Wework Revenue 2016

View wework stock share price financials funding rounds investors and more at craft.

Wework revenue 2016. In 2017 wework doubled the size of our business again. Wework s annual average membership and service revenue. Down to 6 360 per member versus 7 353 in early 2016. Average revenue per wework membership has declined.

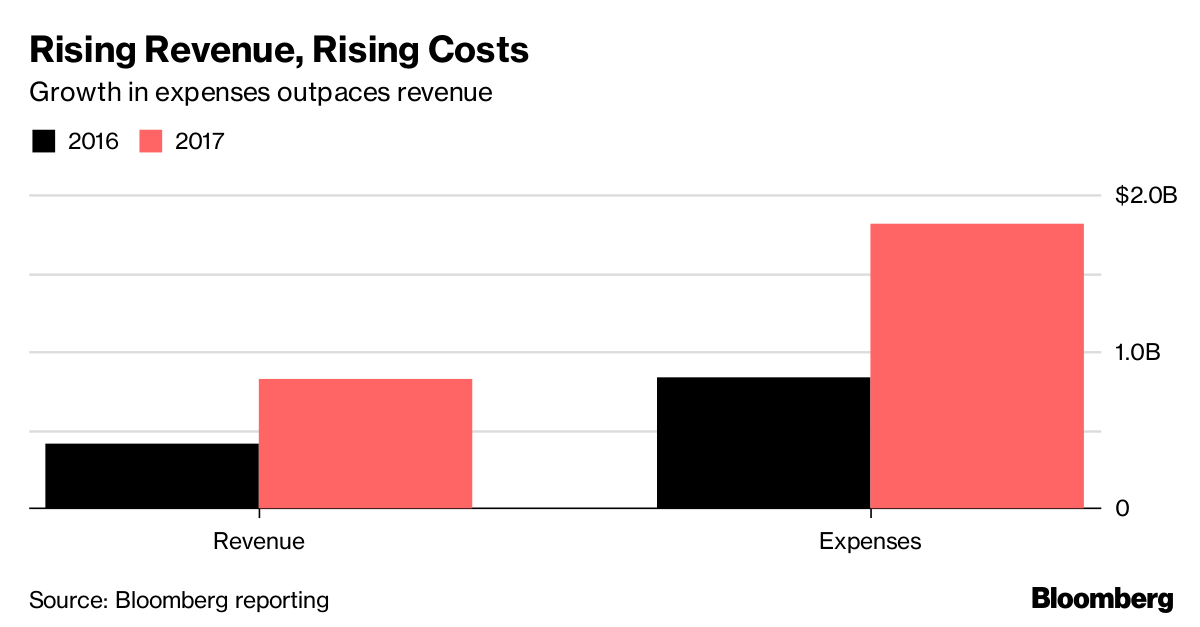

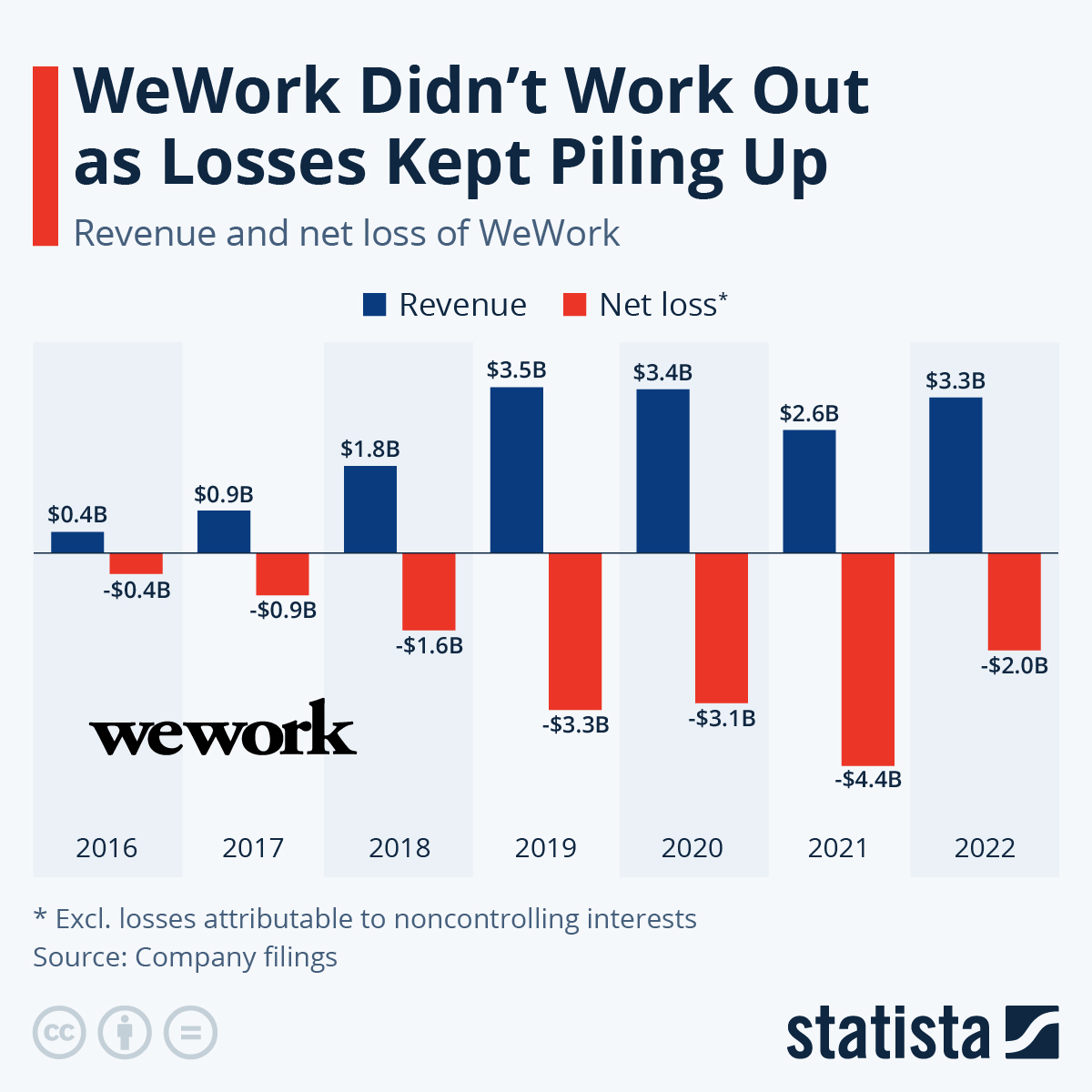

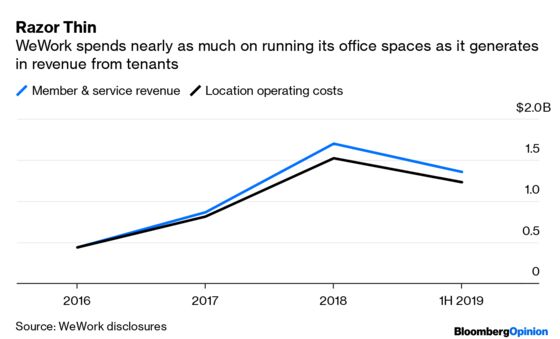

Documents seen by ft alphaville reveal the huge cash costs incurred by wework. From 2016 through 2018 the provider of trendy office space more than quadrupled its revenue to 1 82 billion. The prospectus notes that. Dollars in revenue from its leased office.

Wework ipo filing reveals huge revenue and losses. We reached that point in september last year and by the end of 2018 we re projecting a revenue run rate of 2 3 billion. That disparity amid concerns of an economic downturn are among the reasons investors could be wary. Wework s revenue commitments are just 4bn.

