Us Property Tax Lending

The form of levy or billing varies but is often accomplished by mailing a tax bill to the property owner or mortgage company.

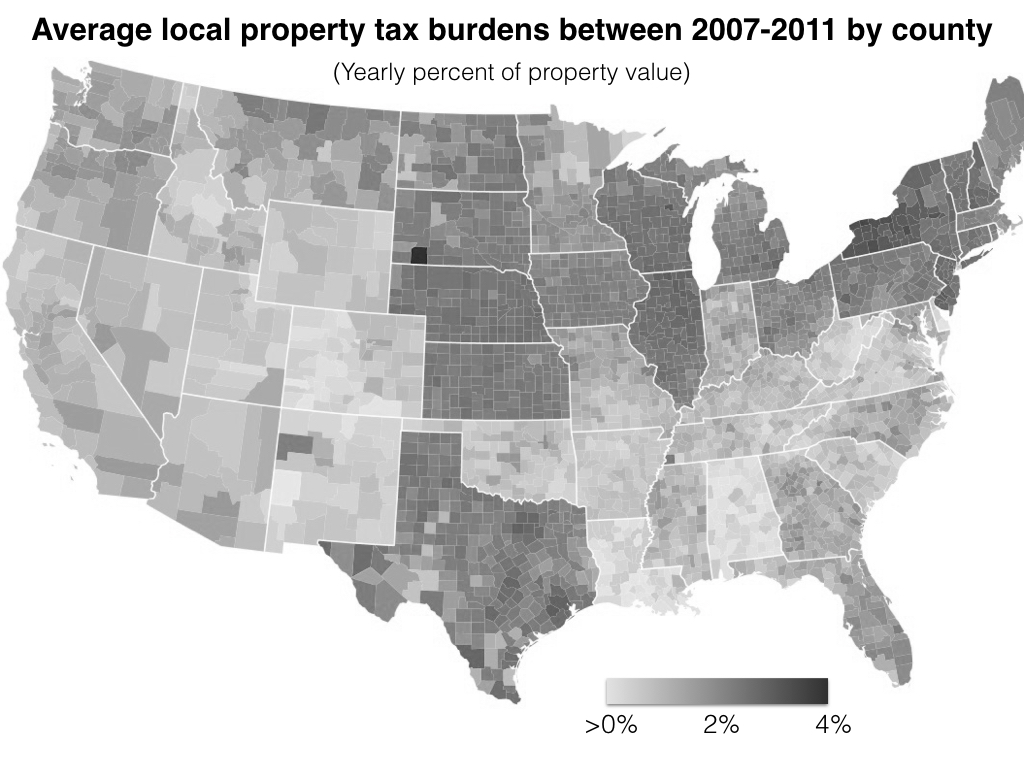

Us property tax lending. Property tax funding 4100 alpha rd suite 670. Property tax funding 4100 alpha rd suite 670. A rate cap limits the amount the lender may increase or decrease the interest rate per each adjustment. Property taxes paid as a percentage of owner occupied housing value.

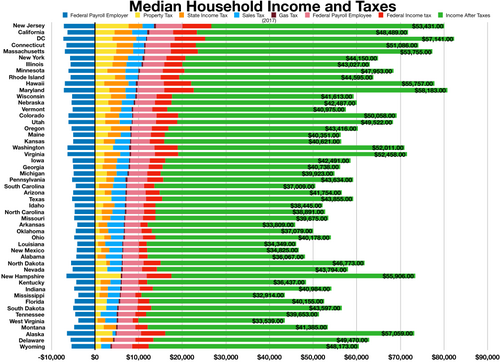

Html table is sorted alphabetically by state but column headers can be clicked on to sort by other columns. Rio tax is part of the biggest property tax lending operation in the state. Taxing jurisdictions levy tax on property following a preliminary or final determination of value. To determine how much property tax you pay each month lenders calculate your annual property tax burden.

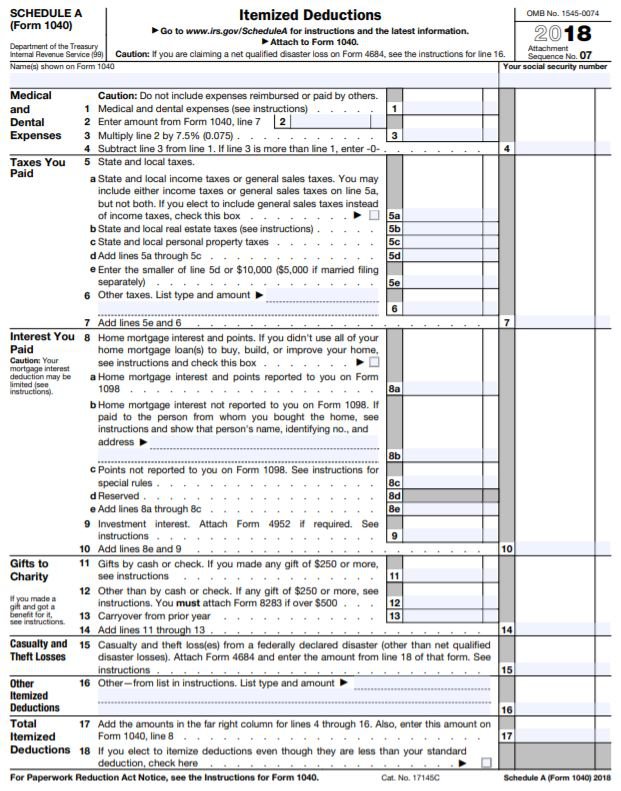

If you live in the home for example you generally can deduct mortgage interest. If you use the property. Paying taxes with a mortgage. Without property taxes you can expect a significantly lower level of service and a higher rate of crime in densely packed areas.

Call us toll free. The benefits property owners get from u s. Before you ever make an offer on a home or get a proper estimate on your mortgage costs you ll have to know how much tax burden your future home has tied to it so ask. That s tax basics in a nutshell a very tiny one.

An adjustable rate mortgage arm allows the lender to adjust the interest rate of a mortgage at scheduled intervals. Lenders often roll property taxes into borrowers monthly mortgage bills. For the 2019 tax year the mortgage interest deduction limit is 750 000 which means homeowners can deduct the interest paid on up to 750 000 in mortgage debt. Calendar year 2015 property taxes.

Tax law depend on how they use the property. Many arms also have life of loan rate caps. The final 5 columns show what percent of the state s tax base is driven by each component. While private lenders who offer conventional loans are usually not required to do that the fha requires all of its borrowers to pay taxes along with their monthly mortgage payments.

Property taxes in the united states generally are due only if the taxing jurisdiction has levied or billed the tax.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)