer owes a company for a good or service purchased on credit. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing. This helps to improve customers cash flow. What is the accounts receivable turnover ratio.

Accounts receivable are legally enforceable claims for payment held by a business for goods supplied and or services rendered that customers clients have ordered but not paid for. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. Accounts receivable financing is a type of financing arrangement in which a company receives financing capital in relation to its receivable balances. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee.

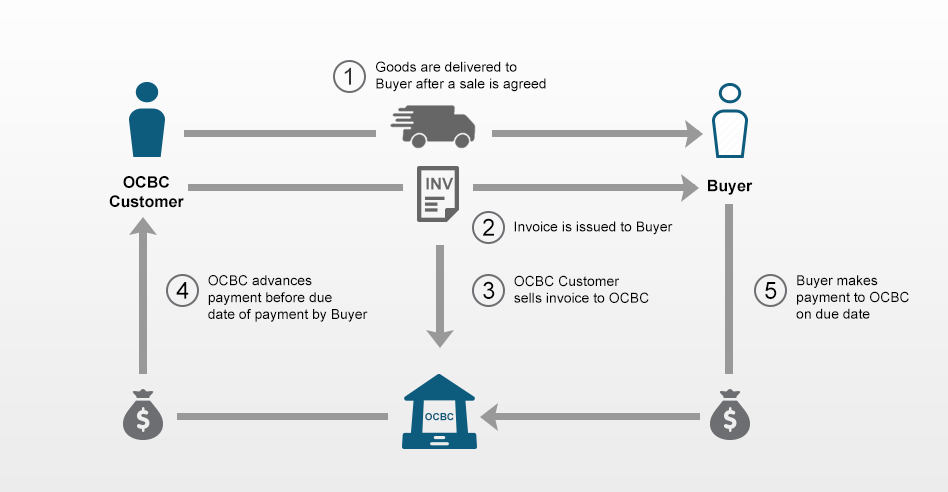

These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. Accounts receivable purchase arp is an arrangement whereby ocbc purchases invoices from our customers to unlock working capital for them. The factor collects payment on the receivables from the company s.

The factoring company assumes the risks on the receivable and in return issue your business. Understanding how accounts receivable factoring works. Improve your cash flows and enhance forecasting. A key for any business to run smoothly and successfully.

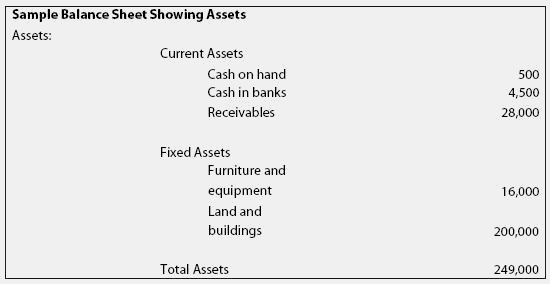

Receivables finance is available in most major currencies and as early as the next business day. Accounts receivable is shown in a balance sheet as an asset. Accounts receivable are current assets for a company and are expected to be paid within a short amount of time often 10 30 or 90 days.