Rollover Annuity To Ira

A tax deferred annuity is a supplemental retirement savings account that s eligible for roth ira rollover only under certain circumstances.

Rollover annuity to ira. If you have a variable annuity that is owned inside an ira account you can roll your funds out of the variable annuity and into a regular ira at a bank mutual fund company or brokerage firm. Rolling over an annuity to an ira several employer retirement plans come in the form of a variable annuity contract such as a 457 or 403 b plan especially in the public sector. A tax sheltered annuity is an employer sponsored qualified retirement plan that s eligible for rollover once employment is terminated. Additionally there are no distribution taxes either.

An annuity can t be rolled over but it can be exchanged tax free for another comparable annuity under a section 1035 policy of the internal revenue service. Annuities funded with an ira rollover are qualified plans. If you are moving ira annuity money then the move would be called a transfer. If you are moving non qualified money tax free then that is technically called a 1035 exchange.

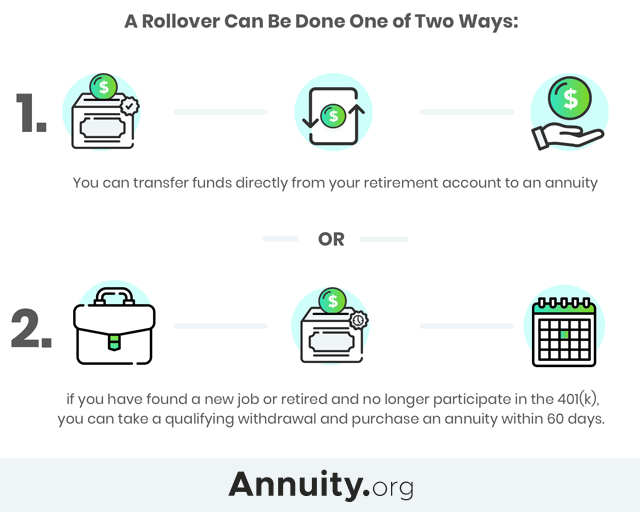

Additionally you can have your employer roll over your 401 k funds into an annuity without withholding any taxes since no mandatory withholding requirements pertain to funds directly transferred into an annuity by an employer. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days. Tax protected retirement savings accounts such as iras or 401 k plans can be directly rolled over into an annuity tax free as long as you follow the irs s requirements.

Instead the transfer is handled by the insurance company similar to the tax free transfer made when one ira is exchanged for another. Annuities funded with an ira or 401 k rollover are considered qualified plans. Rollover is another specific term used for moving ira money in a way that passes through your bank account first. Rolling an ira into an annuity is also a tax free process.

Benefit you benefit from a rollover annuity when the new annuity offers you something that the old annuity did not and the benefit is an actual benefit. Since the funds are still inside of the ira wrapper it is considered a transfer or rollover and no taxes are owed. There may be more than one step in taking your 403b and making it a roth. Annuities funded with an ira or 401 k rollover are qualified plans enabling an insurance company to create an ira annuity into which you can deposit your retirement funds directly.

/GettyImages-1017300682-3086d9bb0cc942df8fc62401a5286372.jpg)