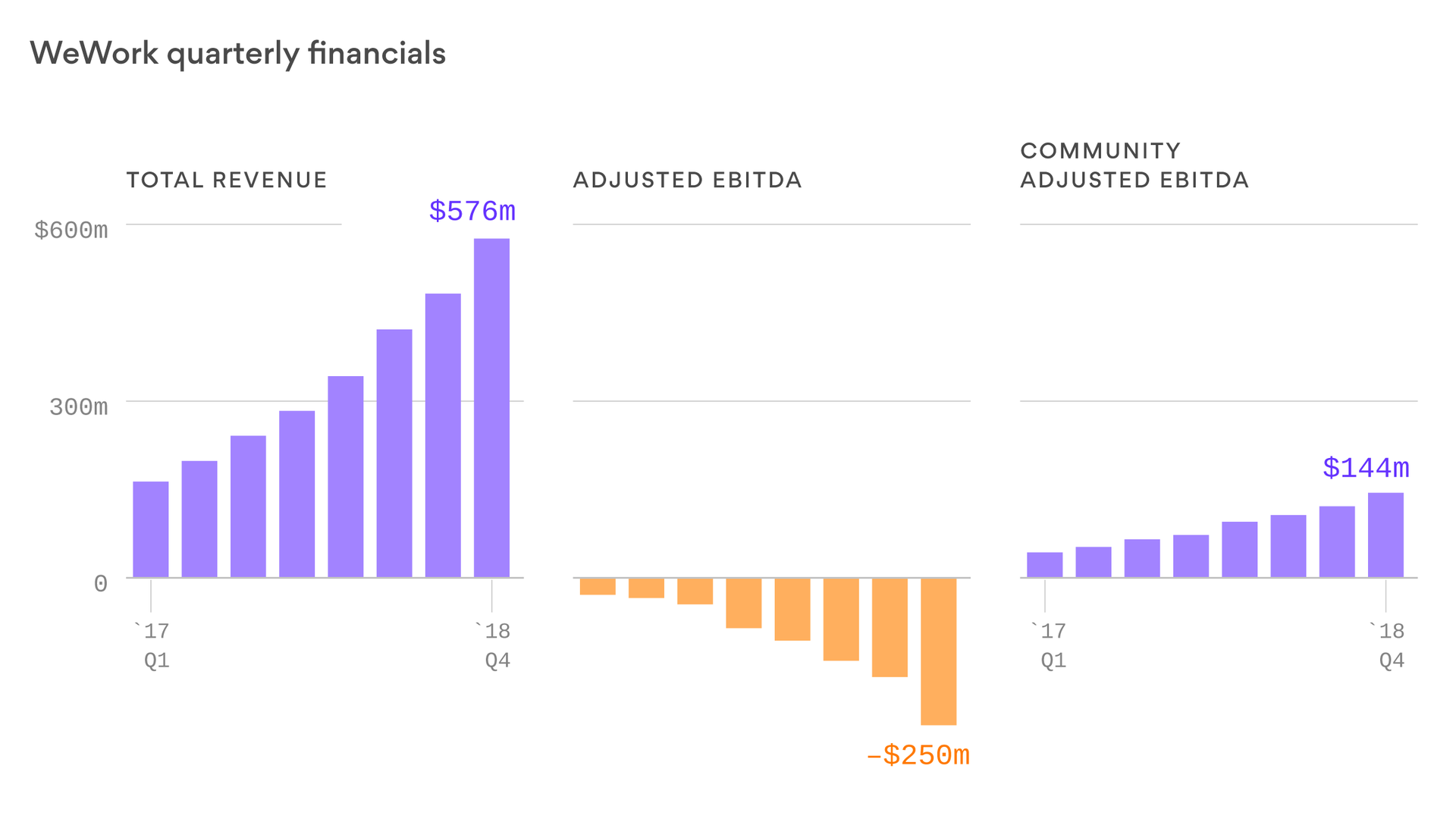

Is the company facing high growth bloat. Wework first opened in australia in sydney s martin place in 2016 and launched in brisbane in march this year. Being a private company wework is rewarded for revenue growth and. Wework annual revenue increased from 886 million in 2017 to 1 8 billion in 2018 a 105 6 increase.

Wework has raised 13 77 b in total funding. The statistic illustrates the revenue generated by wework worldwide from 2016 to 2019. In 2016 we publicly stated we would have a revenue run rate of 1 billion in 2017. Wework has had to revise down its revenue growth and projected profit for 2016 according to a new bloomberg report based on leaked financial documents.

He chastised employees in 2016 for a spending culture around the time that the company cut revenue and profit forecasts.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19586787/TSCi5_how_much_us_space_wework_added_each_year.png)