Term Life Insurance Over 70

According to the national center for health statistics a healthy 65 year old has a 50 chance of living past 85 years.

Term life insurance over 70. If you are 70 or older and need life insurance for longer than 10 years you will want to purchase guaranteed universal life insurance to lock in your rates and coverage until the age of 90 or later. Easy to purchase. As an independent agency known for providing patient personalized service we ve helped thousands of clients in their 70 s with affordable life insurance coverage from a reliable provider. Term life insurance for seniors does not have many moving parts and is easy to implement.

Avoid term life insurance while term life insurance is the most common life insurance on the market today it is not the best option for seniors over the age of 70. Especially when you re over 70. Stranger originated life insurance or stoli is a life insurance policy plan that is held or funded by a person that has no connection to the insured person. Term life insurance for seniors over 70 isn t always necessary but it is very possible to obtain should you need it.

Finding affordable term life insurance for seniors over 70 can be challenging but it s far from impossible. When you obtain the term life insurance policy at 70 years old you will inevitably pay a premium that will increase dramatically over the next 10 years. It s normally based on either a set period such as 50 years or an age limit you can have it until such as 80 years old. These policies are often called term to 90 term to 95 or term to 100 life insurance because they work just like a term policy with rates and coverage guaranteed to a specific.

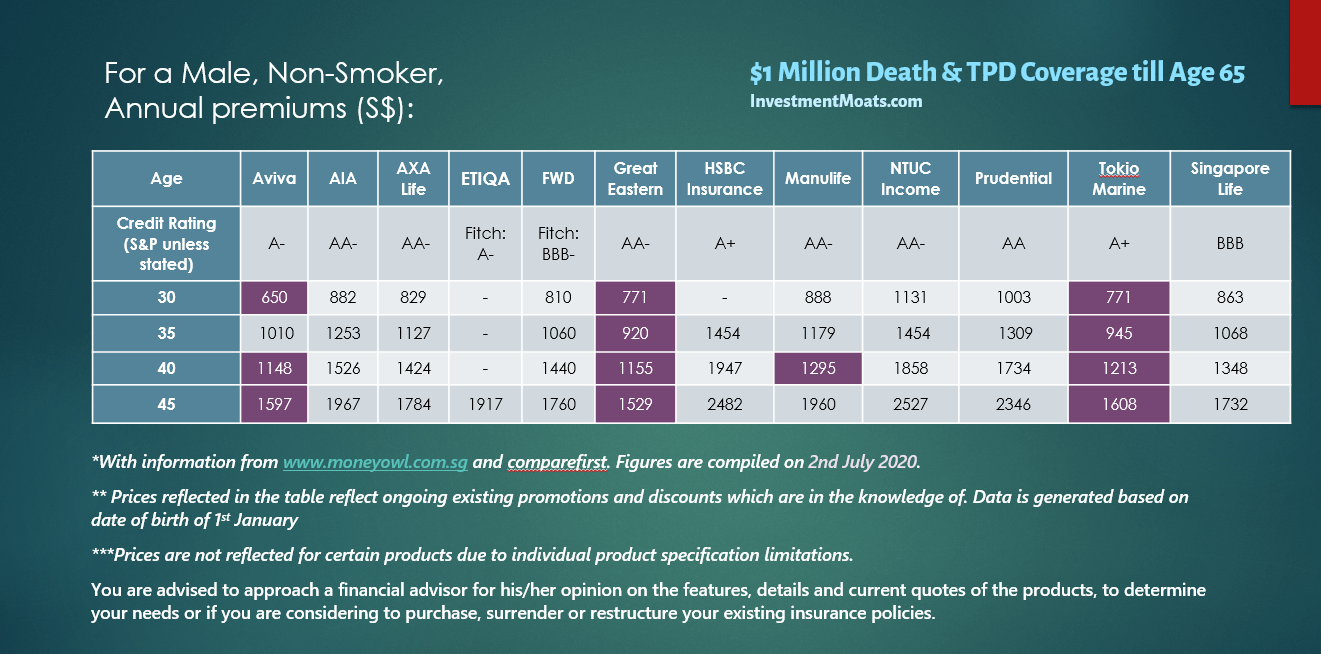

Each employer has their standards for porting a policy. Because each insurer takes different factors into consideration to help them determine a custom premium there s no set price for how much life insurance will cost for someone over 70. Advantages of term life insurance for seniors over 70 easy to understand. You may have felt safe and secure in your life insurance policy when you first purchased your term life insurance plan in your 30s or 40s and passed your medical exam with flying colors.

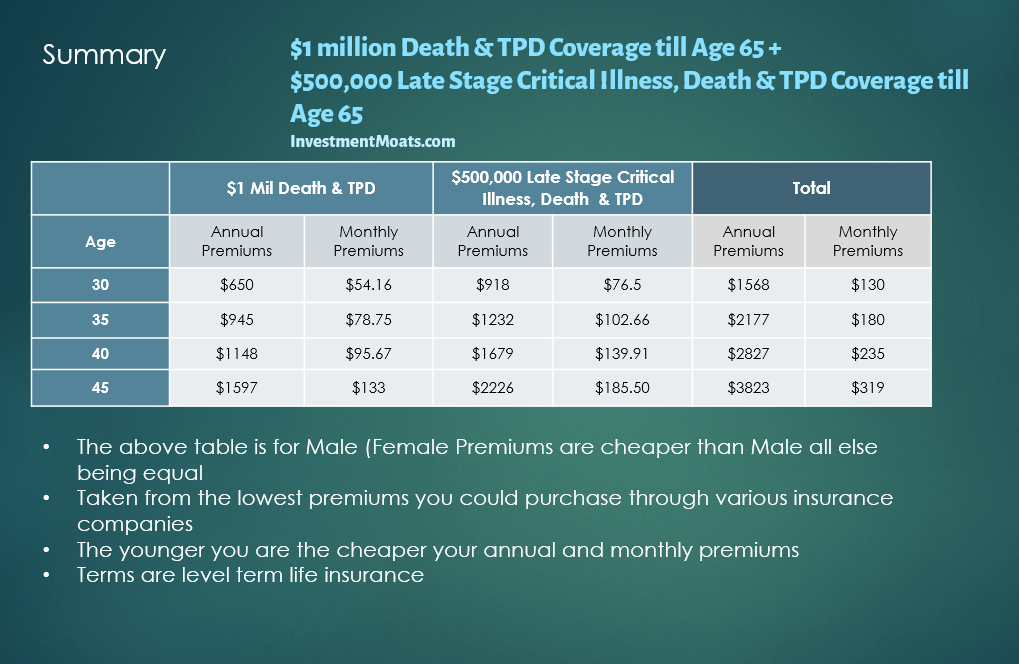

For example 100 000 of coverage for a healthy 70 year old male costs around 90 per month for a 10 year term. Waiting to buy term life insurance until you are older than 70 is a pricey decision but it s better than nothing. So if you still have a mortgage to pay are supporting your family or just had your current policy expired this article may be for you. Term life insurance rate.

The plan holder generally pays a costs either regularly or as one round figure. Some types of policies require a medical exam and blood work as part of the underwriting process but many insurance companies offer term life for seniors without a medical exam. You may have signed up for a 30 year term policy and put it to the back of your mind to worry about in 30 years.